India’s H1 2017 Gold Imports & The Psychology Of “Buying The Dips”

News

|

Posted 11/07/2017

|

7985

Last month we referenced a World Gold Council article that discussed the implications of India’s tax overhaul on gold. For those who missed it, this snippet summarises:

“On 1st July, India’s labyrinth of taxes will be replaced with a simple, nationwide Goods & Services Tax (GST). While this radical step forward could present short-term challenges, we believe it will make the gold industry more transparent and efficient, benefiting the gold industry and gold buyers.”

At the time, we commented that “Already this year Indian gold demand is up strongly and China remains strong whilst the Russians keep adding large amounts to their reserves. China and India alone, the world’s 2 most populous, account for a huge proportion of global demand. More prosperity and inflation would almost certainly see more gold demand.”

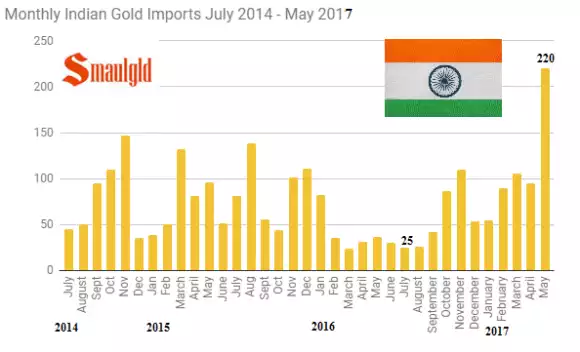

In support of our comments then comes a timely article penned by Anna Golubova yesterday who points out that India’s H1 2017 gold import figure of 521 tonnes has already surpassed that of 2016 at 510 tonnes according to data from GFMS (Gold Fields Mineral Services) Thomson Reuters.

To explain this, senior GFMS analyst Sudheesh Nambiath was quoted as saying “large jewellery manufacturers have seen volumes higher than the monthly average through April to June. Investment-led demand has also turned stronger as there has been an increased interest to stash away cash in gold which many believe may be difficult post-GST. Our estimate is that at least one-third of the wedding related demand that comes up in the fourth quarter has been advanced”

The two important takeaways from this analysis are firstly that Indians view gold as a viable alternative to cash when it comes to storage of wealth and secondly that gold provides a hedge against political disruptions or legislative changes.

Importantly, the pulling forward of demand from a future high tax environment to a current low tax environment is a good example of “buying the dip”. This concept is well established in the East and we’ve recently covered the advantages of this psychology in relation to investment success.

The upswing in gold demand was also observed by the Times Of India on June 29th when they reported on gold premiums jumping significantly ahead of the GST rollout. At the time, the TOI noted that gold premiums were sitting at near eight month highs “as consumers advanced purchases to avoid paying higher tax when a new nationwide sales tax takes effect from July 1”.

The new 3% tax is up from 1.2% previously.

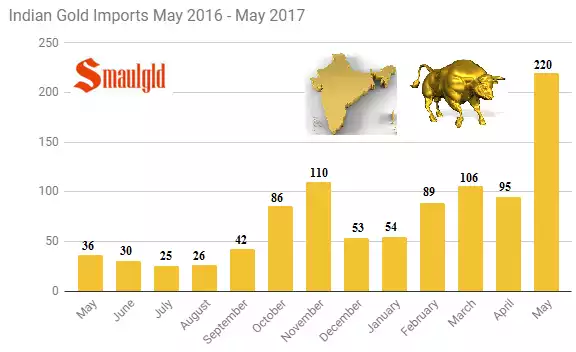

According to Smaulgld “May Indian gold imports were 220 tons up 132% from April imports of 95 tons, and up 511% from 36 tons imported in May 2016” as pictured below.

According to the Times Of India, “jewellery showrooms in key Indian cities like Mumbai and Kolkata were crowded” in June, a typically weak month for demand and despite dealers charging “a premium of up to $10 an ounce over official domestic prices, the highest since mid-November” and up from a $1 premium the week prior.

Kumar Jain, VP at Mumbai Jewellers Association attributes the surge to the fact that "people are advancing buying to avoid paying additional tax"

It remains to be seen whether the surge in Indian gold consumption currently is a replacement for the demand typically seen in Q4 or whether that cyclical demand will still be observable this year.

Rajendra Jadhav at CNBC is predicating the former but in the latter scenario, 2017 annual figures could surpass 900 tonnes which would mark the highest import figure since 2012. If Sudheesh Nambiath is correct in estimating that only one third of peak H2 demand has been brought forward then we should reasonably expect to still see higher figures this year as the peak season comes to pass.

Regardless, the observable human investment behaviour in the face of legislative change in India right now is strong evidence of the widely held confidence placed in gold as a long established instrument of sound money.