Gold Outlook 2022 pt1 – World Gold Council

News

|

Posted 14/01/2022

|

7093

The World Gold Council have just released their Gold Outlook 2022 report. It’s a relatively lengthy read so we are bringing it to you in 2 parts. Today we look at the very topical impact of rising rates in the US. We mentioned yesterday that the 3-4 rate hikes the Fed is now signalling has been so well signalled that the market has now priced it in. It was another sea of red on wall street last night so maybe it is still digesting it… That said the WGC point out a very interesting and bullish dynamic about such signalling v reality for gold. Sell the rumour, buy the fact is a thing. Anyways, over to WGC:

Higher rates in 2021 outweighed inflation risks

Gold finished the year approximately 4% lower, closing at US$1,806/oz. The gold price rallied into year-end on the heels of the rapidly spreading Omicron variant, likely prompting flight-to-quality flows, but it was not enough to offset H1 weakness.

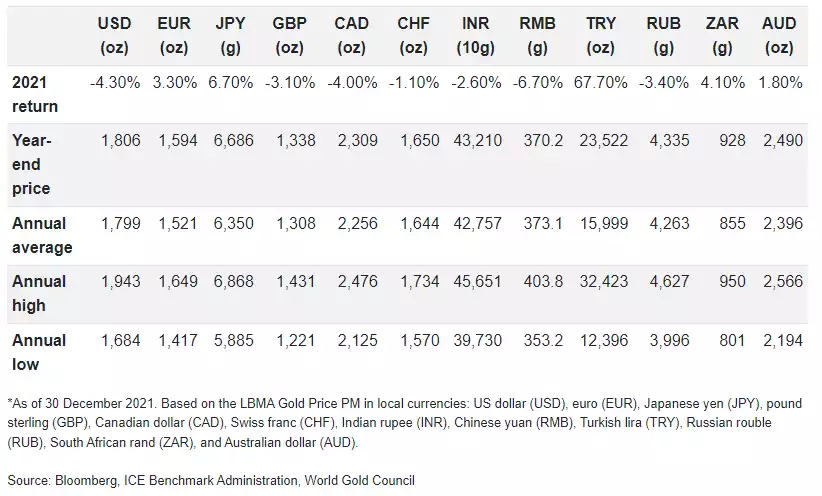

Early in 2021, as newly developed vaccines were rolled out, investor optimism likely fuelled a reduction in portfolio hedges. This negatively impacted gold’s performance and resulted in gold ETF outflows. The rest of the year was a tug of war between competing forces. Uncertainty surrounding new variants, combined with increasing risks of persistently high inflation and a rebound in gold consumer demand, pushed gold forward. Conversely, rising interest rates and a stronger US dollar continued to create headwinds. However, dollar strength led to positive gold returns in some local currency terms, such as the euro and yen among others (Table 1).

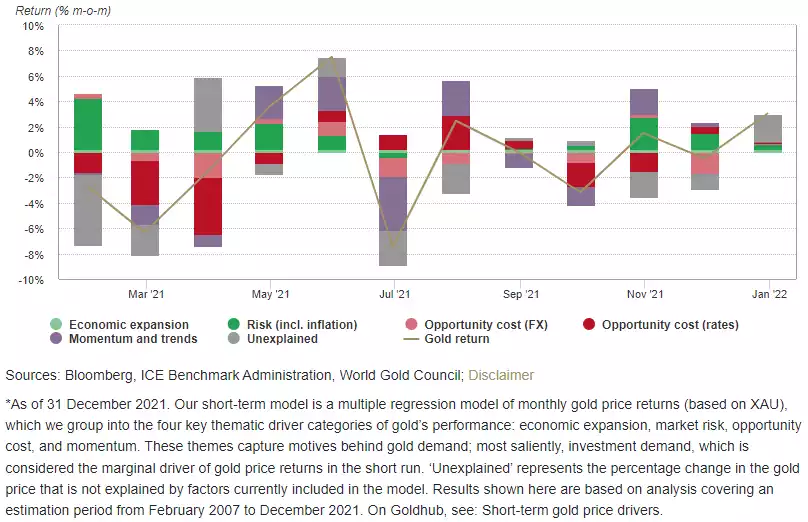

Our gold return attribution model corroborates this. Rising opportunity costs were one of the most important contributors to gold’s negative performance in Q1, and intermittently in H2, while rising risks – especially those linked to elevated inflation – pushed gold higher towards the end of the year (Chart 1).

Chart 1: Rates and inflation were two the most important contributors to gold’s performance in 2021

Contributions of gold price drivers to periodic gold returns*

Table 1: Gold’s price performance was mixed across currencies

Gold price and annual return in key currencies*

Looking ahead, rising rates pose risks but the devil will be in the details

As we enter 2022, the US Federal Reserve is signalling a more hawkish stance. Its projections indicate that the Fed expects to hike approximately three times this year at a quicker pace than previously expected, while aiming to reduce the size of its balance sheet.

