Director Identification Number (DIN) chaos and confusion as Nov 30 deadline passes.

News

|

Posted 07/12/2022

|

14262

Special guest Cass Smith, from Freedom Financial Solutions, joins us today to explain the introduction of a compulsory Director Identification Number (DIN) for all Australian Company Directors, and the recent November 30th Deadline. This is a must read if you are the registered Director of any company in Australia, including Self Managed Super Funds, and haven’t yet applied for and received your DIN, and are seeking a level-headed opinion around the current controversy.

First a little background…

What is a DIN and where did it come from?

The Treasury Laws Amendment (Registries Modernisation and Other Measures) Act 2020 (Cth) amended the Corporations Act 2001 (Cth) to require all company directors, or anyone intending to become a director, to obtain a Director Identification Number (DIN).

A DIN a 15 Digit unique identifier number attached to a director’s identity. Directors will only ever have one DIN. The number will stay the same even when a director changes companies, stop being a director, changes their name or even moves overseas.

According to the Australian Business Registry Services (ABRS) at https://www.abrs.gov.au/director-identification-number/who-needs-apply-and-when

A DIN:

- starts with 036, which is the 3-digit country code for Australia under International Standard ISO 3166

- ends with an 11-digit number and one ‘check’ digit for error detection.

Therefore, the DIN appears to relate to an international record for Directors potentially worldwide.

The ABRS goes on further to say that “Shareholders, employees, creditors, consumers, external administrators, and regulators are entitled to know the names and certain details of the directors of a company”.

All directors are required by law to verify their identity with before receiving a Director ID. This is important because it will help to:

- prevent the use of false or fraudulent director identities

- make it easier for external administrators and regulators to trace directors’ relationships with companies over time

- identify and eliminate director involvement in unlawful activity, such as illegal phoenix activity.

A director must apply for their own DIN, a Tax Agent or other representative cannot apply for a DIN for their clients. It is free to apply for a DIN. The application process requires a director to provide information to the ABRS which includes their tax file number (TFN); their residential address; and information from two documents to verify their identity.

The DIN process, particularly around identification requirements, created a lot of heated discussion and controversy online.

Cass Smith’s Perspective…

In my opinion, the process of applying for a DIN is not giving the Government any more information than they already have.

A director can apply for a DIN using MyGov, over the phone or by using a paper form. Personally, I applied for my DIN using the paper form.

However, it appears that the ABRS has recently changed the paper form so as to imply that it can only be used by people living outside Australia. There is no legislative requirement to use a particular method to apply so it is my opinion that applying using the paper form is still valid.

The date by which Directors must apply for their DIN depends on the date they became a director:

Date you become a director Deadline to apply

- On or before 31 Oct 2021 By 30 Nov 2022

- Between 1 Nov 2021 – 4 Apr 2022 Within 28 days of appointment

- From 5 Apr 2022 Before appointment

The penalties for not complying with the legislation are $13,200 in criminal cases and $1,100,000 in civil cases.

Now that the facts are presented, lets discuss the current social media frenzy over the DIN.

There is currently a major uprising on social media claiming that the DIN is the ‘Digital Identity’. Proponents of this theory such as Fair Business Australia are overtly replacing the term ‘Directors ID’ with the term ‘Digital ID’. By doing so they are creating fear and an uprising of Directors refusing to apply for the DIN.

There are even examples of self proclaimed ‘experts’ in the space charging for their services to advise people how to avoid the ‘Digital ID’. I believe this is false and misleading as the DIN is simply not the ‘Digital ID’ that has many Australians quite rightly concerned.

