Historic Week in Crypto.

News

|

Posted 17/05/2022

|

10065

The cryptocurrency markets experienced a week of historic volatility and chaos, with the exchange rate for two stablecoins, UST and USDT taking centre stage. Over just a few days, two top 10 digital assets by market cap (LUNA and UST) erased nearly $40 Billion in investor value. UST lost its $1 peg completely, and LUNA collapsed to a price of $0.00001 as its supply hyper-inflated. As a result, the Luna Foundation Guard (LFG) deployed their only recently established reserves of 80,394 BTC to defend the peg, although without success.

Later in the week, and on the momentum of UST de-pegging news, the market temporarily expressed fear over the quality of Tether's peg (USDT). USDT traded briefly down to a low of $0.9565, however, recovered within 24hrs, currently trading at a very slight discount of $0.998.

Amidst the stablecoin contagion, and under the weight of $3.275 Billion worth of Bitcoin sold by the LFG, Bitcoin traded down 21.2% to $26,513. This is the lowest price since December 2020 and naturally puts much of the market under financial stress.

So what exactly happened to LUNA?

Over the past few years, the market has seen stablecoins rise to represent a sizeable portion of the total market cap of all digital assets. On the 8-May, stablecoins captured more than $135 Billion in value between USDT, USDC, BUSD, DAI, and UST.

Stablecoins come in several forms, but can generally be represented in three types:

- Collateralised (USDT, USDC, BUSD)

- Crypto-over-collateralised (DAI)

- Algorithmic (UST).

In the case of UST and LUNA, the algorithmic design allowed for users to convert 1 UST into $1 worth of LUNA (and vice-versa), irrespective of the market price of both assets. In effect, this means that the LUNA supply contracts (and price often rises) when there is demand for UST. However, this same reflexivity works in reverse, when demand falls, and prices move to the downside, the supply of LUNA can (and did) hyper-inflate.

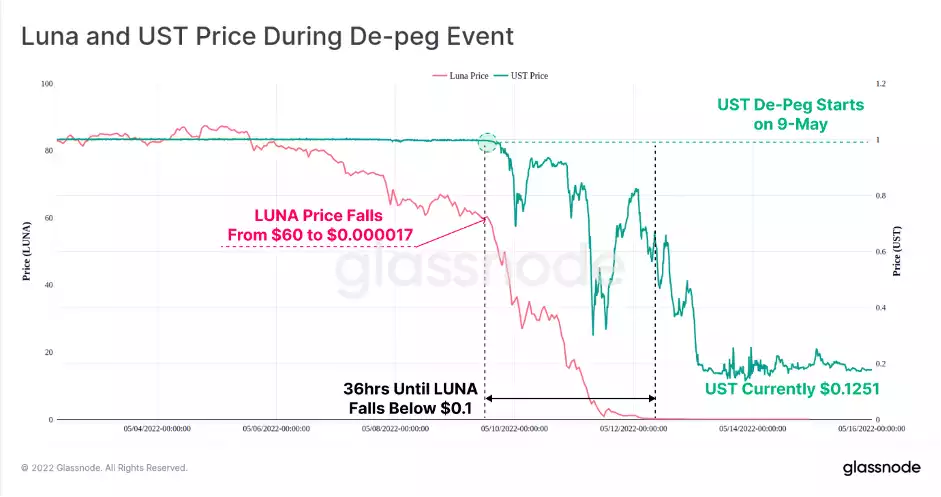

The UST peg began to break on the 9-May when LUNA was trading around $60 (~49.5% off the $119 ATH). Over the next 36-hours, LUNA prices fell below $0.1, and the UST peg traded between extremes of $0.30 and $0.82. This put the protocol redemption mechanism into overdrive, as users both panicked, and arbitraged the exchange of 1 UST for $1 worth of LUNA, inflating the supply and depressing prices further.

