IGWT 6 – Where to for Gold?

News

|

Posted 18/04/2019

|

9355

In our final instalment of looking at the “In Gold We Trust” teaser, is their aptly named Quo Vadis, Aurum. Where to from here for gold?

Let us start with their quote from investment legend Jim Grant:

“The only permanent truth in finance is that people will get bullish at the top and bearish at the bottom.”

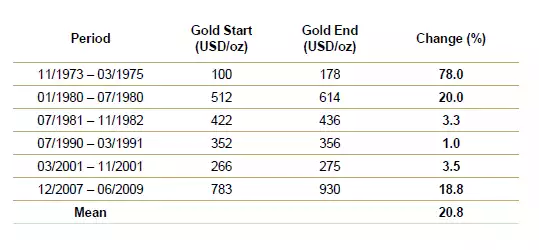

Gold has certainly been in the doldrums since 2013. The bears have ruled. But the signs of recession are many. Regular readers know we report on these across a whole range of measures and metrics. The IGWT report reminds us how gold performs in recessions. Very well!

“On the one hand, investors are looking for safe havens in times of crisis, and gold is the classical safe haven asset; on the other hand, many investors will anticipate monetary and fiscal stimulus and buy gold for inflation protection. If the Fed fails in its normalization efforts and the US falls into a recession – which is our favoured scenario – a loss of confidence in central bank monetary policy seems likely to ensue. It is highly doubtful whether the current global monetary architecture will be able to withstand such a profound loss of confidence unscathed.”

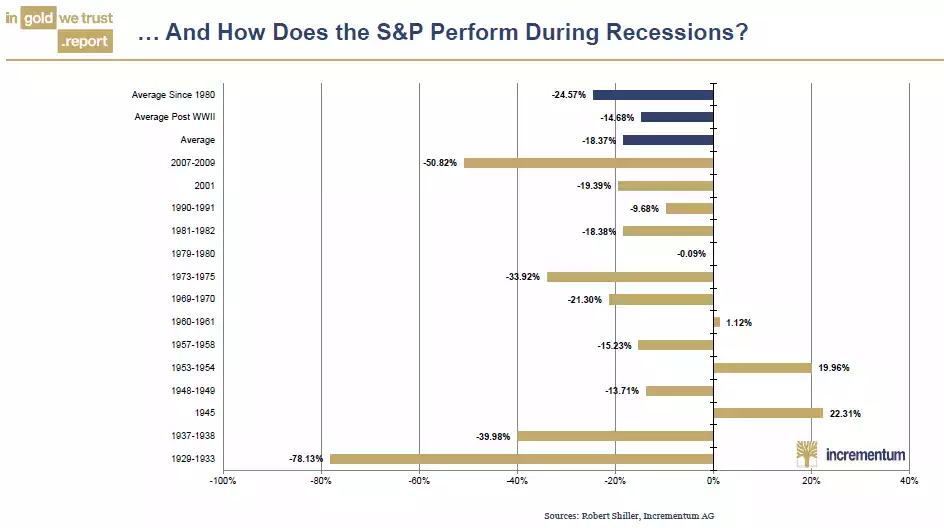

By comparison, and not surprisingly, the S&P500 does not do so well in recessions..

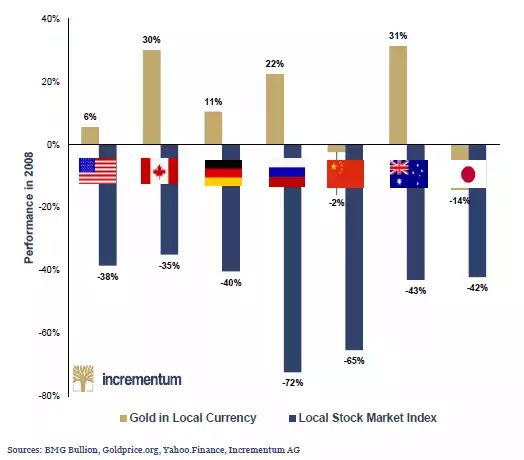

And if we look at the start of the last (but remember it lasted a couple of years) in 2008 you can see how gold performed against the local currency in each major market around the world, including Australia.

