GFC Redux – CLO’s are Booming

News

|

Posted 10/05/2019

|

10512

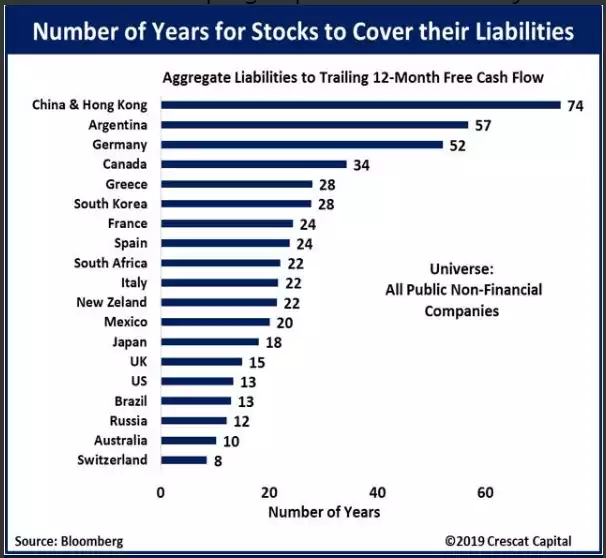

A MUST READ. US Corporate debt, both in quantity and quality, is time and time again flagged as one of the key threats to taking down this current ‘everything bubble’. We have written extensively on it and hope you are taking notice. However what we don’t hear so much about is where it sits on the global stage in relative terms. The chart below puts that sharply into perspective. Yes, things appear much worse in some pretty major economies and topped by the world’s second biggest, China.

However, by size and quality, the US is still the major concern on the world stage. ‘Quality’ has taken a particularly bad turn, not just in the fact that BBB rated debt (the lowest on the investment grade (IG) market before Junk) has risen 400% to $2.5 trillion since the GFC and makes up 50% of the IG market, but is now being leveraged into CLO’s. CLO’s (collateralised loan obligations) package up leveraged loans to on sell to investors. Ring a bell? It was exactly these packages of toxic subprime loans that brought on the GFC. Here we go again. These leveraged loans grew 20% just last year to now be sitting at $1.1 trillion, nearly twice that of the same subprime loans pre GFC. It has the US Fed concerned too as they just noted (ex Bloomberg):

“‘Credit standards for new leveraged loans appear to have deteriorated further over the past six months,’ the Fed said, adding that the loans to firms with especially high debt now exceed earlier peaks in 2007 and 2014.

‘The historically high level of business debt and the recent concentration of debt growth among the riskiest firms could pose a risk to those firms and, potentially, their creditors.’

‘It is hard to know with certainty how today’s CLO structures and investors would fare in a prolonged period of stress,’ the Fed added.”

Now again, this is all in the US and has focussed on quality as much as quantity. Revisit the first chart above as a reminder of the quantity in context. This is far more than a US problem. This is a global problem and a massive one.

Lance Roberts of Real Investment Advice has penned what we consider a must read article on this. It’s not particularly long and is easy to understand. Importantly it starts with a quote of his from June 2007, warning about those leveraged subprime loans, before the GFC started. It may well be time to heed his clear warnings again now.

Here is the article > https://realinvestmentadvice.com/what-could-go-wrong-the-feds-warns-on-corporate-debt/