Inventories – The Hidden Death Knell

News

|

Posted 04/02/2022

|

10459

Yesterday we wrote of the very high likelihood the US Fed will be tightening into an already peaking economy and the cyclical resonance effect being potentially very bad for markets. Its a must read if you missed it and is a precursor to today’s ‘part 2’ piece delving into Julian Brigden’s latest insights. Today we look at the role of inventories in these cycles. We’d venture that not one reader has not been affected by inventory effects since COVID but few would realise their causation in the economy.

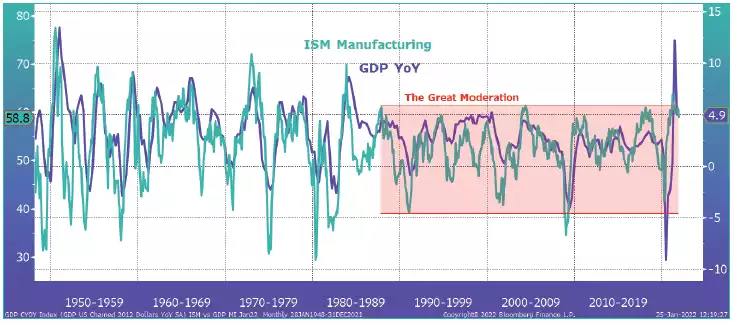

Former US Fed Governor and still prominent economist Alan Blinder says “The business cycle, to a surprisingly large degree, is an inventory cycle”. Yesterday we spoke of Brigden’s Great Moderation and the ‘smooth’ and disinflationary economy since the fall of the Berlin Wall and globalisation of trade and manufacturing. “New World” advocates try to dismiss manufacturing as an important economic metric in an increasingly digital world but the chart below clearly illustrates the tight correlation of the economy and manufacturing, the relative ‘calm’ during the Great Moderation period, and the scale of the disruption since COVID. It is important to note that manufacturing is heavily influenced by inventory swings.

Part of what smoothed out the ISM above is the shift to ‘just in time’ (JIT) supply chains. Logistics and transport both got more efficient and effective and business didn’t need to hold much inventory but still meet the needs of customers. What COVID and China tensions demonstrated, and indeed are still demonstrating, is that JIT can break in a painful way when one or more pieces of that finely tuned supply chain fail. And so we have seen companies around the world move from ‘just in time’ to ‘just in case’. As Brigden explains:

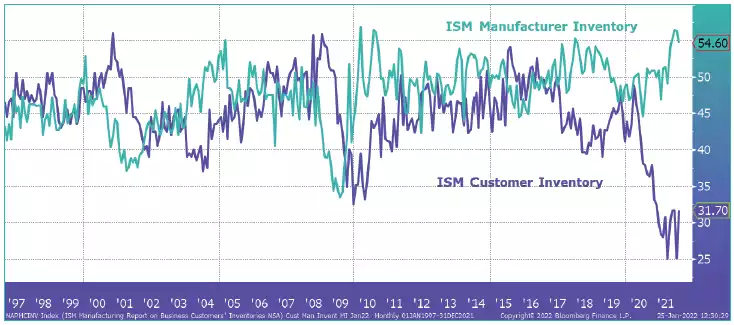

“Definitionally, this requires enterprises to hold larger precautionary inventories, essentially reversing many of the gains of modern inventory control and leaving them exposed to the sort of inventory and production swings we saw before the 1990s. If that wasn’t enough, the pandemic has accentuated risk because it has created a massive divergence between manufacturers’ inventories and those of their customers.”

