Is Wall St about to crash? Debunking TINA

News

|

Posted 15/12/2021

|

11772

There is a saying along the lines of “be wary of times when the generals lead but the soldiers don’t follow”. When one looks at the current situation in the US sharemarket that quote makes a lot of sense as a warning of what might be coming. Let’s break that down..

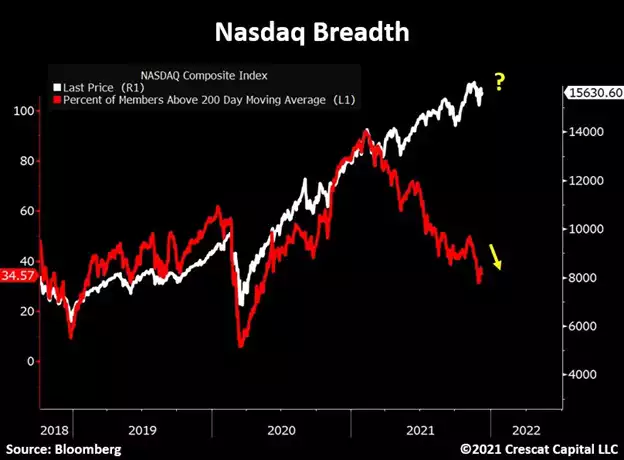

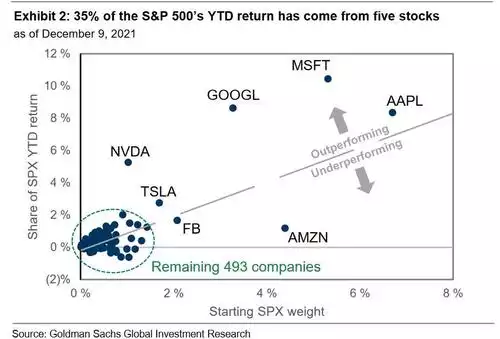

We have discussed ‘market breadth’ before, or more particularly the lack of it. When combined with the incredible concentration of the broader S&P500 in just the big tech FAAMG shares, the fact, as depicted below, that at a time of a near record high NASDAQ, only 35% of it members are trading above the 200 day moving average must come as a huge warning sign..

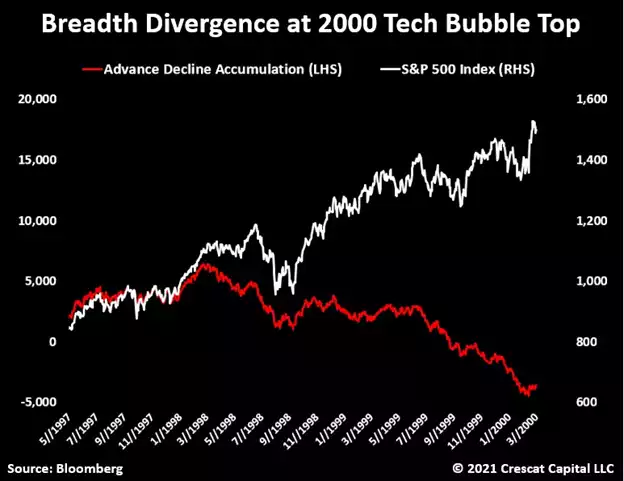

Reminiscent of the last time this happened with the outcome we all know too well….

Goldman Sachs have real concerns too. They have just reported that 51% of returns since April this year on the worlds largest index, the $40 trillion S&P500, have come from just the top 5 performing companies…Apple, Microsoft, Nividia, Tesla and Google… To put that into more perspective the chart below shows year to date performance…

If we look more broadly at valuations and we are now higher than even the previous all time high of the dotcom bubble when looking at the top 10 largest US shares.

The author, Crescat, had these insightful words in this regard..

“Our equity models continue to flash warning signs of excessive valuations among stocks at large. According to our research, on a median and aggregate basis, US equities are at their most expensive levels ever across a lengthy composite of underlying fundamental measures. Conventional wisdom today believes that mega-cap tech stocks are reasonably valued. However, as we showed in our August research letter, the top five market cap stocks in the US, all tech stocks, were 54% more over-valued relative to GDP than the top five market cap stocks at the peak of the tech bubble in 2000. The common refrain is that it is different this time, that P/E ratios are reasonable, that earnings are stronger, and that growth is more sustainable. P/Es had been the one area still not quite at 2000 top levels but that is not true anymore. It is true that earnings are strong, but they are anything but sustainable. There is a business cycle after all, and we are essentially at the peak of one that has been longest ever US expansion, twelve years now since the GFC. The March 2020 Covid recession was a mere blip, hardly a recession at all because there was no reconciliation of the imbalances, no creative destruction, just more inflating of the same bubbles. When it comes to P/E ratios, we believe most investors today are not even looking at them let alone factoring in the effect that sustainably rising inflation would likely have on compressing them going forward. The median P/E ratio of the top 10 largest stocks in the US is now as high as it was at the peak of the Tech Bubble, 37 times earnings.”

But before you say that is just because of the aforementioned concentration… Bloomberg’s broader measure of the entire S&P 500 Index’s long-term price-to-earnings ratio, comparing the current price with the 10-year average real earnings per share ALSO reached 37, the highest since, you guessed it, 2000.

If even that valuation metric can’t convince you, how about Deutsche Bank saying “Valuations are extremely high on almost any metric”?

“Equity valuations are in the 97-100th percentile on almost any metric excluding the 1990s tech bubble period and well into the 90s in percentile terms even including it.”

Let’s go back to Crescat’s reference to those famously most expensive words in investment… “its different this time”.

Some of the narrative around why it is different is the new TINA acronym… There Is No Alternative. That is, when the Fed is printing money hand over fist and interest rates are zero, there is no alternative place for your money than shares. If such sentiment does not flag a bubble, what would!?

Last night, again, Wall St had a bad night. The market is getting nervous ahead of the Fed meeting this week, more bad inflation data and more bad Omicron news out of Europe.

What triggers the inevitable popping of this bubble will only be known in hindsight. Will it be the Fed over reacting to its policy mistake this week or some ‘Black Swan’ event no one could see coming? Any market as perversely distorted amid record high debt levels and artificial monetary stimulus as this has a myriad of Black Swans circling. Which one doesn’t actually matter. Being balanced and prepared is all that matters.

Be wary of following the generals into the ambush. TINA, there is an alternative. Precious metals present a very clear, very compelling alternative amid such madness and at relatively bargain prices.