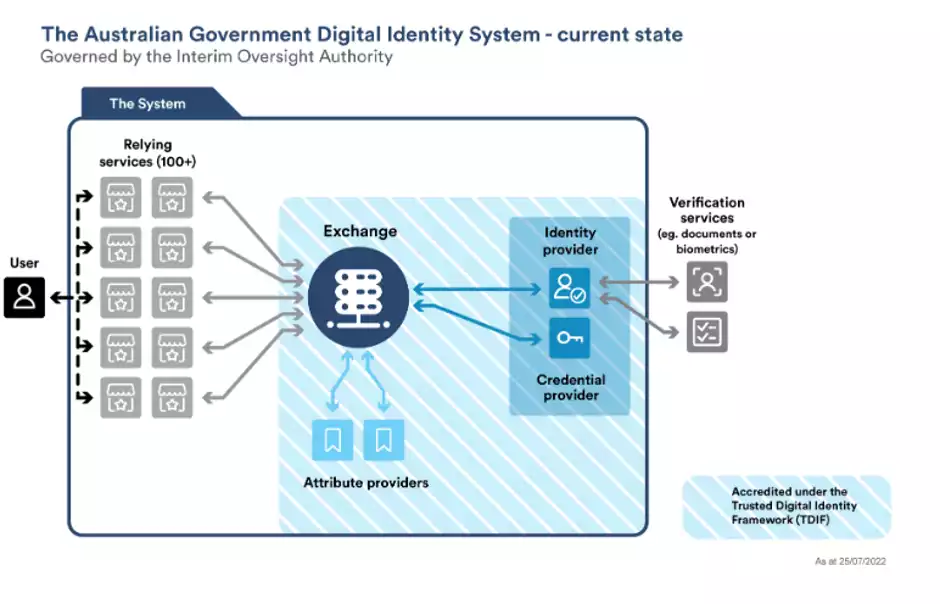

The Australian Digital Identity system is outlined at https://www.digitalidentity.gov.au/ and clearly identifies a digital system linking 100+ services to one online identity. Big brother is watching.

A rational person comparing the ‘Digital Identity system’ to the ‘Directors ID’ can clearly see the difference. The ‘Digital Identity system’ links over 100 services. The DIN links only 1 government service - ASIC.

My concern with the social media gurus, especially the ones charging for their misleading conduct, is exactly that – they are misleading innocent Australian Directors and those that follow their advice face the following costs and risks:

- A fine of between $13,200 - $1,100,000

- Exorbitant accounting and legal costs to re-structure their business affairs

- Potential serious issues with re-structuring business finance arrangements such as increasing interest rates or the banks refusing to allow re-financing due to deteriorated trading condition during covid,

- 20% more tax on business profits every year

- Removal of the key benefit of running a business through a company – limited liability

Of all the above adverse consequences, the removal of limited liability is a key one as far as I am concerned. I have been an Accountant, Tax Agent, Mortgage Broker, Property Adviser and was previously a Financial Planner for over 20 years.

I have seen many clients facing bankruptcy and loss of their family home due to business failures when they have operated as a sole trader and encountered business problems such as a lawsuit, or serious down trend in trading conditions such as during Covid.

Accountants advise clients to use a Company structure to avoid these issues.

The social media gurus advising clients to avoid getting the DIN have not considered any of these issues and they are not licenced, experienced or educated in accounting, taxation, finance and business affairs.

I admit I am concerned about the requirement to apply for a DIN, the fact that the legislation appeared out of nowhere with no consultation, the enormous penalties the fact that it is an international number.

However, a logical analysis of the risks of refusing to obtain a DIN, and/or changing business structures to avoid having to have a DIN, puts the DIN in the same basket as every other number that the government require us to have.

In comparison, we are required to have a Drivers Licence to drive a car, a Passport to travel, an ABN and TFN to avoid having 45% tax withheld on our payments, a Medicare number to obtain cheaper health services. We all accept these numbers as a necessary evil. I believe the DIN is in the same category and these social media gurus need to retract their false and misleading statements, calm down, and advise their clients / followers to obtain appropriate advice from qualified professionals before deciding what to do.

In the meantime, directors who are concerned can apply for an extension of time to apply for a DIN, using the reason that they are seeking professional advice.

Regards

Catherine Smith (aka Cass)

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************