Euro Contagion After Brexit

News

|

Posted 28/06/2016

|

6721

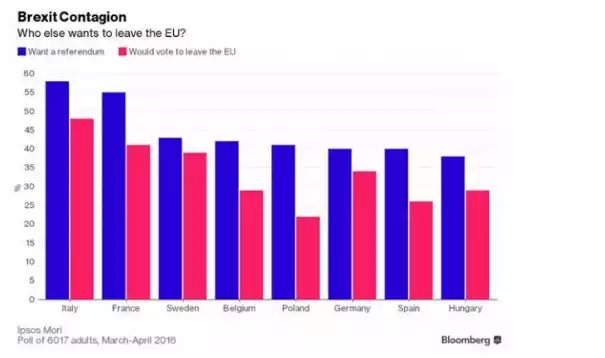

There are many reasons gold and silver jumped as they did on Friday but none more than the fear of contagion in an already weak EU. We touched on this a couple of weeks ago. Euro stocks, particularly banks, continued their rout last night and the pound fell even further whilst gold rose again. The graph below from Bloomberg shows clearly the mood is not great within the Euro project and two of the biggest, Italy and France, are close to the same result with over 50% wanting a referendum to exit.

Unlike the UK, both of these majors have the Euro as their currency. Should either choose to ‘Itexit’ or ‘Frexit’ the ramifications would be enormous. From Doug Noland:

“Recalling the tumultuous 2011/12 period, Italy is again becoming a market concern. Ominously, Italian bank stocks sank 22.1% Friday, a crash that pushed 2016 declines to 52%. Friday trading saw the Italian stock market (MIB) sink 14.5%, increasing y-t-d declines to 34%. And with Italian 10-year bond yields up seven bps to a four-month high 1.62%, the spread to bund yields surged 14 bps this week to a two-year high 167 bps.”

Doug’s latter point raises a key concern. Apart from gold and silver, bonds are the world’s other ‘safe haven’. With the literally trillions of Euros in bonds currently yielding negative returns on a 10 year horizon, they’d want to be pretty safe…. So what do you think happens to faith in these bonds should the Euro experiment fail either on another exit and currency crash or a systemically large bank going down just on the Brexit fallout? Where does the flight to safety go then? From Hebba Investments:

“In that world, both the US Dollar and gold would skyrocket as trillions of Euro holders try desperately to exchange their holdings for safer currencies. We wouldn't be talking about $1350 or $1500 gold - we are talking gold well over $2000 in that scenario and it would happen fairly quickly.”

As we’ve said a number of times recently, this is not just about Europe. The global financial set up is fragile on so many fronts. Ex US Fed chair Alan Greenspan summed it up:

”This [Brexit] is just the tip of the iceberg,….The global economy is in real serious trouble.”