GFC Redux – Housing Too?

News

|

Posted 01/12/2016

|

7481

Yesterday we showed the similarities between US financial markets now and 2007, so let’s look at property today. You will recall that it was a US property crash that triggered the GFC. So how are things looking now?

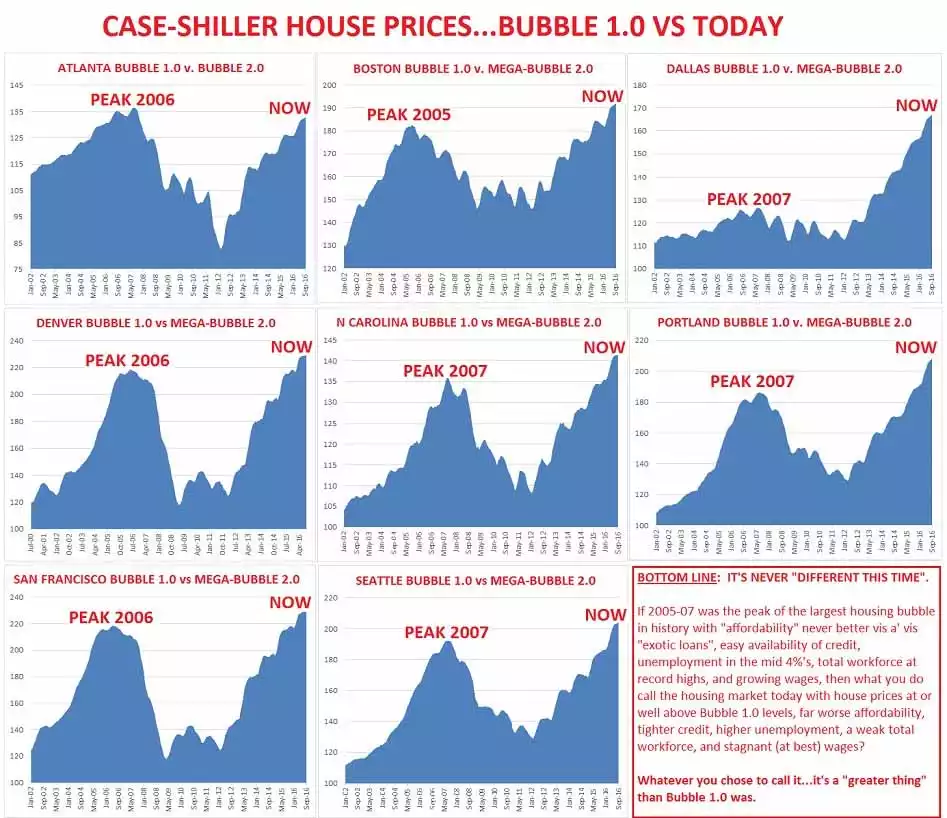

Marc Hanson of property market specialists M Hanson Advisors recently published this collection of charts and commentary:

As Hanson says: “It’s never different this time. Easy/cheap/deep credit & liquidity has found its way to real estate yet again. Bubbles are bubbles are bubbles. And as these core housing markets hit a wall they will take the rest of the nation with them; bubbles and busts don’t happen in “isolation”.”

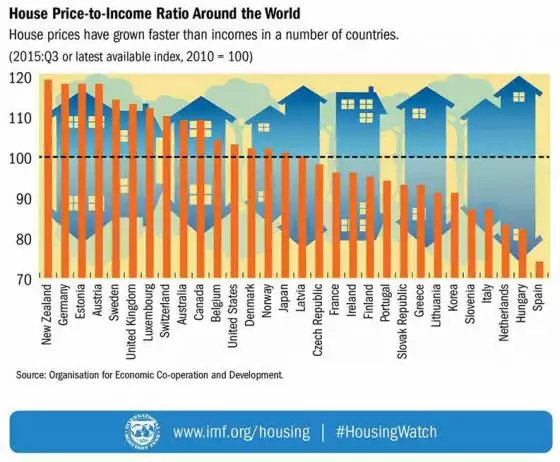

Just as we are seeing in Australia (we will discuss more tomorrow), it is getting harder to afford housing as well:

“Houses have NEVER BEEN MORE EXPENSIVE to end-user, mortgage-needing shelter buyers. The recent rate surge crushed what little affordability remained in US housing. It now it requires 45% more income to buy the average-priced house than just four years ago, as incomes have not kept pace it goes without saying.”

The following graph from the OECD published earlier this year reinforces how US house prices have grown faster than wages since 2010. You will note Australia has been far worse and our friends across the ditch top the list.

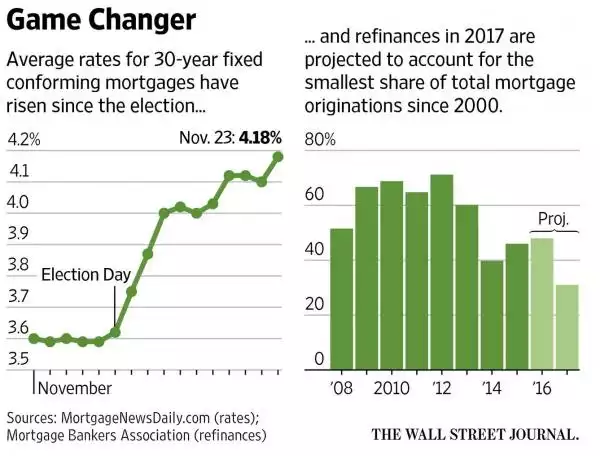

The elephant now in the room however is the impacts of rising bond yields and soon to be official interest rates as well. Mortgage payment stress is coming as increases in servicing interest amid stalled wage growth bites. The other victim could be retail as consumers are less likely to fund purchases by simply drawing from their (to date) ‘cheap’ home loan. Indeed, as the Wall Street Journal reported off the back of a Mortgage Bankers Association report:

“The MBA estimates refinances will fall 46% next year, to $484 billion, which will hurt Americans’ ability to free up cash by reducing the cost of their monthly mortgages.”

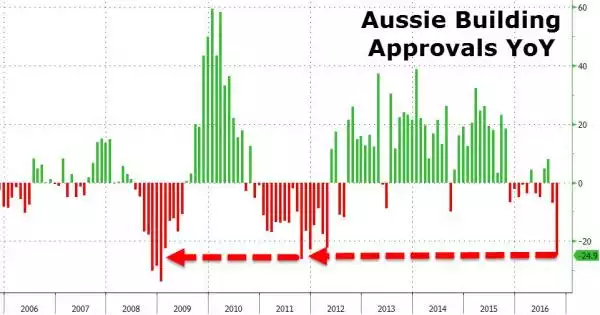

Tomorrow we discuss property in the Aussie context, hot off the heels of yesterday’s Building Approvals plunge per below: