Gold – History Repeating

News

|

Posted 24/11/2016

|

7202

Last night gold broke down through the support line of USD1200, currently sitting at USD1188/oz after hitting USD1181 at the low. This can be a little unsettling for some so it is worth taking a deep breath and looking objectively at the bigger picture.

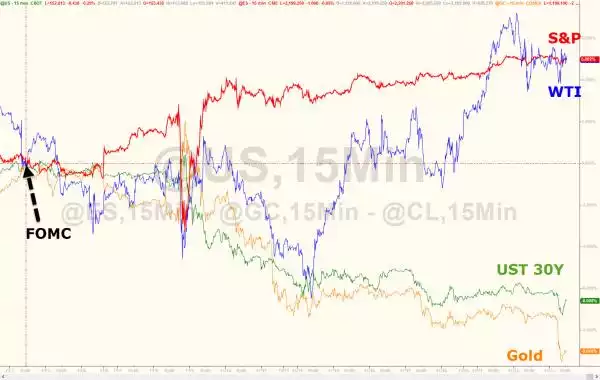

For a start the price action last night was largely off a combination of US Fed minutes from the November meeting leading the market to 100% expectations of a rate rise on the 13th December. This was bolstered by a better than expected Durable Goods Orders print (though we will discuss that is flawed in tomorrow’s Weekly Wrap). What does this mean? Well it reinforces the ‘everything is awesome’ narrative and saw shares continue to rally and gold and bonds sold off. The chart below shows what has happened since that November Fed meeting:

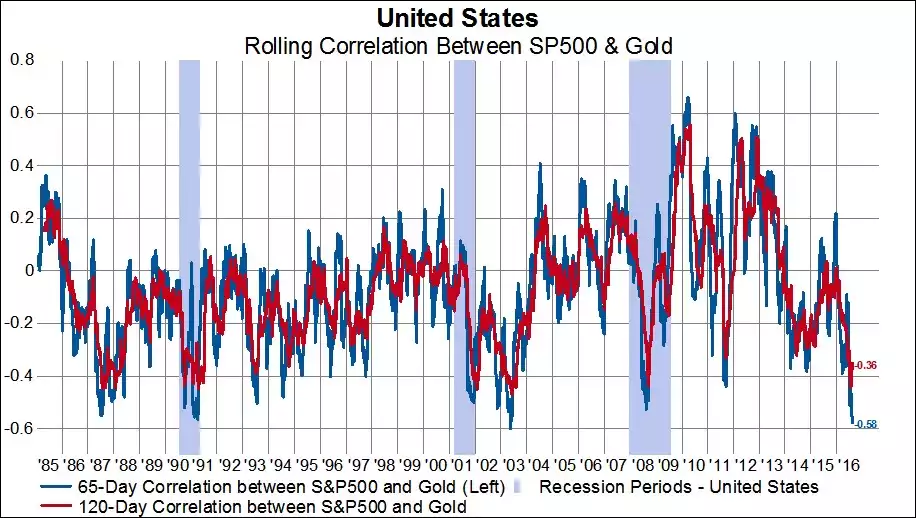

Does this story seem familiar though? That’s right, it’s a repeat of this time last year. On the expectation and then reality of the US Fed raising rates for the first time in 9 years gold hit a low of just USD1,054 and the S&P500 at 2,100 after 1,884 just a couple of months before. But it’s what happened afterwards that may be relevant. Shares crashed back to 1859 in January and gold jumped over USD1200, and kept going up to $1357/oz along with US shares in a rare positive correlation. The more normal negative correlation between gold and shares is back in and that is potentially good news. We showed the following graph at our seminar on Tuesday night. Note the spike in negative correlation during crashes:

As we wrote the other day an increase of just 0.25% in December adds $50b to the US government’s interest bill but that of course is minor compared to the broader market. Reality may hit home.

Keep in mind too that nearly every crash in history followed an interest rate hike (that came too late).

Finally, remember that even after last night gold is up 11% for the year and silver up 17%. The S&P500 is up 7.9% and the All Ords is up just 3.8%... As we wrote yesterday, much of the hype in the sharemarket is hope, not reality, based.

Now is not the time to panic. Contrarians take note…