Fake Growth – The Real ‘Fake News’

News

|

Posted 19/03/2018

|

9213

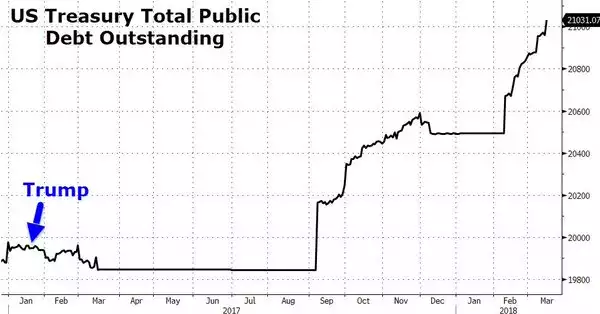

Back in February last year Trump proudly Tweeted “The media has not reported that the National Debt in my first month went down by $12 billion vs a $200 billion increase in Obama first mo.”

So let’s look at how that’s played out since:

Yes, that’s right the $21 trillion threshold was passed on Friday, notably absent of any accompanying Tweet from Mr Trump…

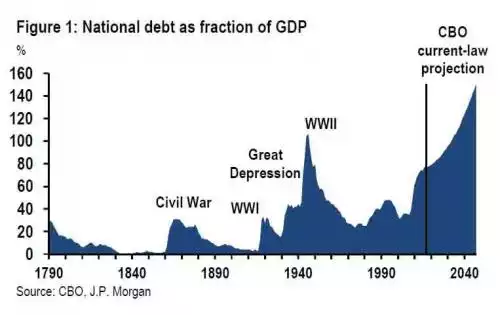

But of course the narrative is that the escalating debt courtesy of tax cuts and big spending on walls and stuff will ignite growth and prosperity and miraculously pay down all this debt. Indeed much of the talk justifying the sky high financial market valuations is the GDP growth now being experienced, albeit at a rate nearly half that of the 50 years prior to the GFC. So let’s look a little deeper at that ‘growth’…

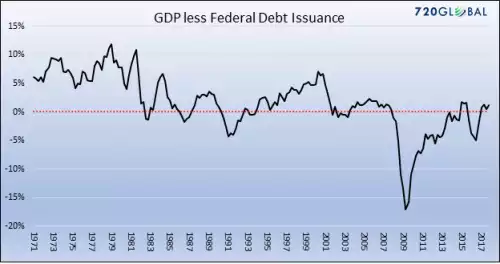

The graph below shows the difference between Treasury Debt Outstanding (TDO) and Gross Domestic Product (GDP). You will note in the period from 1971 (when we left the gold standard) to the GFC, and apart from years of recession, that line has stayed above the red line where the two equate. In other words the US had more economic output than debt added in each year as one would naturally expect. Since 2008, however you can see that has certainly not been the case.

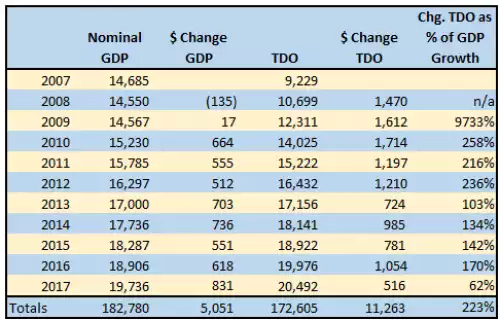

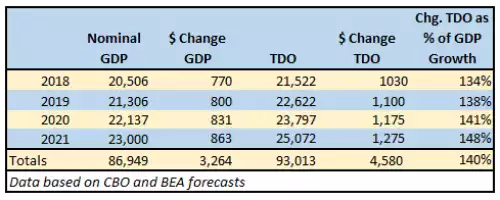

However when you consider that deficit spending is additive in terms of the GDP calculation, the table below puts into perspective this as a percentage in each year:

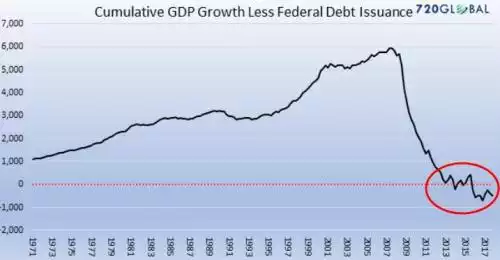

So in fact since the GFC it has taken $11.3 trillion of debt to add $5.1 trillion of GDP. Here’s how it looks cumulatively:

If you’re thinking it looks like it may be recovering then consider the US Government’s own forecasts predict it getting worse, and that is without factoring in an inevitable recession….

Finally, if you think that’s just a ‘US thing’ we remind you of our article at the end of 2016 here, where we revealed Australia had used $6 of debt for every $1 of GDP growth in the 5 years prior… It’s also worth revisiting this article as well.

Now ask yourself if this looks in anyway sustainable without a big reset of some sort.