Gold Tests Resistance and NFP Tests Fed ‘Patience’

News

|

Posted 10/06/2019

|

6541

Friday night saw the latest official US employment figures released (non-farm payrolls or NFP) and it was a shocker of a print. Against expectations of 175,000 new jobs, only 75,000 were created. To make matters worse, April and May were revised down by 75,000 and so making it a net zero month, and wage growth disappointed as well.

This, in the market’s mind, cemented a rate cut in July with the odds at 71% for July and even 37% for this month despite the Fed saying they would be ‘patient’ with any cuts at their last meeting.

Whilst shares finished higher, that is clearly not from traditional buyers and hindsight will likely show the corporate buybacks are to thank. Bank of America Merrill Lynch’s CIO Michael Hartnett is sounding warnings. He reported that for last week the market bought a near record $17.5 billion of bonds (2nd largest ever) and divested $10.3 billion out of shares, and year to date those figures are a whopping $183b into bonds and $155b out of shares. On top of that, institutional hedging has spiked as well… they are not trusting this rally. As we reported last week the smart money is running to safety. These figures also highlight the dangerous anomaly we are currently seeing of bond yields (inverse to price) plunging whilst share prices rise???

That is not a trend that can last…

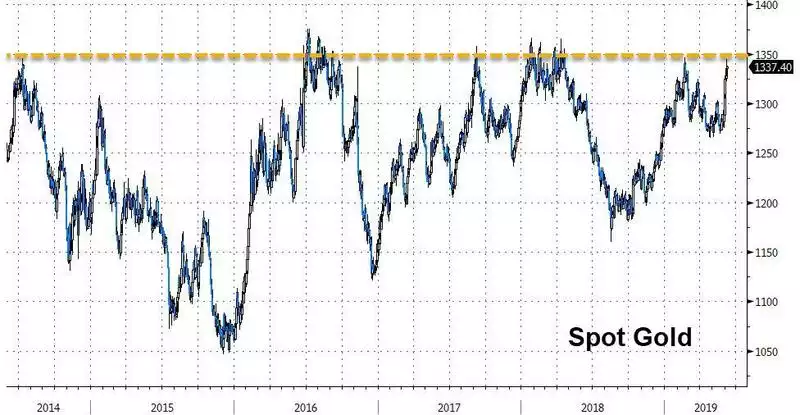

The same flight to safety into bonds has also been into gold and we are at that same old resistance line around $1350. This is the 6th time we have seen gold test this line in 5 years.

We shared Greg Canavan’s views on this setup last week and you can see (from the chart above) that even if the breakout doesn’t happen this time we have a very positive formation since that late 2015 bottom in the gold price. Each low since has been higher (higher lows in trading speak) and the fundamentals that we often report on continue to ramp up in unison.

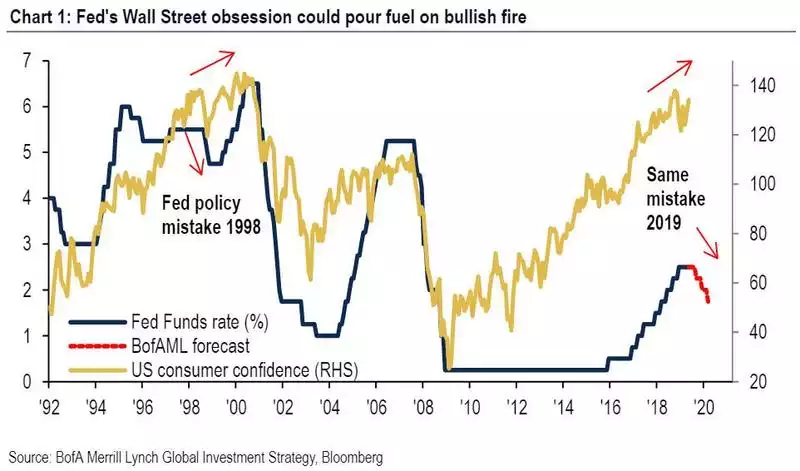

Getting back to BoAML’s latest concerns and we revisit the fact that nearly every previous recession has been preceded by the Fed tightening into fundamental weakness and then capitulating (too late) into lowering rates.

The hapless US consumer still thinks everything is awesome and Trump will save the day. The chart above indicates history tells us otherwise.