HOT US CPI – Policy Mistake Screams Market

News

|

Posted 11/02/2022

|

8767

Wow. The US CPI print came in last night and again exceeded expectations at a blisteringly hot 7.5%, the highest seen since March of 1982 (when rates were 11.5% not zero). This was the 9th beat of ‘transitory’ expectations in the last 11 months, but it was the market, a Fed member reaction and, most importantly, history that should have holders of financial assets worried.

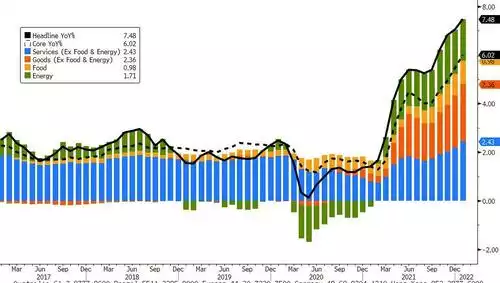

The chart below tells the story. 20 straight months of CPI increases across both goods and services. Core CPI hit 6%!

And 2 more charts illustrate the tenuousness of the ‘transitory’ narrative. Firstly the price rises at the ‘factory door’ (i.e. the Producer Price Index or PPI) are still way outpacing CPI. As we’ve discussed before that either means businesses earnings drop as margin disappears if they don’t raise prices, or they raise prices to match PPI and CPI rips higher. Both are disastrous for shares.

Secondly, wage growth is not keeping up with CPI. So either wages go up and more pressure on prices through consumer spending, or wages go up and more pressure on earnings, or wages continue to be outpaced by prices rises (as has happened for the last 10 straight months) and the socio economic and political issues we’ve seen exacerbated by the rich enjoying rising asset prices while ‘the rest’ go backwards flare up.

We then had St.Louis Fed president Jim Bullard last night light a fire in markets calling for a full 100 bps (1%) rate rise by 1 July, starting with a (double) 50bps hike immediately (not happened since 2000). By immediate, he is literally talking a special Fed meeting now, not waiting for March. That sent the market pricing a 50bps rise from 60% after the print to 100%! As you might well imagine, Wall Street sold off with both the S&P500 and NASDAQ down around 2%. This easy money addicted sharemarket is staring down the barrel of tighter policy and it doesn’t like it!

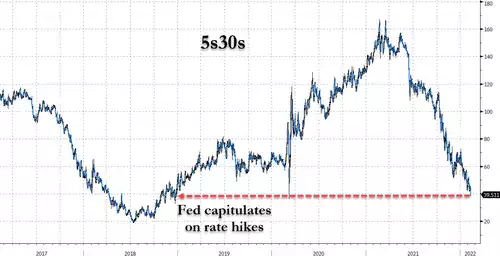

The ’market of truth’, the US bond market is also very very telling right now. 10yr bond yields spiked above 2% for the first time since 2019 and yield curves collapsed across the board. The 2yr 10yr plummeting to its lowest since the grip of the COVID recession and the 5yr30yr to the same level that (ironically/tellingly) saw the Fed reverse their tightening attempt in 2018…. Forward swaps are already pricing in rate cuts amid a recession in 2 years…

And whilst talking of too little too late, hiking into weakness ‘policy error’, lets just pause and consider that at the time of a 7.5% inflation print the Fed is STILL printing money via QE (remember tapering is just less of more) and rates at zero.

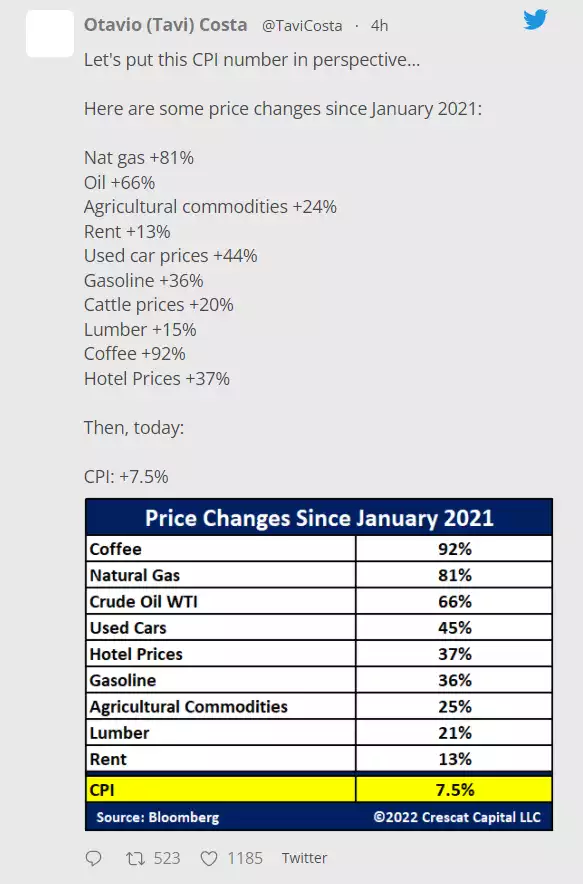

Can we also pause and revisit the makeup of the 7.5% CPI that we are all going oooh and ahhh about…

We have written many many times about the weightings and composition of the CPI basket. It’s the same for Australia. They don’t want Jo Public knowing the full number. Does your wallet really believe Australian inflation is only 3.5%?

Remember when the world is carrying the debt burden it is today, when the issuer of the world’s reserve currency has public (government) debt (not including all the corporate and private) equating to $30 trillion or 100% of the total GDP of that country, the ONLY way to reduce that debt is through inflation or default. They need the former and can’t afford the latter. So why scare the public with higher inflation figures when you can quietly rob them to pay down (inflate away) your excesses?

As sure as night follows day, central banks will be forced into tightening what has been an historically unprecedented loose monetary experiment into an economy built largely off it and hence unable to handle it. We wrote of this last week and it’s an important read.

Gold and silver have been inflation hedges and hard safe haven assets for 5000 years. Whilst the scale of hubris and monetary abuse of this credit cycle may be unprecedented, the inevitable outcome is not. It is starting to feel like that outcome is getting close.

This is history simply repeating without lessons learned, as humans, and in particular our political and corporate leaders, cannot resist the greed and self interest that a credit based Fiat monetary system allows. The changing world order that Ray Dalio recently spoke to is a repeating cycle.

Are you ready?