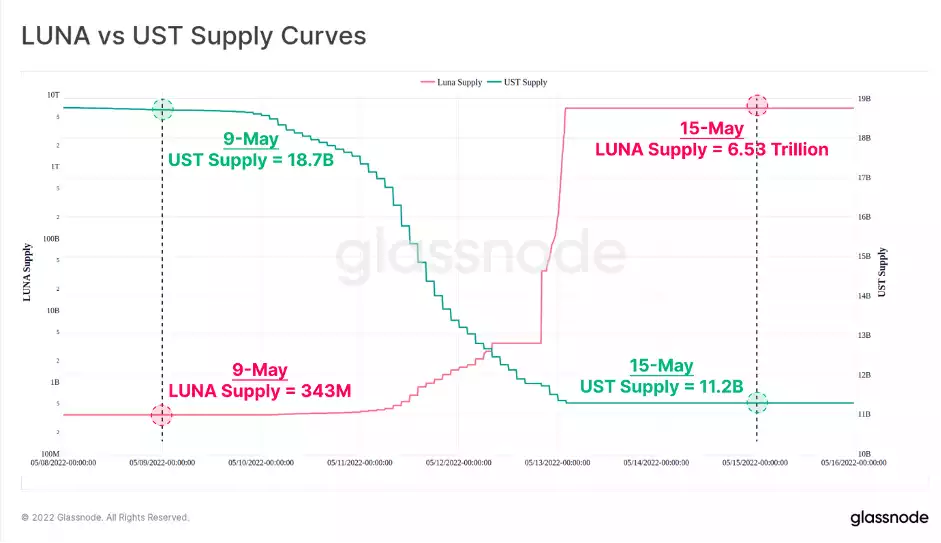

The magnitude of LUNA supply inflation can be seen in the chart below, where UST supply (green, RHS) is on a linear scale, whilst LUNA supply (red, LHS) is on a log scale. Over one week, 7.5 Billion UST were redeemed (40% of supply), whilst the LUNA supply inflated from 343 Million to over 6.53 Trillion, an annualised inflation rate of 99,263,840%.

At one stage on 13-May, the LUNA blockchain was even halted as a result of second-order effects on network stability and governance due to the hyper-inflating supply.

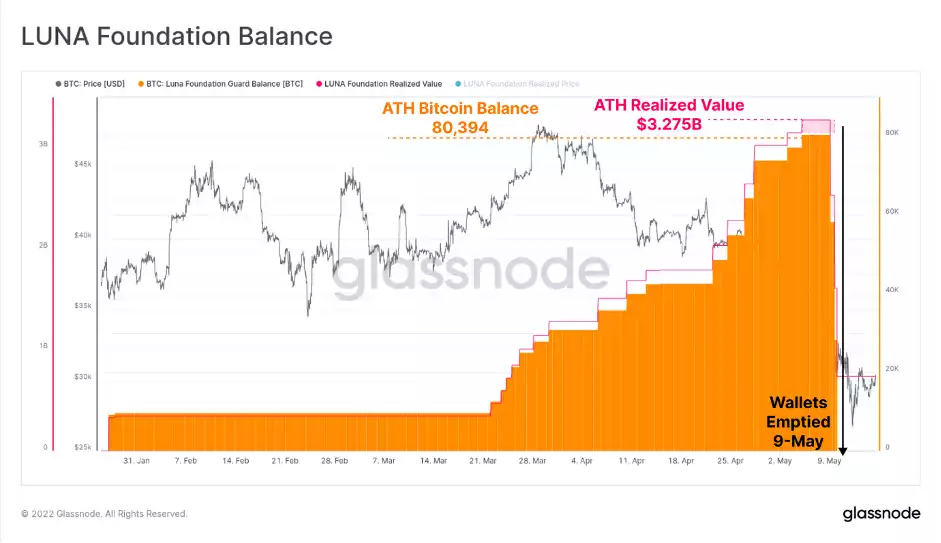

As the UST peg traded lower, the Luna Foundation Guard began to deploy their recently acquired Bitcoin reserves to stabilise the peg. Their total reserves had built up to 80,394 BTC over recent months, with the largest acquisitions occurring between 21 March and 5 May. The total realised value of their holdings, with coins valued at the time they were added to the wallet, was $3.275 Billion.

This resulted in aggressive selling pressure on BTC.

