Gold & Silver v Bitcoin – and / or?

News

|

Posted 13/12/2017

|

41176

For some reason there is a lot of talk about bitcoin OR gold and not bitcoin AND gold. We are on record as believing these two stores of value are complimentary not exclusionary.

For the same reason we think bubble talk on bitcoin may be premature so too both still have a role as monetary assets or as a store of value. Goldman Sachs global head of commodities Jeffrey Currie put forward his view yesterday and we think it insightful:

- “First, the investor pools are vastly different. Gold investors who use ETFs, futures or commodity indices are automatically covered by anti-money laundering (AML) and counter-terrorist financing (CTF) regulations which are already “baked in” to processes in these markets. Even physical trading in jewellery, bars, coins etc. has seen a huge increase in regulatory scrutiny, globally, over the last few decades. In the US, professional jewellers and dealers must have an AML program implemented, and significant cash purchases or precious metal sales require additional reporting to the IRS on a transaction by transaction basis. In contrast, there is still very little clarity on how trading in cryptocurrencies could be made to comply with AML and CTF regulations, even in theory. This creates huge regulatory hurdles for professional investors wishing to enter these markets.

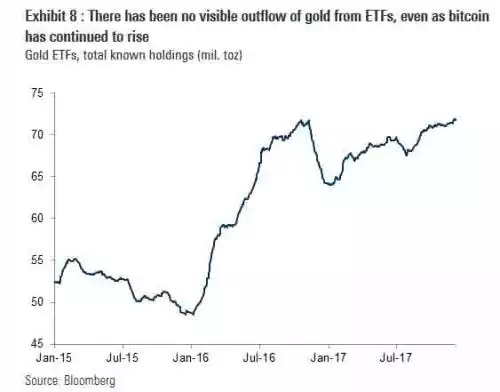

- Second, as the chart below shows, there has been no discernible outflow of gold from ETFs. Indeed, total known gold ETF holdings recently reached their highest level since mid-2013 (currently up 12% YTD, see Exhibit 8). This is somewhat related to the first point, as mutual funds are the largest holders of gold ETFs, but even accounting for this there is no evidence of a mass exodus from gold.

- Third, and final, the market characteristics of gold and cryptocurrencies are vastly different Currie claims. In this context, the market cap of bitcoin is still just under $300 billion, while the total value of gold is a little over $8 trillion. And while bitcoin has a mathematically certain total supply, and gold has a finite (but less certain) supply in the earth's crust, even a cursory examination shows very different market dynamics according to Currie. As a result, Goldman believes that the composition of demand between bitcoin and gold is the key difference in the recent price action, and specifically, bitcoin is attracting more speculative inflows relative to gold.

And…

"The market cap of bitcoin is $275 billion versus gold at $8.3 trillion. Even all of the cryptocurrencies combined have a market cap less than $500 billion. While the lack of liquidity and increased volatility may keep bitcoin interesting, it is unlikely to convince investors looking for the kind of diversification and hedging benefits which gold has proven to possess over its long history.", and finally…

"to deal with the AML and CTF uncertainties surrounding bitcoin, and attract a wider investor pool, custody issues must first be resolved beginning with identifying it as a commodity, fund or security….as bitcoin has no liability that all securities have by definition. Even a dollar bill is ultimately a liability to the US government."

It’s good to hear two sides of any argument. The obvious other conclusion one could draw is that for Bitcoin to get anywhere near gold’s $8t market cap, the price would need increase 30 times its current rate.

Many believe we are hurtling towards a market crash of epic proportions, one that will see a scramble from financial and even property assets to monetary asset safe havens. It would seem foolhardy to think that is all going to Bitcoin and not the proven gold and silver as well. The reality is it will likely be both. Consider too that last night Ether surged 30%, Litecoin 80% and Ripple 100%. The crypto space is not just Bitcoin, and it looks like the others are playing catch up….