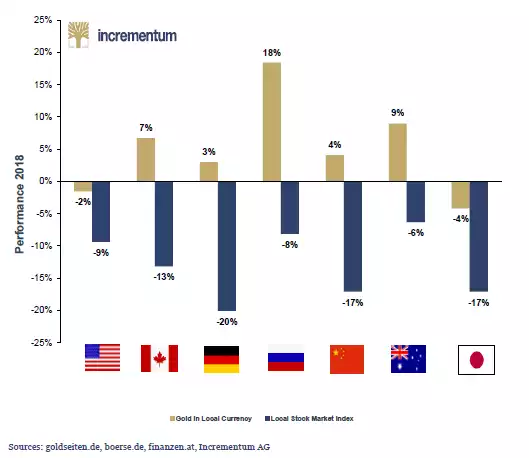

Last year showed the first real cracks in the goldilocks economy. In all but the US (fuelled by Trump stimulus) and Japan (where their central bank bought a staggering amount of shares with printed money), gold outperformed the local sharemarket. And that was just with some cracks…

Quite rightly IGWT ask:

“What happens if both stocks and bonds dive in a bear market? What will be the safe haven, now that the traditional pattern of negative correlation has changed? Will it be cash, property, Bitcoin, or – yet again – gold? We are convinced that in a bear market environment, gold will be among the biggest beneficiaries.”

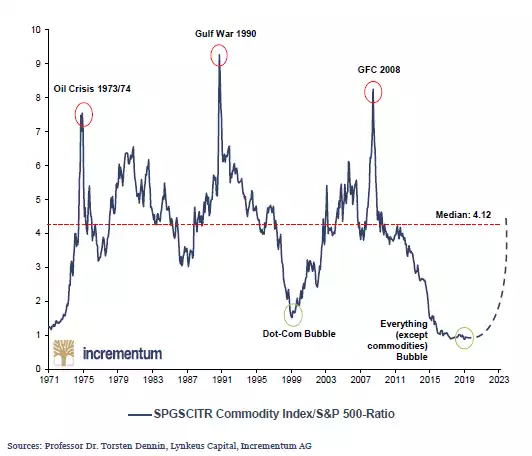

Finally, they revisit the broader commodities picture. Now for the record we don’t think gold should be considered a commodity. Gold is principally money. We talked a couple of days ago about gold having a stock-to-flow ratio (total existing supply v annual production) of approximately 64 years. We don’t see how something with a stock to flow ratio so high could be considered a commodity that in theory is therefore used and hence would imply a stock to flow ratio closer to 1. However, we do concede gold does tend to loosely follow the broader commodities complex so let’s re-join IGWT (after our little rant…) and look at where that sits:

Compared to the S&P500 the commodity index is at lows not seen since 1971 and well below its mean. In other words financial assets are way over inflated compared to real assets. Maths doesn’t care for the narrative. Maths tells us that reversion of the mean will come in to play. Whether it is a U shaped (as above) or V shaped reversion is anyone’s guess.

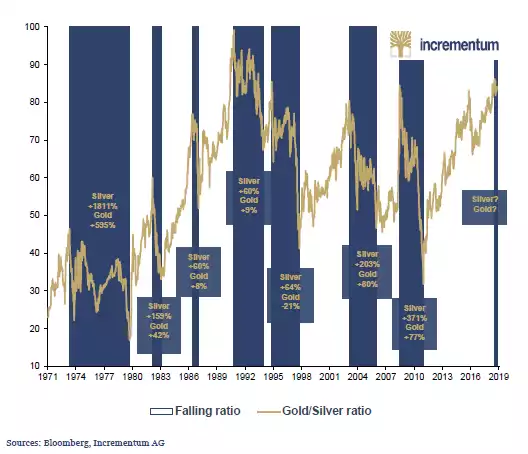

And of course no credible discussion of where to for gold could ignore that sky high gold:silver ratio we are looking at right now. IGWT present this so succinctly:

“The gold/silver ratio recently traded at the highest level since 1991! At the moment, it seems as if the ratio has hit a potential reversal point again after an upward trend of almost seven years. The ratio has spiked over 80 and is currently trading at 85. According to the results of our statistical analysis, a sustainable increase in the gold price is unlikely to happen in tandem with an increase in the gold/silver ratio. A falling gold/silver ratio significantly increases the probability of a bull market in gold and silver.”

We hope you’ve enjoyed our 6 part summary of the In Gold We Trust teaser. You can see why the guys at Incrementum are held in such high esteem. The full report comes out at the end of May and we can’t wait to read it all.