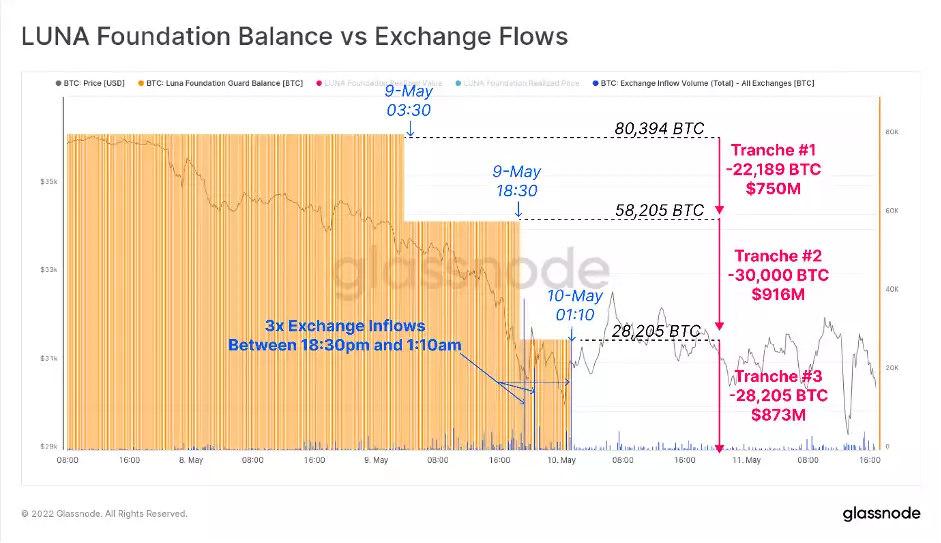

The LFG Bitcoin balance was emptied in three tranches as shown below. The first tranche deployed around $750M in value (22,189 BTC) at 3:30 on 9-May as the UST peg traded down to $0.98. The second tranche of 30,000 BTC ($916M) was deployed 15-hours later, and the final tranche of 28,205 BTC ($873M) was emptied from the wallet 6.5hrs later.

A series of equivalently sized exchange inflows (shown in blue) occurred between 18:30 on 9-May and 01:10 on 10-May as coins were moved between custodians by the market makers engaged by LFG.

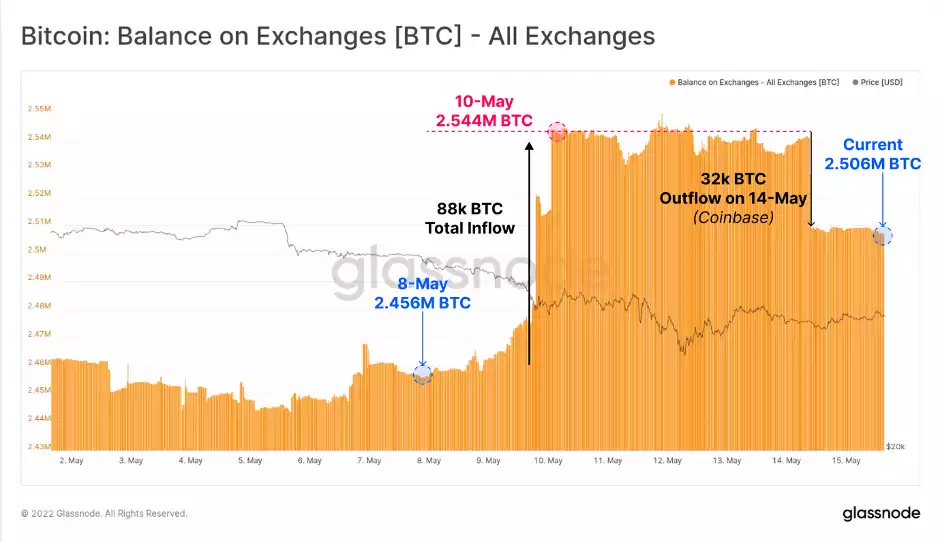

Aggregate exchange balances increased by around 88k BTC over this period, which is higher than the 80,394 deployed by the LFG. This signals that these events triggered a contagion effect and panic, as Bitcoin investors added to the sell-side pressure.

As the LUNA saga unfolded, the coins acquired by LFG were spent on-chain at prices much lower than when they were purchased. With the USDT peg also coming under pressure, prices broke below the $29k support level set in July 2021. This put all investors from the 2021-22 cycle into a loss and precipitated a significant and widespread net loss.

Net losses realised by all on-chain spending hit over $2.5Billion for two consecutive days, which is on par with the largest capitulation events in history - the largest if considered in aggregate.

What happened this week was historic. However, in many ways, aligns with the characteristics of a textbook digital asset bear market. It remains to be seen if a full return to the Realised Price is required to put this bear market to rest, and if so whether it is for months, weeks, days or just a short a moment. What we do know is that historic capitulation events (the last being the COVID 2020 crash) have been ideal times to purchase crypto.