Heavy Gold And Silver Futures Shorting Is Actually Very Bullish

News

|

Posted 15/09/2014

|

5327

Summary

- Gold and silver were hammered by heavy shorting by U.S. futures speculators over the past month.

- These elite traders have been extremely bearish on gold since its major lows in mid-2013, but they are actually a strong contrarian indicator.

- Every time their hyper-leveraged short-side bets soar up near extremes, gold is bottoming and ready to surge in a frenzied short-covering rally.

Gold and silver have been pounded lower over the past month, contrary to their bullish seasonals. This selling pressure has come from the usual suspects, American futures speculators. They've been busy aggressively dumping gold and silver futures, particularly on the short side. But each time they pressed this bet in the past 15 months, gold soon surged higher. Shorts are bullish since they must soon be covered.

Gold suffered its worst quarter in 93 years in 2013's second quarter, a nauseating 22.8% loss. This was triggered by the Fed's stock-market levitation, which sucked vast amounts of capital out of alternative investments. Gold plunged early in that catastrophic quarter when major support failed, and again later on Ben Bernanke's initial QE3-taper scare. This naturally left gold sentiment overwhelmingly bearish.

American futures speculators responded by betting heavily against gold and silver during that Q2'13 timeframe. And given gold's once-in-a-century plunge, they obviously enjoyed great initial success. But even after gold decisively bottomed in late June 2013, this elite group of traders remained extremely bearish on the precious metals and kept selling their futures. This has continued for the 15 months since.

The ironic thing is that fantastic Q2'13 gold-downside bet hasn't worked very well since then. Of the 303 trading days since gold plummeted to $1199 in late June 2013, it has only closed lower briefly on 3 trading days in late December. The universal gold bearishness of the past 15 months hasn't paid off, it was a bad bet. Gold has weathered the heavy selling to grind sideways in a massive bottoming consolidation.

Yet American futures speculators still remain exceedingly bearish on precious metals, which is truly seriously irrational given their sideways price action. The reason is likely twofold. Until the Fed-driven stock-market levitation decisively rolls over, demand for alternative investments will remain weak. And given theextreme leverage inherent in gold futures, speculators must maintain an ultra-short-term focus.

At $1250 gold, a single 100-ounce gold-futures contract controls $125,000 worth. Yet the maintenance margin on US gold futures is now just $4600. Thus traders running at maximum margin have leverage to gold of 27.2x! That is astoundingly risky, as a mere 3.7% gold move against these guys would wipe out literally all of the capital they bet. For comparison, stock trading is legally limited to 2.0x leverage.

Big gold moves aren't uncommon. Since 2009, fully 1/13th of all trading days have seen gold close 2%+ higher or lower. So highly-leveraged futures speculators can be wiped out in a matter of days if they make the wrong bet on gold! Thus their myopia is as extreme as their leverage, with their whole world existing between a week in the past and a week in the future. Any minor gold slide rekindles their bearishness.

If the stock markets edge up to new nominal records, American futures speculators are quick to dump gold. If the US dollar is stronger, they are quick to dump gold. If the Fed hints at interest-rate hikes, they are quick to dump gold. If some elite investment bank makes its umpteenth weathervane bearish call on gold, they are quick to dump gold. If some geopolitical hot spot appears to cool, they are quick to dump gold.

Already having a heavily-bearish bias and forced by leverage to be short-sighted, American speculators jump on every opportunity to sell gold futures. And that is exactly what happened to gold and therefore silver over the past month or so. Gold would droop for a couple days, futures traders would rationalize that as confirmation of their bearish theses, so they would sell more gold futures and amplify its decline.

This creates a vicious cycle. And in the absence of normal levels of gold investment demand thanks to the Fed's artificial stock-market levitation, there isn't enough offsetting physical buying. So futures selling dominates the gold price, and it slumps towards lows. The funny thing is these extreme bets against gold by such sophisticated traders always prove wrong, as gold ralliesright at their peak bearishness!

