Incrementum’s Annual “In Gold We Trust” Report

News

|

Posted 04/07/2017

|

9791

Gold was under strong pressure overnight with selling taking advantage of the thin 4th of July holiday period. A strong rebound in the USD exacerbated the situation with the Commex August gold contract down $21.60 and the September silver contract down $0.497 according to Kitco.

This can be frustrating on the surface with Gregory Mannarino early this morning saying “nobody would be selling huge orders like this onto the market and be willing to take anything for it” and reminding us that when it comes to gold, “longer term I can’t imagine a better place to be”.

The price action overnight is an illustration of the points made yesterday when we discussed the importance of education and context in determining prudent investment moves. It is timely then that the 2017 version of Incrementum’s “In Gold We Trust” report has been released as it’s an excellent source of information on the monetary system, inflation, bitcoin, populism, US recession odds, portfolio characteristics of gold and mining shares.

Published for free in both a 169 page extended version and a 29 page compact version, the report is opened articulately and as such is quoted here:

“We live in an age of advanced monetary surrealism. In Q1 2017 alone, the largest central banks created the equivalent of almost USD 1,000 bn. worth of central bank money ex nihilo. Naturally the fresh currency was not used to fund philanthropic projects but to purchase financial securities. Although this ongoing liquidity supernova has temporarily created an uneasy calm in financial markets, we are strongly convinced that the real costs of this monetary madness will reveal themselves down the line.”

We cover the poignant points below but for those time challenged readers; the report articulates that we are approaching a period of wealth transfer where value is shifted from one class of asset into another. There are strong indications that gold and silver are set up to be the recipients of this wealth transfer with the value being extracted from “everything else”.

Head of research and investment funds at Incrementum Ronni Stoeferle in an interview with Kenneth Ameduri released over the weekend supported the conclusion made in Incrementum’s 2016 report; namely that we are in the early stages of a new bull market in gold. Stating that the next US recession is already on our doorstep, the report notes that the de-dollarisation already occurring supports gold technically and fundamentally at the moment.

Staggeringly, the 1T USD mentioned in the introduction is sufficient to buy every human being on this planet 1/10 of an ounce of gold and the ultimate result of its creation according to the report is asset price inflation. Real estate, bonds, share prices are at or near all-time highs where commodities and gold are very cheap both in absolute and relative terms.

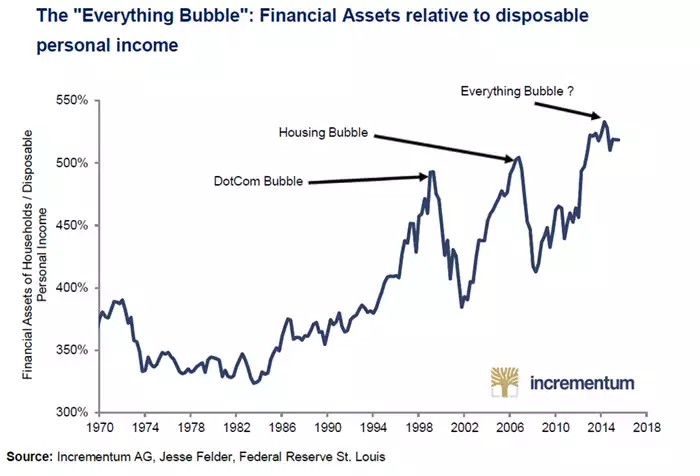

A graph on page 6 of the compact report shows that financial assets of households in relation to disposable income has now exceeded the peaks of both previous bubbles (displayed below for convenience). Importantly, the last bubbles were limited to certain sectors where as now the contamination is everywhere. Ronni concludes that “the next bust will be significantly bigger than 2008. You should have insurance and this insurance should be gold”.

At gold’s peak of around $1900 in 2011, inflation rates were 4.4% YOY. Since then we’ve seen falling inflation rates. Disinflation is by far the most negative environment for gold based on the report’s analysis. This also leads to the conclusion that a strong dollar environment which we see in disinflationary scenarios is a negative environment for gold. Note that the USD index was trading at a 14 year high at the end of last year. There are quite a lot of signs that inflation numbers have bottomed last year and we are heading into an inflationary environment.

On politics, the report indicates that Donald Trump wants a weak dollar and the likelihood is that the next couple of years will see just that; an excellent environment for gold and commodities.

The whole world believes that the US economy is doing so well and that the US is firmly on the rate hike path with a hawkish fed yet from Ronni’s point of view, “that’s nonsense”. The fed will have to change course sooner or later because there’s a large gap between the soft and hard data. “Economic confidence may be high but the hard data doesn’t confirm strength. A recession going forward is one of the biggest catalysts for gold”.

There are a lot of positive signs confirming gold’s new bull market. Gold has clocked up positive gains in 2016 and 2017 in every currency which indicates good market breadth and is something we covered yesterday. The relative weakness vs the stock market is receding with gold relative to the S&P bottoming.

Incrementum is bullish on mining stocks with Ronni stating that “we’ve seen a lot of creative destruction. Free cash flow in the gold bug index last year was higher than in 2011when gold was trading at $1900 so the companies did their homework, reduced debt, restructured balance sheets, all positive signs”. Given that the last bear market in mining stocks was the longest in history it’s clear that the next bull market will be “quite interesting”.

Lastly, Ronni poses an interesting thought experiment for those not bullish on gold; that is to ask “when would I not need any gold in my portfolio?” The answer would probably be “when the debt levels can be sustained or reduced, when the threat of inflation is low, when real interest rates are high, when confidence in the monetary authority is strong, when the geopolitical environment is steady and predictable and when governments deregulate markets, simplify tax regulations and respect civil liberties.

It’s reasonably safe to say that we are currently seeing exactly the opposite.

Both the full length and condensed versions of the report are free and available at https://www.incrementum.li/