Gold & Bitcoin a “beautiful thing” & Demise of USD - Pal

News

|

Posted 26/05/2020

|

24810

You can now listen to the article and all our daily news, via YouTube and Anchor

Real Vision’s Raoul Pal every now and then drops a Twitter thread that can capture so much in so little and we feel compelled to share. As regular readers know Pal, one of the world’s best macro traders, has a firm belief we are part way through what he calls ‘The Unfolding’ where we have gone through the Liquidation phase (the big sell off of everything in Feb/March), are now in the Hope phase (markets rebounding, people talking about a V shaped recovery) that he seems to lean toward a June turning point, and then we go into a protracted Insolvency phase as happened in the Great Depression where we have widespread company insolvencies under all that debt. We spelt it out here.

Part of that is a rampant USD that eats everything before eating itself. Here’s his Twitter thread giving a nice summary:

“The Dollar Standard:

The US Economy fell from 40% of World GDP in 1960 to just 25% today.

However, 79.5% of all world trade is conducted in US dollars.

84% of all non-domestic debt globally is US Dollar debt.

Around $100trn of global debts are denominated in US Dollars.

Total US domestic non-financial debts are $80 trn (and rising fast).

The Fed balance sheet is currently $7 trn.

If this recession is morphing into a global solvency event (which by definition is a slow miserable grind, not a shock and awe event, which is a liquidity event), then the current strategy of the Fed trying to stave off debt impairment is near impossible but they will try and haha, the money printer will go Brrr...

But the dollar will continue to rise as demand for dollars rises.

And that in turn slows global growth, making the dollar shortage worse and the solvency crisis worse as cash flows fall globally, which makes dollar in even short supply....

So the Fed print more money to try to replace cash flows via fiscal stimulus. Velocity of moneys falls as money is hoarded.

All other central banks print more to offset their own systemic strains.

Dollar rises since $1 of QE from ECB is worth 4x in liquidity adjusted terms as $1 from the Fed. The Fed can't win.

And that in turn slows global growth, making the dollar shortage worse and the solvency crisis worse as cash flows fall globally, which makes dollar in even shorter supply....

So the Fed print more money to try to replace cash flows via fiscal stimulus. Velocity of moneys falls.

Dollar rises since $1 of QE from ECB is worth 4x ...

Repeat Ad Infinitum until system finally breaks.

Then figure out a new Non-US Dollar dominated currency system.

This is not a low probability outcome, but it's clearly not a certainty either. But I give it higher odds than most do.

It feels like the next phase of dollar strength is about to start (Yes, I've been saying this for a few weeks now – I’m either early or wrong!).

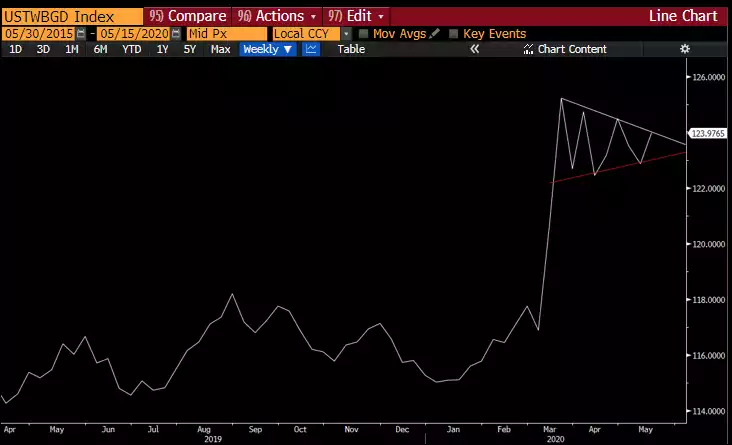

The chart of the Broad Trade Weighted Dollar suggests I’m more likely to have been early...

But here is the beautiful thing....

If I'm right, gold and bitcoin go up.

If I'm wrong and the dollar falls from here, gold and bitcoin go up.

That is why these are such dominant trades. US Dollar is next most dominant, and then bonds to negative rates.”

As Pal alludes, he is a macro trader. He is not interested in what a trade will do over a week or month. He’s looking big picture and trading on year or 18 month horizon but knowing it could all start in say June. In his latest Macro Insiders article he lays that out:

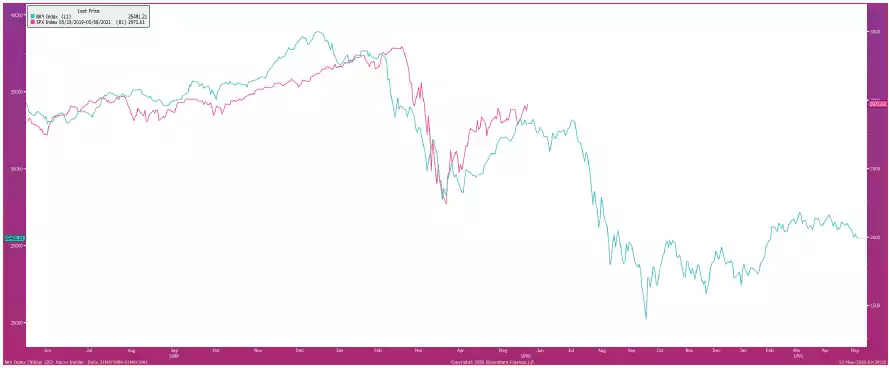

“It would be fitting for the equity market to top out, the bond market to move to lower yields, the indebted companies’ share prices to fall, commodities to fall and the dollar to rise – all in June – matching the “hope” rallies in Nikkei 1990, SPX 2001 and SPX 2008.

That is my bet and I’m sticking to it.

I’ll leave you with the chart of the Nikkei 1990 and the SPX present day...”

“There are a lot of headlines, lots of Twitter noise, lots of inexperienced retail investors piling in and the serious investors giving stark warnings – Buffett, Druckenmiller, Paul Tudor Jones, David Tepper, Howard Marks, Paul Singer etc.

This has all the classic signs of a “hope” rally.

Beneath the surface, things don’t quite add up. The market is beginning to whisper, “debt deflation” and “insolvency”.

Filter out the noise and listen carefully. If it gets louder in the next few weeks, get ready to take action.”

What February & March taught us is when the market tanks and everyone is piling into gold and silver it’s a very crowded space (our waiting room in particular…) and immediate delivery supplies run out. Better a month too early than a day too late might be an apt edit to the well-worn gold adage ‘better a year too early than a day too late’…