Expert Warns Go to “Good Money” Now

News

|

Posted 25/03/2019

|

8766

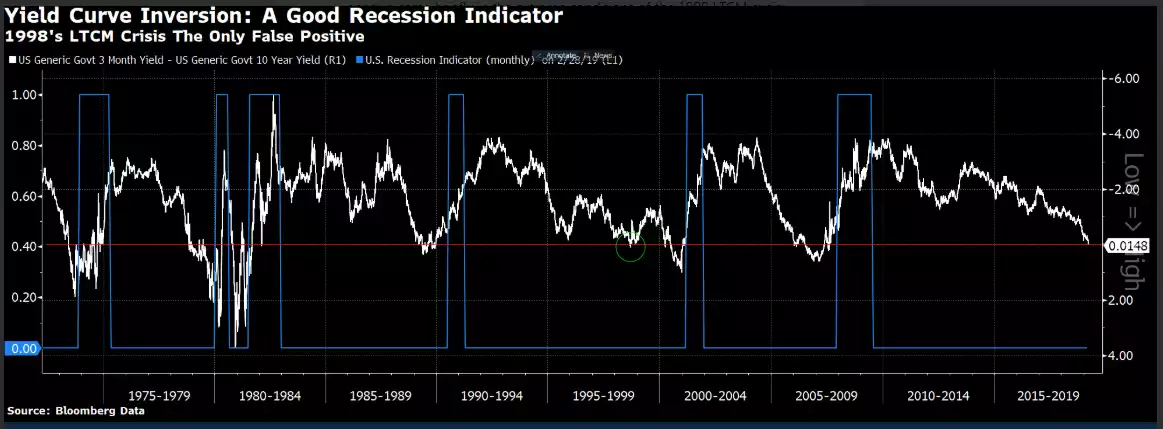

As we have been warning for some time and after the trickle of various US Treasury yield spreads turning negative, Friday saw the key spread of 3m / 10yr invert for the first time since before the GFC. We wrote last week when the UST 3m/10yr got awfully close. Combined with more poor economic data out of Europe (Germany in particular) Friday night, we saw heavy losses on Wall St. The S&P500 was down 2%, NASDAQ down 2.5% and gold rallied to almost US$1320. There was no end of articles over the weekend claiming the end is nigh, and indeed the inversion of the yield curve has had a pretty faultless track record in modern money times. From Bloomberg:

“For those asking if 3month-10year inversion is a good recession indicator - yes it is. In the post-Bretton Woods era, no false negatives, and the only possible false positive came briefly in the extreme conditions of the 1998 LTCM crisis.”

If you recall, the collapse of the $126billion LTCM hedge fund was avoided by the US Fed stepping in before what would almost certainly have triggered a global financial crisis. The Fed secured a multi bank bailout and lowered rates. There is so little slack in our already strung out system (now after the Fed had to capitulate from tightening) that one has to wonder if they could even do that now if history repeated.

News Limited was running articles headlining ‘financial collapse’ and ‘economic Armageddon’ and quoting Former Coalition policy adviser John Adams. To wit:

““In all likelihood, the coming economic crisis will be worse than the Global Financial Crisis because global debt is more than $US85 trillion higher than in 2007,” Mr Adams told news.com.au.

“Think of a bomb with a detonator with a timer that has been shown in many Hollywood movies. The inversion of the yield curve is when the bad guy in the movie turns on the detonator with the timer ticking down.

“In the movies the hero is always able to come and rescue the situation before the bomb goes off. Unfortunately, since 1969, no one has been able to turn off the detonator before the bomb goes off.”

He said ordinary Australians were “completely exposed” to a global downturn which could morph into a “systemic economic crisis”….

“Australia currently has the largest debt bubble in its history at the same time when the world is experiencing the largest global debt bubble on record.”

He said the inversion of the US yield curve was just the latest market signal that Australia was on track for an “economic crisis”.

“The end game for Australia is either our private sector debt becomes unserviceable or the Australian dollar doesn’t hold its value. Both outcomes spells disaster for ordinary Australians,” he said.”

Adams went on to describe how Aussies might prepare including: “researching previous economic crises, managing cash flow, reducing debt, holding onto “good” money that will retain its purchasing power…”,etc.

There simply is no better “good money” than real money. In our world of Fiat currency, synthetic derivatives and other ‘paper promises of wealth’, one of the only real forms of money is precious metals; gold, silver and platinum.

Newcomers to gold may think they have somehow ‘missed the boat’ with AUD gold at near all time highs right now. The critical piece missing in such a simplistic analysis is the Aussie dollar part of that equation. In USD gold is still down 30% off its 2011 highs. However at that time the AUD was worth $1.075USD. Since then the AUD has fallen to just $0.7 USD. However, as Adams and many others warn, it is likely to fall further as Australia feels the pain of its debt excesses and ‘all in bet’ on property. So as USD gold rallies on financial market weakness as history indicates it will, one could easily see AUD gold benefit doubly from a rising USD spot price AND a falling Aussie dollar. And that is the very definition of the “good money” Adams refers to.