GFC Redux – Here We Go Again…

News

|

Posted 30/11/2016

|

7183

We were struck by a Tweet yesterday by The National Property Research Co. (who co-presented with us at The Future Proof Portfolio seminar recently) quoting the definition of stupidity as ‘Knowing the truth, seeing the truth, but still believing the lies’. The context for them was the apartment market and we will go through that tomorrow, but let’s look at shares first.

Vern Gowdie of The Daily Reckoning in his article on Saturday included the following:

“The US share market is in dangerous territory. Each new high makes the market cheerleaders joyous, but it should make prudent investors nervous.

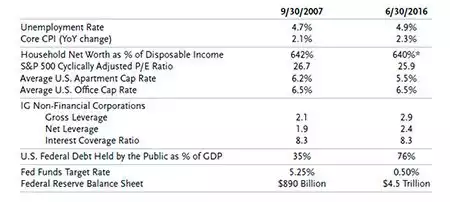

This table compares a number of valuation and economic data sets between the previous market high in September 2007 (and we know what followed that) and now.

Source: TCW

To quote from the report:

‘It’s back to the future — again. Leverage has returned, most notably in the corporate sector where debt metrics have not just round-tripped, but are now in excess of the levels experienced before the Great Recession.’

Lessons have not been learned. The addiction to debt is even greater than it was in 2007.”

Too often we are not so much ‘stupid’ as lead astray by people supposedly more learned than ourselves and whose message reinforces our investment bias or, quite simply, what we hope to be true. Vern Gowdie spends most of that article deriding the vested interest of most financial analysts and advisors who never tell you shares are looking over valued.

Whilst you may think we spruik a similar vested interest we are at lengths to remind you we spruik nothing more than balance; reminding you that a financial crash is a certainty and that gold is historically highly uncorrelated to financial assets. That can make gold an excellent hedge, and indeed a profitable investment, with such an occurrence.