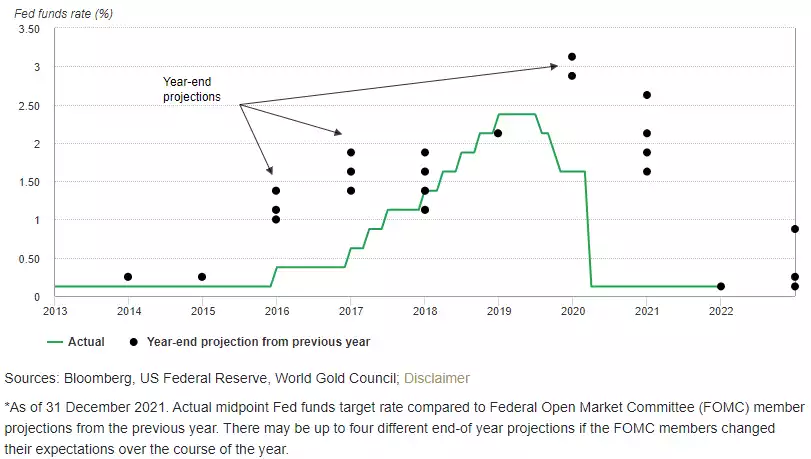

An analysis of previous tightening cycles, however, shows that the Fed has tended not to tighten monetary policy as aggressively as members of the committee had initially expected.

Chart 2: The Fed signalled a more hawkish stance in the previous tightening cycle than what was delivered

Projected mid Fed funds target rate versus actual*

Dot-plot projections suggest that year-ahead Fed expectations have significantly exceeded actual target rates (Chart 2).

More importantly though, financial market expectations of future monetary policy actions – expressed through bond yields – have historically been a key influence on gold price performance.

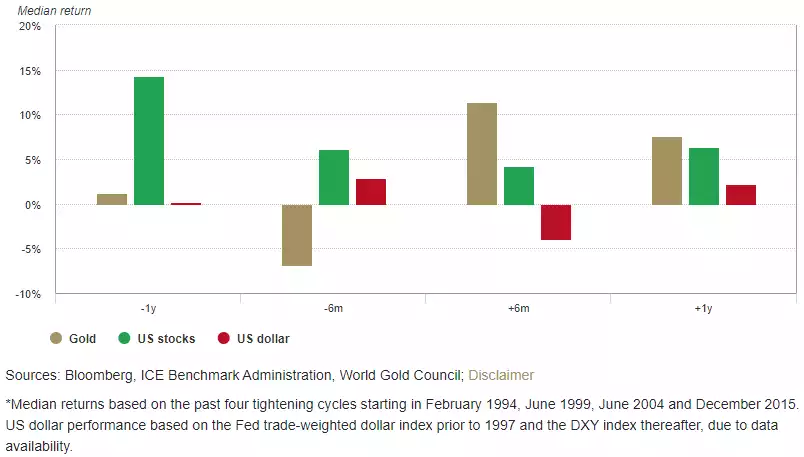

Consequently, gold has historically underperformed in the months leading up to a Fed tightening cycle, only to significantly outperform in the months following the first rate hike (Chart 3). Gold may have partly been aided by the US dollar which exhibited the opposite pattern. Finally, US equities had their strongest performance ahead of a tightening cycle but delivered softer returns thereafter.

Chart 3: Gold has typically outperformed following the first rate hike of a Fed tightening cycle

Median return of gold, US stocks and US Treasuries over the past four Fed tightening cycles*

Finally, while there’s a lot of emphasis on the relationship with US interest rates, gold is a global market. And not all central banks may move as quickly as the Fed.

For example, the European Central Bank has stated that it is “very unlikely” that interest rates will rise in 2022 despite recent record inflation prints. And while the Bank of England increased interest rates in December, its Policy Committee seemed to indicate only modest future rises.

The Reserve Bank of India has also signalled that it will maintain its accommodative monetary policy stance to revive and sustain economic recovery and mitigate the impact of COVID. And the People’s Bank of China cut one of its policy rates by 5bps in December shortly after lowering the required commercial banks reserve ratio to cushion the country’s economic slowdown.

While diverging monetary policies could result in a stronger dollar, steady or decreasing rates should support regional gold investment demand.”

This all generally gels with our view that the Fed may be talking up rate hikes and now even reducing its balance sheet, but the elephant in the room is how the easy money addicted economy can handle that when the inflation is largely supply chain driven whilst real wages remain negative and in an economy fundamentally not strong enough to handle it. On Monday we will bring you part 2 which speaks to these forces.