Global stocks. Last time this happened….

News

|

Posted 23/03/2015

|

3735

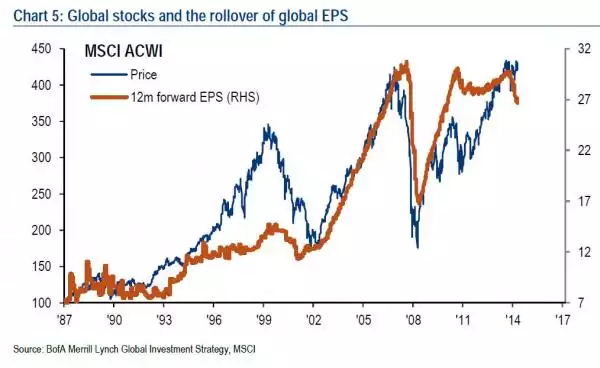

We may appear at times to focus too much on US share markets in our reporting the various warning signs of an imminent correction. Whilst it is arguably the most bubble like and most ‘contagious’ in a global context, it is certainly not alone and with the ECB now embarked on its own full blown QE program, Euro shares are off and running too. But like the US, these markets are rallying on cheap money forcing a search for yield as opposed to buying future performance. So looking at the global index, the basket of sharemarkets around the world, we see exactly the same situation. We see an index at record highs but with forward earning in decline, and sharply so. In fact the graph below courtesy of Bank of America shows global equity 12-month forward EPS -6.7% year on year, the fastest plunge since the GFC. We are not saying the crash will happen tomorrow or even this year, but it will happen and the world’s oldest safe haven is at bargain prices right now.