Dot.com / GFC Redux

News

|

Posted 21/12/2017

|

11264

We always enjoy the balanced analysis of RealInvestmentAdvice’s Lance Roberts. Like us he tries to look past the ‘everything is awesome’ crowded trade to warning’s being ignored or not fully appreciated by the sheeple. In his latest update he shared these sage words:

“If you have been around the markets for any length of time, you can quickly spot the “pigeons at the poker table.” These are the ones that continually rationalize why prices can only go higher, why this time is different than the last, and only focus on the bullish supports. Trying to “draw to an inside straight” is not impossible, it just leads to losses more often than not.

But therein lies an important point.

As investors, our job is NOT making the case for why markets will go up.

Read that again.

Making the case for why markets will rise is a pointless endeavour because we are already invested.

If the markets rise, terrific. We all made money, and we are the better for it. However, that is not our job.

Our job, is to analyse, understand, measure, and prepare for what will reduce the value of our invested capital.”

So why should people be starting to think cautiously now? In the same client update he compared this market to that of 1999 and 2007:

“In 1999:

- Fed was hiking rates as worries about inflationary pressures were present.

- Economic growth was improving

- Interest and inflation rates were rising

- Earnings were rising through the use of “new metrics,” share buybacks and an M&A spree. (Who can forget the market greats of Enron, Worldcom & Global Crossing)

- Margin-debt / leverage was at the highest level on record.

- Stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

- Speculative asset of choice: Dot.com stocks

In 2007:

- Fed was hiking rates as worries about inflationary pressures were present.

- Economic growth was improving

- Interest and inflation rates were rising

- Debt and leverage provided a massive “buying” binge in real estate creating a “wealth effect” for consumers and high-valuations were justified because of the “Goldilocks economy.”

- Margin-debt / leverage was at the highest level on record.

- Stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

- Speculative asset of choice: Real Estate

In 2017:

- Fed was hiking rates as worries about inflationary pressures were present.

- Economic growth is improving because of 3-hurricanes and 2-wild fires.

- Interest and inflation rates are expected to rise

- Earnings were rising through the use of “new metrics,” share buybacks and an M&A spree.

- Margin-debt / leverage is at the highest level on record.

- Stock market was beginning to go parabolic as exuberance exploded in a “can’t lose market.”

- Speculative asset of choice: Bitcoin”

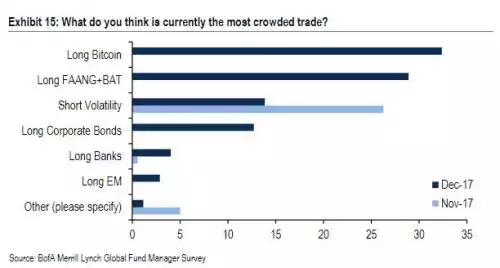

As a note, and leaving Lance for a bit, another similarity we have noted with 1999 is that whilst Lance understandably lists Bitcoin as the speculative asset of choice, the latest Bank of America Merrill Lynch global fund manager survey found, like 1999, tech stocks (FAANG and China’s equivalent, BAT) are only just behind it. Note too Short Volatility is #3! The crowd are very relaxed….central banks ‘got this’….

