Gold & Silver - currency hedge

News

|

Posted 27/02/2015

|

5889

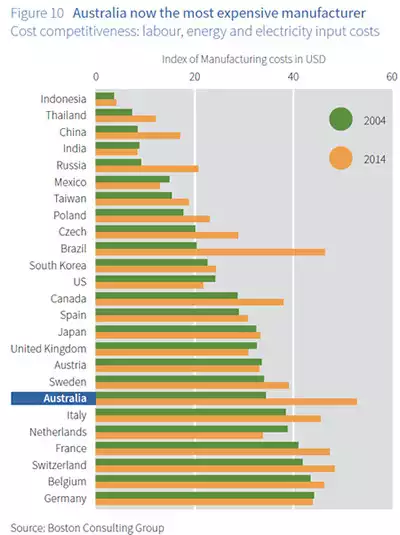

In today’s radio news we revealed the report just released showing Australia is now the most expensive manufacturer in the world as can be seen in the chart below:

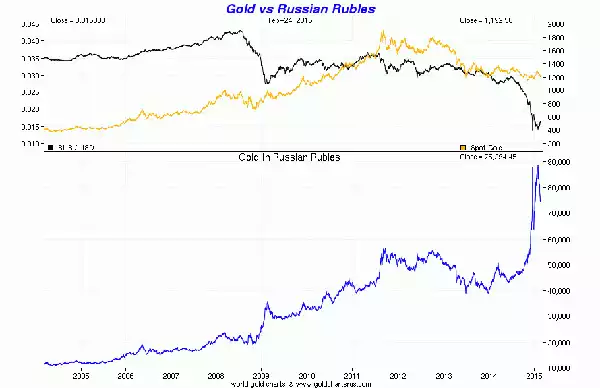

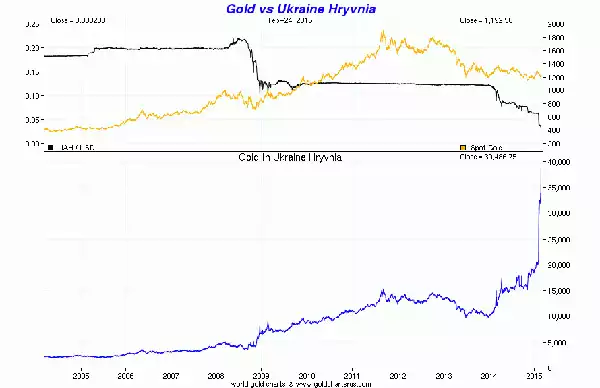

In the ever increasingly globalised economy this means a whole lot of things but today we just want to focus on our Aussie dollar. Clearly, apart from a structural overhaul of our productivity costs, we need and you would have to bet will get, a lower Aussie dollar to compete. So how can you either profit from or at the very least protect your wealth from such a fall? Gold and silver, as we wrote about here. Check out the price of gold in 3 of the more prominently crashing currencies around the world below (PS look very closely to the far right for Ukraine..!):

These give you a clear picture of how your wealth escalates when the currency falls against the USD.