Happy 45th Birthday Credit Cycle

News

|

Posted 18/08/2016

|

8399

First an apology. We missed reporting a very special birthday on Monday, the birth of the greatest credit cycle the world has ever seen 45 years ago. On 15 August 1971 US President Richard Nixon “temporarily” ended the gold standard. Rather than the USD being backed by gold and the fiscal discipline that requires, Nixon ushered in an era of Fiat currency – money backed by nothing more than the promise of the government. Remove the discipline of gold and governments go on a deficit funded spending spree.

Lets look at what’s happened since…

- In 1971 US debt was $370b. It is now up 5,245% to $19.4 trillion or 117% per year

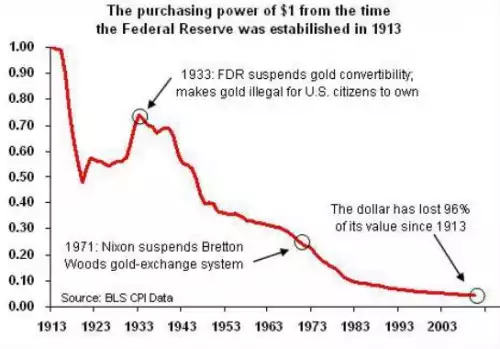

- Nixon said this was “temporary” and that "Your dollar will be worth just as much tomorrow as it is today... " – so how has that worked out? Well clearly 45 years later it is still Fiat and today the USD, measured against that gold it used to be pegged to, has gone from 1/35th of an oz of gold to 1/1350th. That simplistically looks like it has lost over 97% of its value since 1971 but in 1933 President Roosevelt suspended gold convertibility at $35. The graph below shows the decline in USD value more clearly.

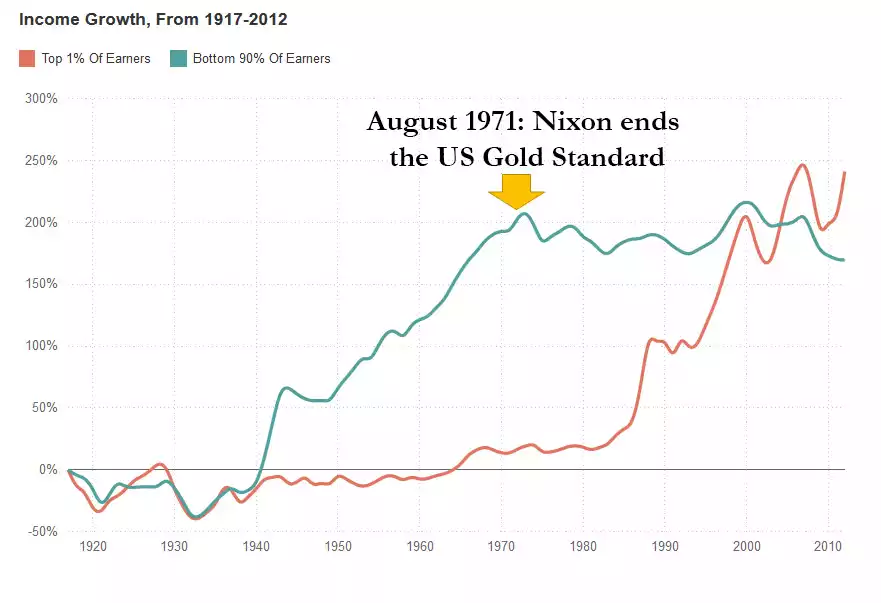

- To put it in clearer ‘real’ terms the US citizen has seen their dollar devalue by about 5 times and wages in real terms have declined while the top 1% of earners have profited from the credit cycle per the graph below

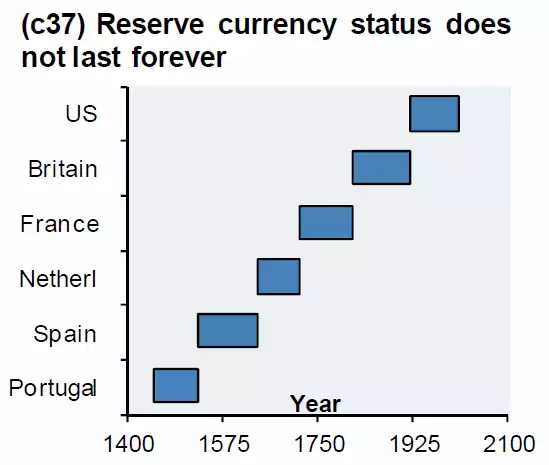

- The other thing is when you abuse your Reserve Currency privilege to the extent the US has, you usually see a forced default and new Reserve Currency. This is not a new thing per the graph below we have shared many times:

History would indicate the USD’s time is nearly up. The major posturing around the SDR (Standard Drawing Right) of late might indicate it is the planned successor.

This is not a new thing. Credit cycles or periods of currency debasement always end, and they always end very very badly. Throughout history, gold and silver have preserved people’s wealth during such occurrences. Is there any coincidence that in 2016 with the real onset of the clear sign of distress with negative interest rates and record setting money printing the smart money (those 1%’ers) – the central banks, hedge funds, banks etc - are piling into gold?