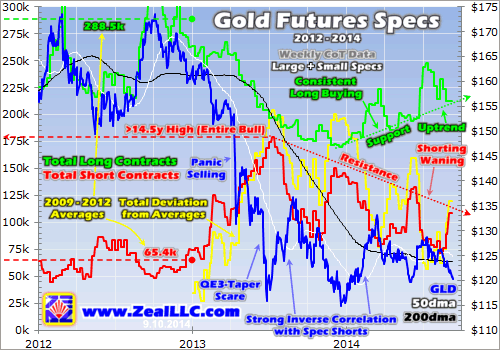

This first chart looks at American speculators' total long and short positions in gold futures, which are reported each week in the CFTC's famous Commitments of Traders reports. On top of these collective bets the gold price is overlaid, as seen through the lens of the flagship SPDR Gold Shares ETF (NYSEARCA:GLD) that stock traders prefer. The worst time to be bearish on gold is when futures speculators force it near lows.

And that's exactly what's going on today. Around $1250 gold isn't far above its June 2013 low of $1199, its December 2013 low of $1190, and its June 2014 low of $1244. Seeing gold and therefore GLD shares heading towards the bottom of their 15-month consolidation trading range makes investors and speculators very nervous and bearish about gold's prospects. It feels like gold is ready to fall off a cliff.

At times like this, nearly everyone is bearish except the hardcore contrarians. We humans have a natural tendency to extrapolate our present conditions out into infinity. We want to assume that trends in force today are going to persist indefinitely. This dangerous assumption is why the vast majority of traders lose money in the markets. They succumb to the herd groupthink and popular emotion near extremes.

That fails because the markets are forever cyclical. Once everyone is bearish, the selling has already happened and a reversal is imminent because only buyers remain. So it is foolish to sell low in the midst of extreme popular bearishness. Yet since nearly everyone wants to feel accepted by their peers, to believe markets move in the same direction forever, bearish calls abound right as prices are actually bottoming.

The elite and highly-respected Goldman Sachs is a prime example of this, reiterating its 15-month-old (and wrong) forecast that gold will fall to $1050 by the end of this year. Each time gold nears the lower support of its bottoming consolidation trading range, this high-profile bearish call gets much attention. But Goldman Sachs, along with all of Wall Street, is merely a weathervane extrapolating current trends.

Back in August 2011 when gold was skyrocketing and a few contrarians like me were warning that it was way overbought and due for a serious correction, Goldman Sachs was wildly bullish on gold. It came out with report after report upping its gold price targets over all time horizons. It declared that a year later, gold would be around $1860. But a year after that euphoria, gold had slid down near $1600!

Goldman Sachs is bullish on gold or stocks or anything when they are high and topping, the exact wrong time to be. And it is bearish on gold when it is lowand bottoming, the smart time to be bullish. As a herd, American futures speculators are the same way. They are weathervanes that reflect prevailing sentiment, with no desire to fight the crowd to buy low and sell high. This is crystal-clear in this chart.

Note that the blue GLD-share price has a strong and nearly perfect inversecorrelation with the total level of American futures speculators' gold shorts. Just as this elite group of traders is the most bearish on gold as evidenced by their real-money bets, gold is bottoming and on the verge of a sharp rally. This happened in mid-2013, late 2013, mid-2014, and is almost certainly going to happen again soon here today.

After Q2'13's epic once-in-a-century gold plunge, American futures speculators were so convinced that gold would spiral lower indefinitely that their bets against it surged to an at-least 14.5-year high. It may have even been an all-time record. But defying these guys, gold soon rallied sharply. Extreme gold-futures shorting is inherently self-limiting, as it sets the stage for massive and frantic short covering.