Part of what causes this massive divergence is two reasons on the manufacturing side. Firstly manufacturers have been over ordering to build up precautionary inventories and potentially front running inflation for them; and secondly producing as much as they can but missing key components like silicon chips and so unfinished but largely complete (cue images of football fields of F150 trucks waiting for a single CPU). On the customer inventory side we have empty shelves, car yards etc waiting for these stalled goods. The head of ISM Manufacturing which give us all these insights just warned it will take:

“three-four months’ worth of heavy output here to burn off the backlog and fill the shelves”

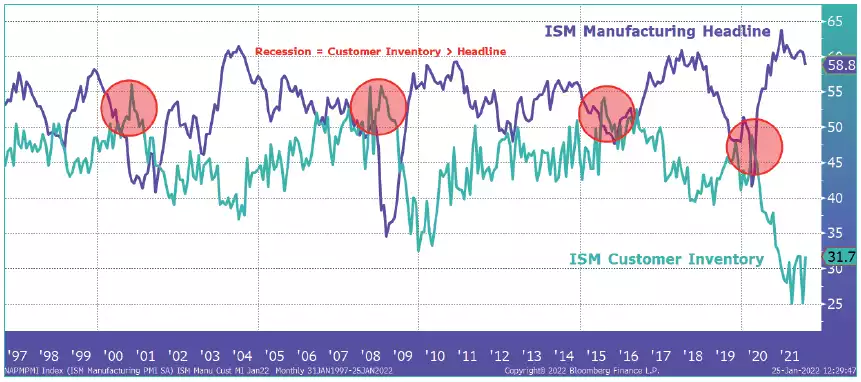

And so piecing together yesterday’s article and this potential surge of inventories you can see yet another procyclical alignment like the Tacoma Bridge analogy…

“But imagine a scenario where, just as we finished filling those shelves, demand dropped sharply because the Fed had overtightened and tipped over equities? Could we rapidly flip from a backdrop of inventory famine to inventory feast just as demand weakened? Could this drive customer inventory to a peak just as the headline ISM Index drops, thereby generating a recession and forcing the Fed to reverse policy the other way?

That may not be how things play out, but the stars do seem to be aligning.

“Over-ordering has a long history

To illustrate the power of the inventory cycle, it’s worth looking at another historical analogy. In the book “Hand-to-Mouth Buying and the Inventory Situation”, George Gade describes how, at the end of WWI, pent-up demand, together with the end of wage and price controls, led to a surging economy. The result was that manufacturers massively over-ordered to try and get ahead of inflation. Unfortunately, this left them dangerously exposed. When the equity market started to roll over in late 1919 (ultimately falling 45%), the ensuing slowdown left them with an inventory overhang. The result was a collapse in production and a particularly severe recession.

Covid was just an accelerant

Even before Covid, the structural factors that underpinned the Great Moderation were reversing and given time, would have resulted in greater economic cyclicality. In that sense, CV-19 is merely a catalyst, albeit a remarkably effective one.

That has not only left us with massively overvalued risk markets and an unusually vulnerable setup in inventories, but also a Fed that is just waking up to how far they are behind the curve. When combined with hyper financialisation, which ensures the instant transmission of a fall in asset prices straight into the real economy, we have the ideal set up for a policy error and a sudden economic slowdown — practically the definition of market volatility.”

Overnight we saw US Factory orders for January fall the most since April 2020 – in the meat of the COVID crash, and earlier this week both Markit’s and ISM’s Manufacturing Indexes fell again.

And if you missed it, last week the Atlanta Fed’s GDPNOW forecast (typically the best at getting it right and part of the very same US Fed ‘steering’ this ship) revised its Q1 economic growth forecast to just 0.1%!

So to recap… we have sky high inflation forcing the Fed’s hand to raise rates; we have clear signs of an economy having peaked and weakening (= stagflation); a tsunami of inventories on their way but not quickly; a ‘hyper-financialised’ economy that reacts immediately to the sharemarket; a sharemarket that is correcting sharply on just the expectation of tighter monetary policy – but then bouncing on the “but surely the Fed know they can’t tighten” trade; and so a Fed with the win-free choice of hiking too late and into weakness and crashing the entire market and by default global economy, OR do nothing and allow inflation to run wild – both financial assets and the general economy – delaying but exacerbating the inevitable.

And yet somehow gold hovers around US$1800 without Jo Public seeing the “For Sale” sign on it….