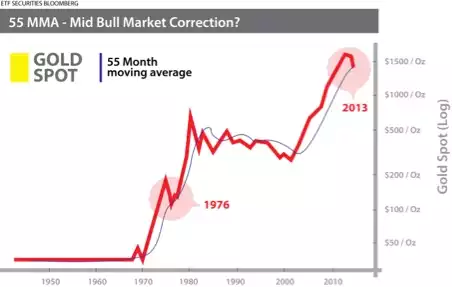

Is this 1976 or 1980?

News

|

Posted 21/03/2014

|

3562

We’ve written before about how the current correction looks more like the 1976 correction not the 1980 end of the bull market. Yesterday we posted a Bloomberg piece on same. Why? We are being fed a whole lot of ‘positive news’ out of the US but famed statistician John Williams gives this snapshot of the US situation stripped bare:

- Strongest Recession Signal Since Eve of the Economic Collapse

- Real Retail Sales on Track for 4% Annualized Plunge in First-Quarter 2014

- Housing Starts on Track for 34% Annualized Plunge in First-Quarter 2014

- For Second Month, Unadjusted Monthly 0.4% CPI Inflation Was Squashed to 0.1% by Seasonal Adjustments

- February Annual Inflation: 1.1% (CPI-U), 1.0% (CPI-W), 8.8% (ShadowStats)

- Real Earnings Down 0.2% in February

Shadowstats.com, March 18, 2014

Here’s a reminder of what happened in 1976…