Gold v Fiat Currency

News

|

Posted 01/09/2017

|

7957

Regular readers and investors in gold are well versed in the difference between fiat currency (those plastic notes in your wallet and that ‘digital balance’ in your bank account) and the world’s oldest and truest form of money, gold. Every now and then, though, you get a little reminder of the absurdity of modern ‘money’.

This week has just seen the 9th European country to offer, and more absurdly actually sell, sovereign bonds with a negative yield. Yep, that’s right, you are buying a government backed debt instrument on the basis that you will pay for the privilege rather than receive a dividend yield. Such is the state of the world that this is considered prudent to preserve your wealth. And to think gold gets grief for not offering a yield! At least gold’s yield is not negative and at least it’s not backed by the promise of a government to pay you back the principal at expiry. That’s not being alarmist by the way. The list of 9 includes some pretty shakey characters like Portugal, Cyprus, and Italy to name a few. Topically, let’s not forget the threat discussed yesterday (and more fully here) of the world’s reserve currency and pre-eminent bond, the might US Treasury note, at risk of default in 29 days…. Check out the list below:

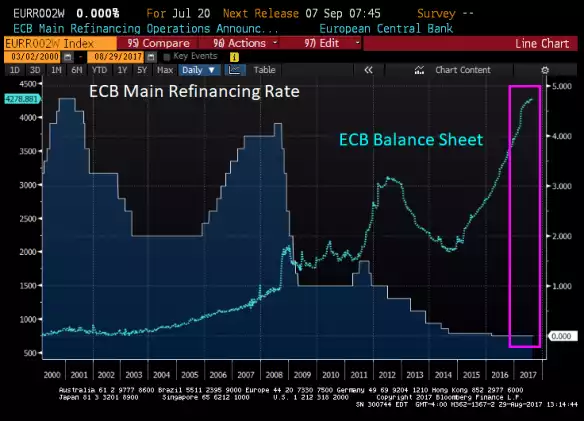

So how did this happen? The answer is in one graph below. The ECB (European Central Bank) has printed nearly $3 trillion since the GFC and lowered their cash rate below zero. In June they overtook the US Fed as having the biggest balance sheet at over $4.6 trillion and now as you can see below are nearly $5 trillion. That is an awful lot of debasement of a currency.

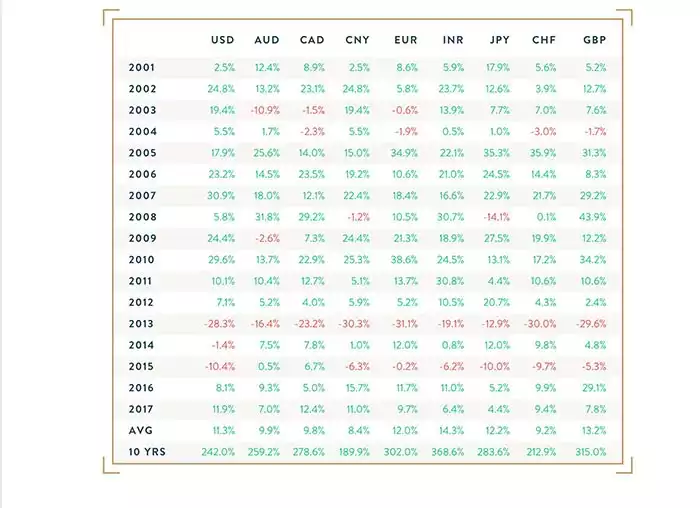

Gold supply on the other hand barely grows at less than 2% per year. No printing press there….So is it any wonder that when you look at the price of gold’s performance over the last 10 years against a range of fiat currencies it has fared so well in preserving real wealth?

Finally a little bit of housekeeping from yesterday’s news. We weren’t very clear in that the 4,582 tonne referred to is only that contained in Fort Knox. The US has a total reported holding of 8,407 tonne which would be worth $342 billion at yesterday’s mentioned price of $1308/oz.