Gold a “No brainer” buy

News

|

Posted 03/03/2015

|

6368

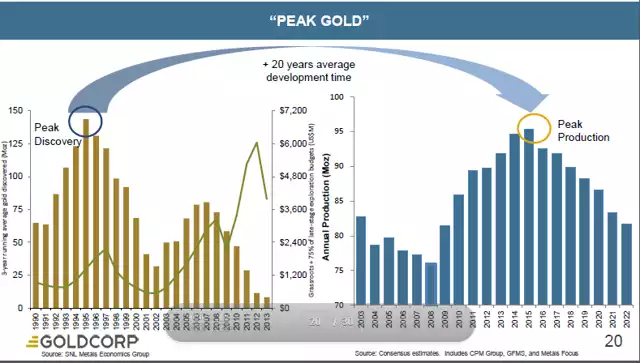

Last week we posted a news article on the evidence from the top 7 producers illustrating clearly we are likely to see “Peak Gold” this year. A table in that article showed the stark declines in reserves – what these guys have in the ground to mine in the future. Without new discoveries, production sees these reserves decline until they are gone. One of the bigger players, GoldCorp included the following graph in their annual report. As we’ve reported earlier too, such a trend appears common amongst the top producers. Gold at these low prices means exploration is the first victim of fiscal management. The graph below illustrates this very clearly:

Let us leave you with this quote from Hebba Investments LLC

“In conclusion, despite all the negativity over the last few years, golds star is set to burn very bright regardless of what happens in the global economy as reserves are simply not being replaced at the current gold price. Investors do not need to see any financial chaos to have a higher gold price - all investors need is to have the same lack of discoveries trend that we've seen over the last 15 years continue into the future. Thus investors should buy gold, ignore the noise, and wait until economic fundamentals take gold to much higher prices.

Of course, if somehow the stunning growth in worldwide debt catches up with the global economy - all bets are off and we could see a gold price many multiples of what we have today. There are very few no-brainer investments out there, but gold seems to be one of them and for patient investors this is a great time to buy.”