Gold’s “Decisive Turn Around”

News

|

Posted 24/05/2017

|

6542

Jim Rickards mapped out why he sees gold going on to US$1300 or higher shortly in a recent interview and we thought it worth sharing… “The most important development this week may be the one you never heard about on the news or the internet.

On May 10, gold launched a decisive turnaround from its most recent decline

This kept intact the pattern I’ve been writing about for weeks of “higher highs, and higher lows” as every retreat finds a footing higher than the one before and each new high reaches new, higher ground.

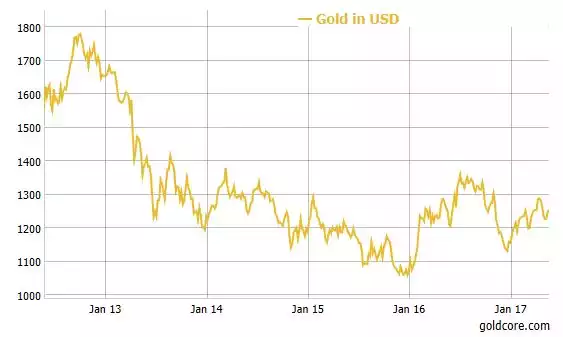

Gold in USD (5 Years)

This pattern began on Dec. 15, 2016, at an interim low of $1,128/oz. Since then gold has hit new highs of:

- $1,216/oz on Jan. 17

- $1,256/oz on Feb. 24

- $1,289/oz on April 18.

Each time gold retreated from those highs, it found a new bottom at a higher price than the time before. The recent low was $1,218/oz on May 10. In this new spike, gold has now rallied to $1,251 as of early Friday.

If this pattern holds, the next stop is $1,300 or higher.

A Fed rate hike on June 14 could be a catalyst for a move even higher, just as the last two rate hikes on Dec. 14, 2016, and March 15, 2017, were turning points for gold.

No market moves up in a straight line, and gold won’t either. But what we’re seeing right now is very encouraging.

While everyone is focused on the Washington circus this week, they’re missing what could be the real news — gold.”