It’s Not Just Australia – Negative Growth Goes Global

News

|

Posted 07/03/2019

|

7770

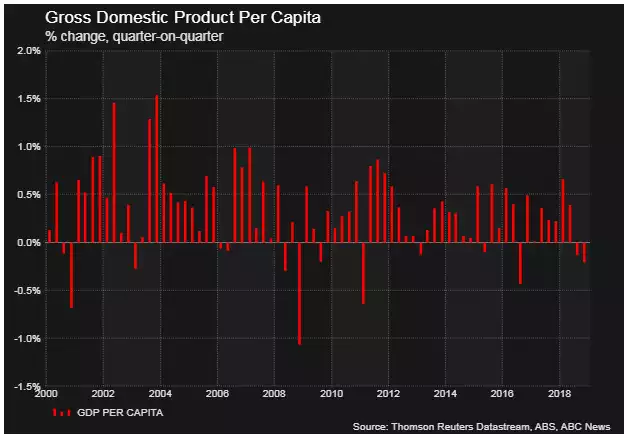

When we wrote yesterday of the ‘hard evidence’ of Australia’s growing economic troubles we didn’t yet know of the GDP print that you have no doubt seen on every news program since. Yesterday Australia techinically entered a recession on a per capita basis. In other words we’ve just had the second month of GDP growth weaker than population growth.

On an annualised basis we are staring at 1% growth, less than population growth. i.e. our economy is actually shrinking in real terms. Already we have some ‘commentators’ calling for ‘helicopter money’ by gifting all citizens money to spend to ‘fix’ this problem. We refer you to our article on Friday for context on the ridiculous nature of this.

We won’t go over the detail as you no doubt read or heard it all yesterday. For regular readers, none of this will be a surprise anyway.

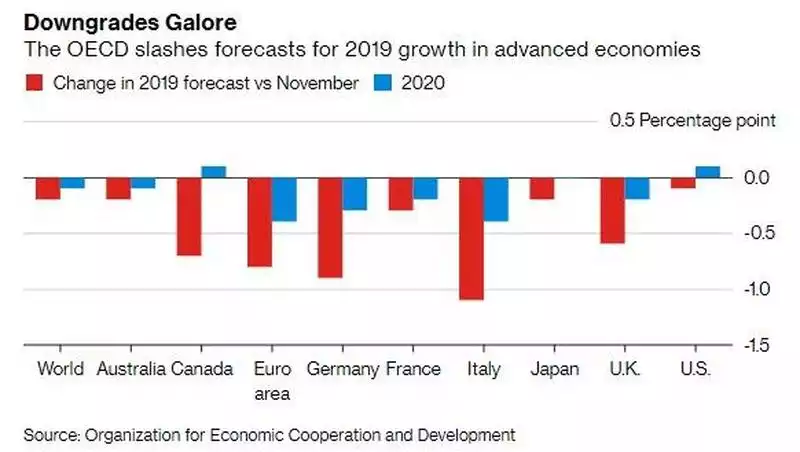

However too many will not realise the global nature of what hit our local headlines yesterday. Just yesterday the OECD joined the IMF in slashing its 2019 global GDP forecasts from 1.8% to just 1% (again less than world population growth rate of 1.2%) and warning the “outcome could be weaker still if downside risks materialize or interact.”.

You can see the Eurozone is a key contributor to the downgrades with Germany dancing with recession already. In the context of the 2 articles referred to above (with central banks coming to the rescue), the OECD pre-emptively warned that more easy money policy from the ECB was not going to fix this stating “monetary policy alone cannot resolve the downturn in Europe or improve the modest medium-term growth prospects.”

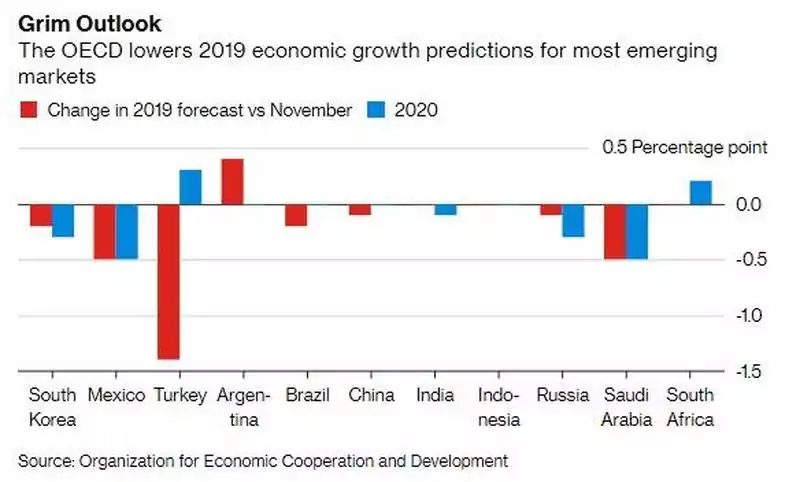

Emerging Markets too are not taking up the baton:

There is now also no denying the post GFC economic saviour, the US, is in the same boat. The Atlanta Fed’s Q1 GDP estimate has just dropped to 0.3% annualised and there has been a host of data showing slowing retail spending, production, construction spending, and of course last night’s $79.5b trade deficit, the worst since the GFC. Yesterday’s Fed Beige Book said growth was now only "slight to moderate."

A big part of the equation, as with Australia, is stagnant wage growth affecting spending. There are however a growing number of Americans overcoming that ‘hurdle’ through debt… The US now has 480m credit cards, 26% more since the GFC, the equivalent to 1.5 for every man, woman and child and $870billion in total. Car loans are at a record high and we just learned 7m Americans are at least 90 days behind in repayments. Combined with their other debt, US consumers have around $13.5 trillion of debt, around 70% of the entire US GDP.

You will recall government debt already is around 105% of GDP and growing rapidly. Indeed figures released yesterday show the US is on track for another $1 trillion deficit this 2019 US fiscal year, the first 4 months up 77% on the same last year and taking the interest bill to $192b for the period (highest ever) and on track for a record $575b for the year. The US is dragging a massive ball and chain as the cost of ‘Making it Great Again’ mounts.

The warning signs are there for all to see. It’s up to you whether you heed them and prepare.