Interest Rates Lower for Longer

News

|

Posted 22/04/2016

|

6299

The harsh realities of extended low interest rate environments will come as no surprise to those reliant on, or planning to be reliant on savings. Nevertheless, RBA Governor Glenn Stevens spelled out these realities in a speech delivered in New York earlier this week. Referring to superannuation accumulation, Mr. Stevens conservatively stated that "many of the owners of accumulation funds are going to feel disappointment" when referring to the growth performance of fund allocations in high volatility, low growth environments and further referred to the "difficulty, or impossibility, of defined benefit pension plans making good on their promises with long term rates of return so low".

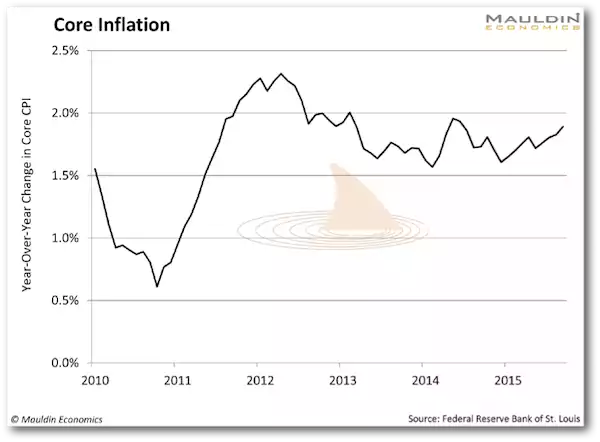

At about the time of Mr. Stevens’ presentation, an article was released by Mauldin Economics citing three arguments for an extended period of low interest rates from the U.S. perspective. The first of these is non-existent inflation. Arguments aside regarding how inflation is actually measured (a topic of some contention in the financial community), the article highlights the fact that official core inflation is stubbornly stuck below the Federal Reserve’s target threshold of 2% and that this would need to change prior to any consideration of meaningful increases in interest rates.

The second reason raised by Mauldin is the absence of any economic recovery. With now wafer thin positive GDP prints and the plethora of bad economic metrics that we often report on, we fail to see anything near an economy that could be classified as “overheated” which is what is typically required for rate hike cycles.

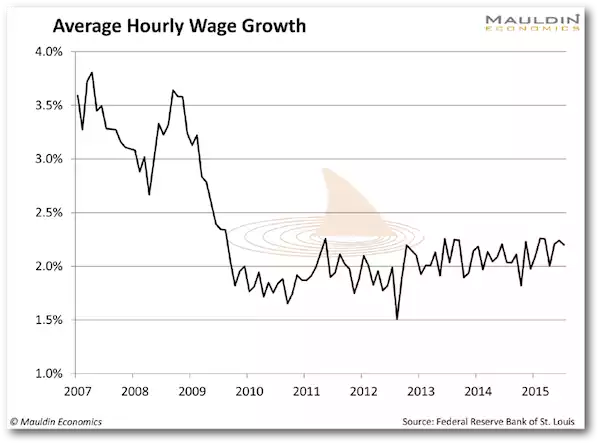

Lastly, the issue of effectively absent wage growth is cited. Indeed the details behind the NFP prints that we present show evidence of the replacement of high paying jobs with those offering lower or even minimum wage incomes. In more recent years the issue of “employer-sponsored healthcare” is identified as a factor in the stagnation or deterioration of take home pay as pictured below.

It’s this environment that sees people mover further out on the risk curve creating further suppression of value. With the strength in the AUD of late, media talk has focused on further cutting moves ahead and it is exactly this type of environment that makes alternative asset allocation even more attractive. In closing, we refer to the final point in our article of the 8th where Jim Rickards discusses precious metals in low yield environments.