When everyone thinks gold is doomed to spiral lower forever, everyone who wants to sell gold futures has already done so. Traders with long-side bets who succumbed to the bearish groupthink are already out, and traders with the cojones or hubris to make hyper-leveraged short bets have already laid them in. And with essentially no futures sellers left, that leaves only buyers. So a minor gold rally can quickly explode.

At relatively-conservative-for-futures-traders 20x leverage, a 5% gold move against their bets will erase 100% of their capital risked. And it doesn't take much at all to spark 1% to 2% up days in gold that will trigger nearly instant 20% to 40% losses for these speculators. A material stock-market down day, a worse-than-expected economic report, some geopolitical flare-up, many things can ignite a sharp gold rally.

And when leveraged futures speculators see 20%, 40%, 60% of their capital risked annihilated in a day or two, they have no choice but to cover. In the futures realm, shorts are covered by buying offsetting longs. So in terms of positive price impact, there is zero difference between adding a new long and buying one to offset and close a short. As speculators buy to cover, the gold-price gains naturally start accelerating.

The faster gold rises, the more other speculators are forced to cover too. This process forms a virtuous-circle self-reinforcing upleg for gold prices. The more traders buy it, the faster it rises. The faster it rises, the more traders want to buy it by adding new long-side positions and the more traders trapped on the short side have to rush to cover. Thus gold is due for an imminent sharp rallywhen futures shorts hit extremes.

And such extremes certainly aren't hard to define. Between 2009 and 2012 in the last normal years before 2013's crazy Fed-driven gold anomaly, American speculators held the short side of 65.4k gold-futures contracts on average in any given week. That's the opposite of extreme, the baseline. And early July 2013's at-least-14.5-year record high of speculators holding 178.9k gold short contracts is peak extremeness.

While this latest week's read of speculators holding 108.5k short gold-futures contracts was nowhere close to that, it is still extreme by a couple key measures. First, over the past 15 months as gold failed to plunge into oblivion despite the extreme bearishness, futures traders are gradually learning not to listen to the sentiment weathervanes. With each subsequent gold low, their zeal for shorting this metal wanes.

So a strong downward-sloping resistance line on extreme gold-futures shorting tops has formed. And the levels of speculator shorts we are seeing today are almost there. Odds are it will hold again, that a sharp short-covering gold rally is imminent. If gold couldn't be hammered to decisive new lows over the past 15 months despite the most extreme bearish headwinds seen in well over a decade, it probably can't be now either.

The second clue we've reached extremes is the speed of the surge in speculators' gold-futures shorts over the past three weeks. These super-leveraged downside bets on gold have rocketed 50.1% higher in that short span! An explosion of shorting is the bearish equivalent of a speculative mania to the upside, an unsustainable surge to a climax of pessimism. Once that peak hits, all the sellers have already sold.

American speculators' gold-futures shorting surged similarly near gold's major bottoms in late 2013 and mid-2014. These short bets can't soar at such spectacular rates for long. So it really looks like gold is carving a major bottom in today's extreme bearishness, on the verge of a serious rally initially sparked by frantic short covering that will catapult it higher. One final clue buttresses this bullish outlook on gold.

Despite their recent propensity for emotional and theatric shorting, futures traders are a big and diverse group. More of them are betting on gold's upsidethrough long contracts than the other way. The green line above shows their total long-side bets. They've been gradually rising all year in a nice uptrend despite the extreme bearishness plaguing gold. These traders understand the great wisdom in buying low.

With speculator longs rising all year even when gold happened to be wilting, it is very unlikely the short-side traders will get much help from long-side liquidations. And without heavy long-side selling like we saw in that catastrophic second quarter of 2013, there is just no way gold prices are going to plummet to the deep new lows that Wall Street is calling for. This increases the odds gold is carving a bottom today.

