IMF Debt Binge Warning

News

|

Posted 07/10/2016

|

6892

Before we get into today’s article, it was another hard night for silver last night. Listen to this week’s Weekly Wrap podcast for our thoughts.

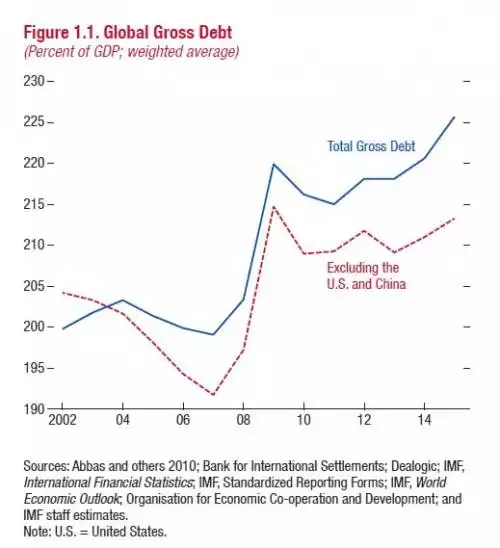

If you missed it yesterday the IMF, after already earlier in the week revising down growth forecasts across the globe, issued their latest Fiscal Monitor report with yet another record tumbling in this unprecedented global financial experiment we find ourselves in. Total non financial sector debt, or total public and private debt, hit a new all-time record high of $152 trillion (that’s $200 trillion in Aussie dollars). Now that is of course a huge number but it needs context for full effect. Try 225% of global GDP… That (per the chart below) is about 5% higher than just before the GFC. And remember that excludes all financial sector debt! Of more concern than the headline:

"two-thirds, amounting to about $100 trillion, consists of liabilities of the private sector which, as documented in extensive literature, can carry great risks when they reach excessive levels.”

They point out that Australia is one of the worst, referring to our ‘fast paced binge’ on new debt. As we’ve reported before, we have the highest personal debt to GDP ratio in the world, with Canada snapping at our heals. Both us and Canada have gone on a cheap money property splurge and the IMF is warning of the consequences (“great risks”) of that both in terms of creating bubbles (Canada’s property appears to be popping now) but also the ability to service this debt when rates inevitably rise. In their words:

“there are concerns that the sheer size of debt could set the stage for an unprecedented private deleveraging process that could thwart the fragile economic recovery."

In what could be the first signs, in the first nine months of 2016, commercial bankruptcy filings in the US jumped 28% compared to the same period in 2015, September saw a 38% (!) jump on the same month last year.

But it’s not just private debt that has them worried. Topically just one week after the US posting it’s 3rd biggest deficit in history ($1.4 trillion) taking their national public debt to $19.57 trillion, the IMF warned:

“New empirical evidence confirms that financial crises tend to be associated with excessive private debt levels in both advanced and emerging market economies, but high public debt is not without its risks. In particular, entering a financial crisis with a weak fiscal position exacerbates the depth and duration of the ensuing recession. The reason is that the absence of fiscal buffers prior to the crisis significantly curtails the ability to conduct countercyclical fiscal policy, especially in emerging market economies.”

So as you may be feeling a little uneasy with what happened to gold and silver this last week keep in mind why you likely bought it and ask yourself how the world extracts itself from this ‘binge’ without all financial assets inflated by it not unwinding in a way that will make the falls this week look minor.