Investing against ‘doesn’t make sense’

News

|

Posted 09/05/2014

|

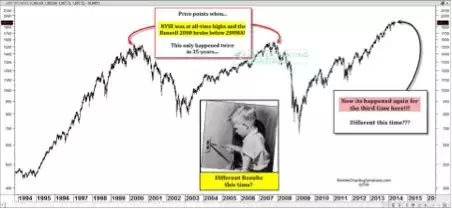

2942

There seems to be a disconnect at present between what we see, feel, read and hear about the poor state of our economy and a share market hitting record highs. Billionaire George Soros says the way to make real money is to bet against something that is wrong or doesn’t make sense. Two more graphs (below), like many we have reported recently, again reinforce the contradiction above. Why? Maybe because sharemarkets have been propped up by money printing… The US continues to ‘taper’ off said money printing and the party may soon be over. So are you ready for such a crash? Gold and silver were the best performing assets post the 2000 and 2008 share market crashes, and are proven hedges against “doesn’t make sense”.