Derivatives Time Bomb

News

|

Posted 28/10/2019

|

15012

Often described as the ‘elephant in the room’, derivatives are both feared and written off as harmless depending on which camp you are in. We are clearly in the former camp (last discussed in detail here) and at the Gold and Alternative Investment Conference (GAIC) last week saw a host of excellent speakers building the case for both gold and silver and then cryptocurrencies on the Saturday.

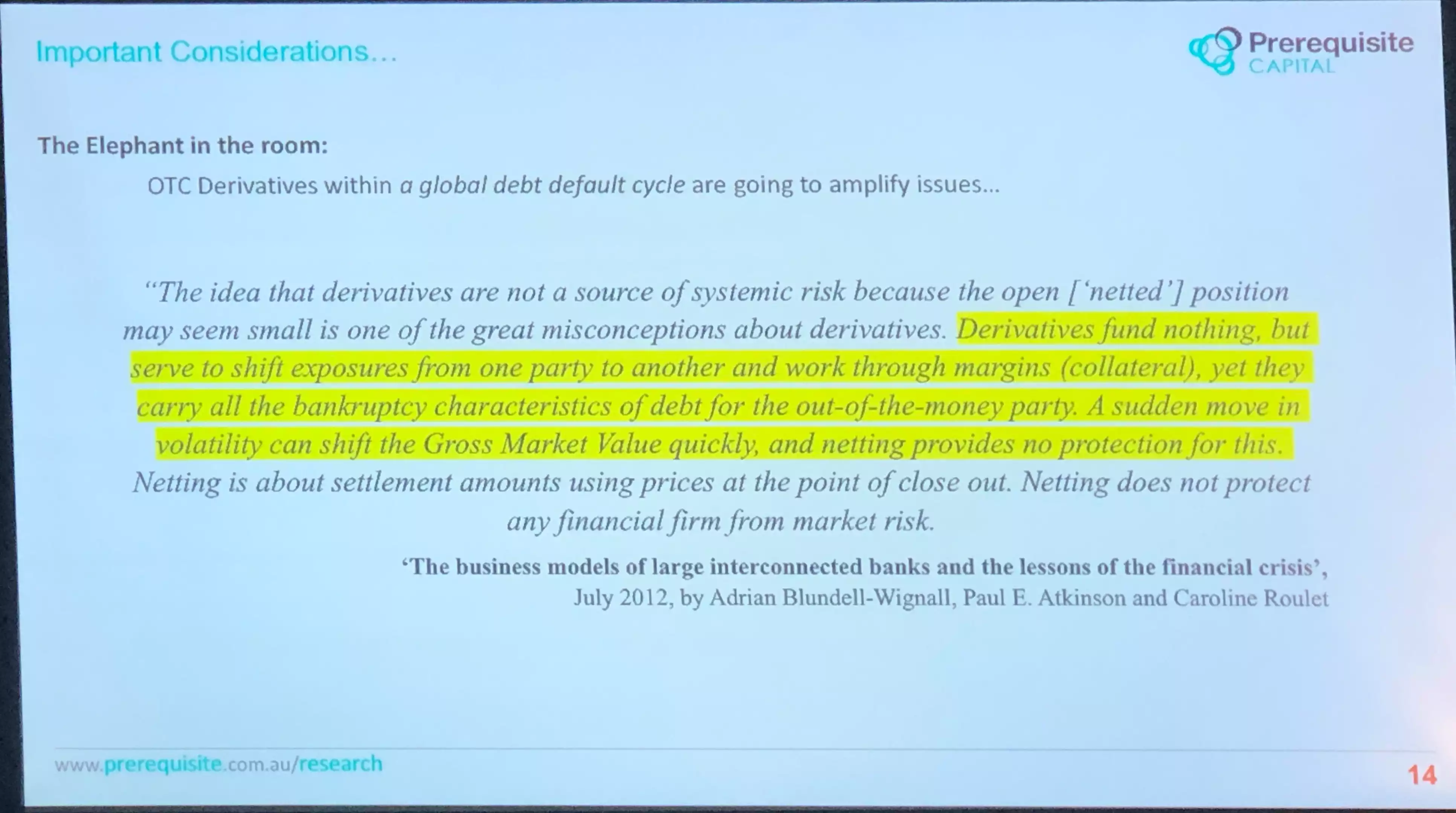

One speaker, Daniel Want of Prerequisite Capital, gave an excellent presentation. Part of his presentation gave us a salient reminder of the extent and implications of the massive derivatives exposure of the system including this debunking of the ‘it all nets off’ argument (excuse the quality of the photo from the audience):

As we noted in the above previous article “What few realise is that for as bad as the GFC was, it was about to get a whole lot worse with a multi trillion dollar pile of CDS (credit default swap) derivatives close to blowing up.”

