ETF’s Flows Positive BUT dwarfed by China

News

|

Posted 10/12/2018

|

7673

2018 has been notable for the outflows of gold from North American gold ETF’s (Exchange Traded Funds) offset by increases in Europe and Asia. That’s not an enormous surprise as the US sharemarket has (until the last month or so) been rising strongly amid the perception the US economy was somehow different to the rest of the world. “Who needs gold when everything is awesome?” has been the trade. More recently that perception has taken quite the battering, forecasts for gold are becoming bullish, and so we have seen a strong turnaround in demand generally but also specifically in the ETF’s.

The World Gold Council’s latest report on ETF holdings has seen the second consecutive month of inflows, some 21.2 tonne in November, taking year-to-date flows positive (incoming) in US dollar terms for 2018.

Despite the 2 consecutive monthly inflows for North America they are still net negative for the year given the 6 consecutive outflow months beforehand. The contrast with Europe is marked, with inflows up 7.1% compared to that 4.6% decline in North America. As we’ve written before, Europe is struggling with Germany’s economy last quarter posting a contraction, and moribund growth elsewhere, combined with the Italian budget and debt issue, Brexit and broad geopolitical unrest.

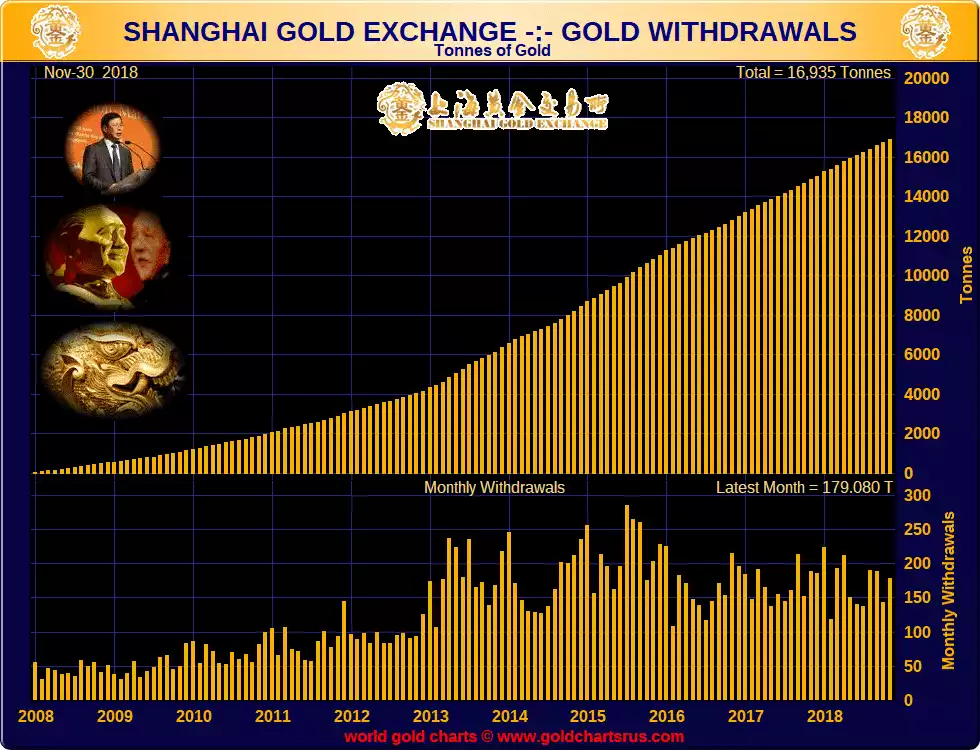

You will note Asia are not big owners of gold ETF’s. They are down 1.5% for the year but off a small number. Generally Asia is (rightfully) wary of such tenuous paper promises and prefer the real thing, bullion. To illustrate this let’s look at the largest Asian nation, China. The latest figures for withdrawals from the Shanghai Gold Exchange (considered the best measure of total gold consumption in China) put this very firmly into context. Per above, TOTAL inflows into gold ETF’s for November was 21.2 tonne. Total gold consumption for China in that same month was 179.1 tonne, over 8 times more. Per the chart below that figure is not an outlier either. This year has seen multiple prints close to and above 200 tonne in a month.

The difference is all this gold going into Chinese hands is going into very strong, strategic, long term hands. ETF’s flit around on the whim of financial traders. See those 250 tonne spikes in 2013? That was China taking all the gold spewed from the ETF’s on the first big price drop courtesy of those very same ETF’s. They have been relentless accumulators since, scooping up the bargains offered by the west.

If you look to the top right hand corner of the chart above you will see China has consumed 16,935 tonne of gold since the GFC (around $945b). The west, on the other hand, have piled into an economic stimulus fuelled sharemarket.