IGWT 5 – What Are Gold Shares Telling Us?

News

|

Posted 17/04/2019

|

9124

In our 5th instalment looking at the “In Gold We Trust” report, they look at gold stocks (shares) and what the equities market is telling us about gold.

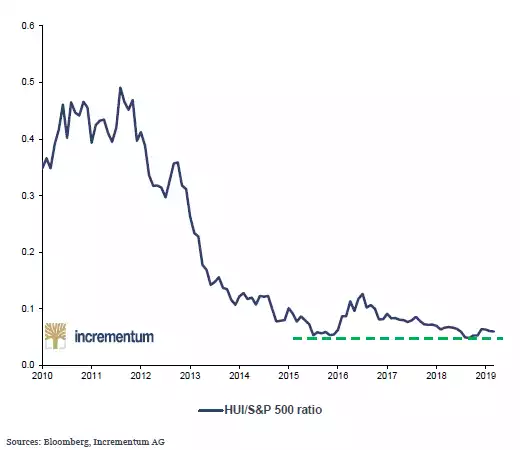

The HUI Index is the so called Gold BUGS (Basket of Unhedged Gold Stocks) index on the New York Stock Exchange. The ration between the HUI and the S&P500 is currently at levels similar to 2001 before the last bull market in gold share took off, and the mini bull run from December 2015 when they doubled against the S&P500:

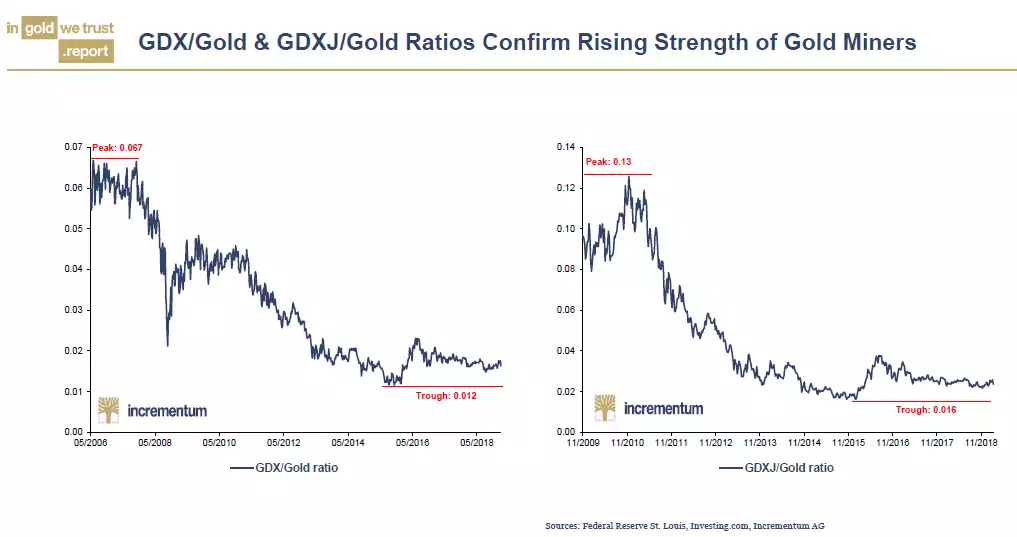

Likewise against the price of gold the big ETF’s of GDX and the Junior equivalent GDXJ are on the rise.

But it’s very early days:

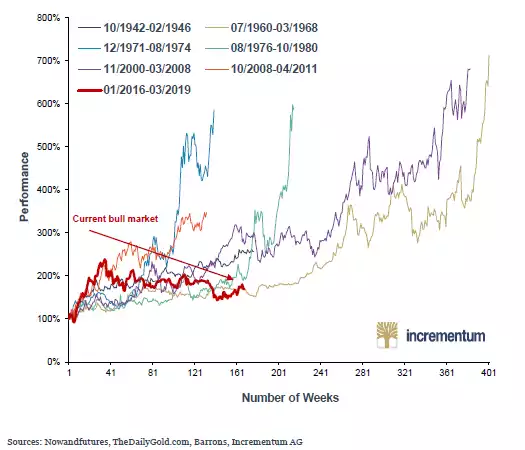

“The chart [below] shows all bull markets in the Barron’s Gold Mining Index (BGMI) since 1942. One can see that the current uptrend is still relatively short and weak compared to its predecessors. Should we actually be at the beginning of a pronounced uptrend in precious metals stocks – which we assume to be the case – then there remains plenty of upside potential. Moreover, the chart shows that every bull market in the sector ended in a parabolic upward spike, which lasted nine months on average and resulted in prices doubling at a minimum.”

Gold shares are potentially a great investment and can potentially outperform the price of the underlying commodity, gold. However the big word there is ‘potentially’. When you buy shares you are buying the management as much as the material. That involves risk. The key takeaway from the gold shares set up is that shares are often a fantastic signal of what’s to come for the price of gold, the investment without the counterparty risk. And that looks pretty compelling when you consider the charts above.