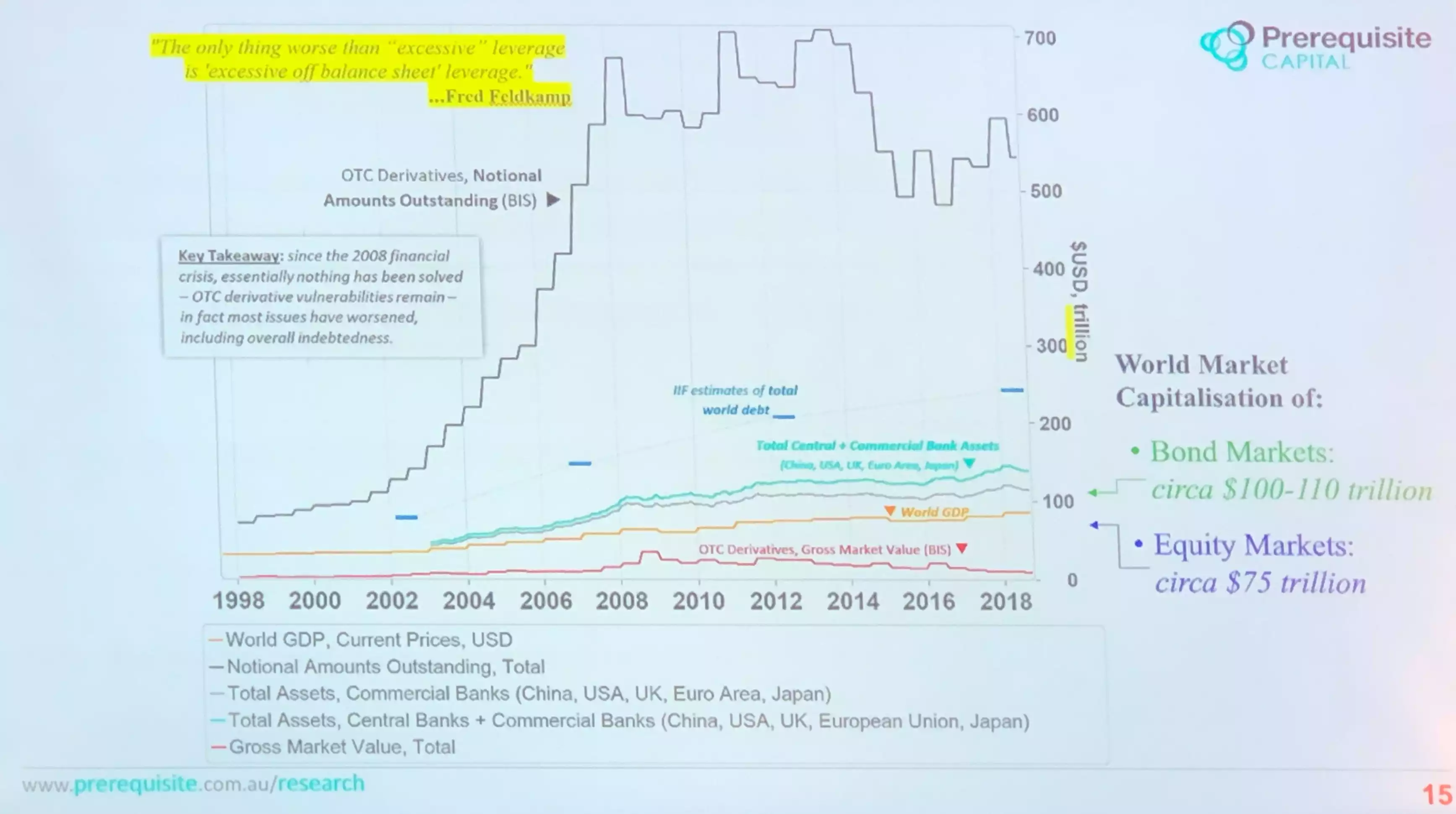

So how have they addressed this since the GFC?

Not particularly effectively is the answer.

As you can see, derivatives are only part of the issue, but potentially a massive one. The above chart puts into perspective the sheer scale of debt, at a bank, central bank and total level compared to total GDP bond and equity markets. The debt burden is so incredibly excessive it seems impossible for it not to eventually trigger the kind of uncontrolled or ‘disorderly’ market event that sees the derivative ‘worst case’ issue playing out.