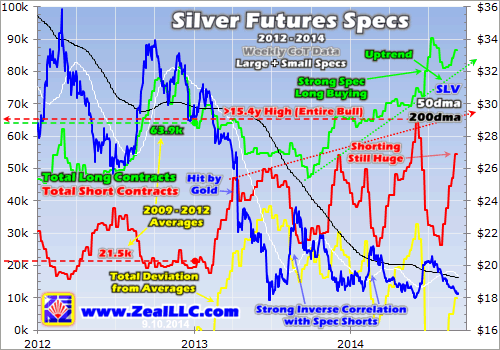

Interestingly most of this analysis holds true in silver futures too. Silver has always been slaved to gold, amplifying its gains and losses. When gold is strong traders rush into highly-volatile silver to catapult it higher, and when gold is weak traders abandon it. Silver has also seen a huge spike in speculator shorting, raising the odds it too is on the verge of its own parallel short-covering rally when gold's starts.

Here silver is represented by the prices of the flagship iShares Silver Trust (NYSEARCA:SLV) shares. It too has a strong inverse correlation with futures speculators' short positions. Silver tends to be bottoming right when they are peaking, futures traders as a herd are the most bearish at exactly the wrong times. Silver-futures shorts actually hit their staggering at-least-15.4-year-if-not-all-time high just recently in June 2014.

That 65.2k contracts is truly extreme, and in this latest Commitments of Traders week speculators' shorts surged back up to 54.4k contracts! Such excessive selling is self-limiting, as soon everyone who is willing to sell silver low has already done so and only buyers remain. All it will take is a decent gold up day to ignite some gold-futures short-covering, and silver-futures traders will scramble to cover as well.

Silver acts as a sentiment gauge for gold, maybe its premier one. So the terribly-weak silver prices over the past 15 months reflect the exceedingly-bearish gold sentiment. Yet despite this, silver hasn't fallen below its original mid-2013 lows! This is partially due to a strong uptrend of speculator buying of long-side silver-futures contracts. Like in gold, these bullish bets indicate fewer traders willing to short silver.

As usual, the entire precious-metals complex hinges on gold. With gold-futures shorts so extreme and gold sentiment so overwhelmingly bearish, an oversold rally is inevitable very soon here. And that will ignite short covering that will feed on itself and accelerate gold's mean reversion higher. I still believe the most-likely catalyst will be the Fed-spawned levitating US stock marketsdecisively rolling over.

They have done nothing but power higher since early 2013 because the Fed's QE3 bond-monetization campaign was seen by traders as a backstop. But QE3 is scheduled to end in a matter of weeks, in late October. This has ominous implications for the lofty stock markets, which plunged sharply in major corrections after both QE1 and QE2 ended. When QE3 is over, the Fed can no longer short-circuit stock selloffs.

Once investors and speculators are jolted out of the Fed's fantasyland back into the real world where stock markets go up and down, alternative investments led by gold will regain their attractiveness as a prudent portfolio hedge. Gold and silver will surge as capital returns, but that will be dwarfed by the gains in the radically-undervalued stocks of their miners. Contrarians buying them low will earn fortunes.

Contrarian trading is so simple in theory, yet so hard in practice. In order to buy low and sell high, you have to buy when everyone hates a particular sector and sell when everyone loves it. That means you have to fight the crowd and your own dangerous emotions. You have to force yourself to be bullish when everyone else is bearish, like in gold today. And bearish when everyone else is bullish, like in general stocks.

The bottom line is gold and silver were hammered by heavy shorting by American futures speculators over the past month. These elite traders have been extremely bearish on gold since its major lows in mid-2013, quick to ramp up their downside bets. But they are actually a strong contrarian indicator. Every time their shorts soar up near extremes, gold is bottoming and ready to surge on short covering.

Futures trading is an exceedingly-risky hyper-leveraged game, so these speculators can't afford to be wrong on gold for long. Once it inevitably starts rallying, the losses on the short side explode so those traders are forced to rapidly cover. This initial buying entices in more long-side buyers, which can ignite major new uplegs. With speculator shorts back at extremes today, gold and silver once again look very bullish.

Author: Adam Hamilton