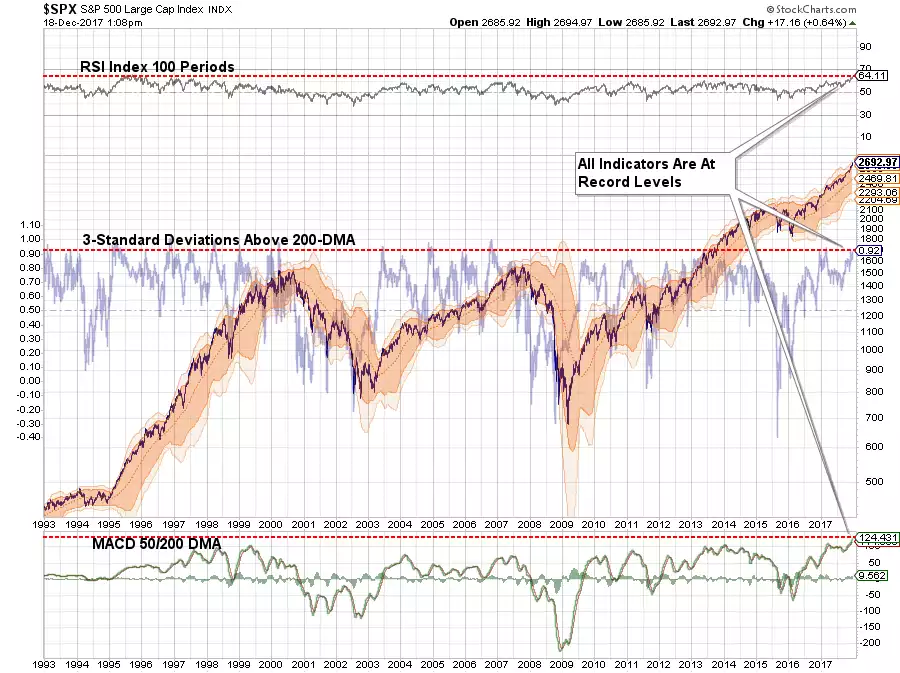

Back to Lance and the following 2 charts then put it all very much into perspective:

“The chart below shows the S&P 500 from 1993-present. As shown, the 100-period RSI, 3-standard deviations above the 200-dma and the 50/200 day moving average MACD line are all at historical extremes. While such readings do NOT suggest a downturn is imminent, it does suggest that risk is elevated and potential upside from current levels is likely limited.”

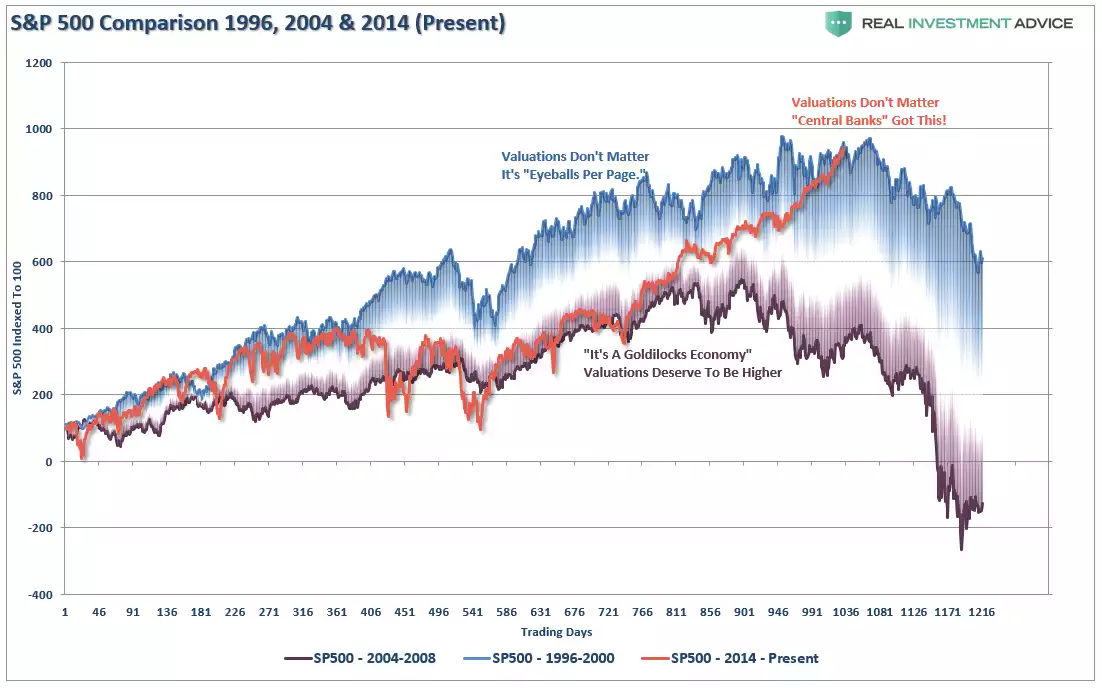

And then combining each of the 3 bull markets scaled to 100:

As Lance says “Sure. This time could be different. It just probably isn’t.”