Demand takes off again

News

|

Posted 02/10/2014

|

2930

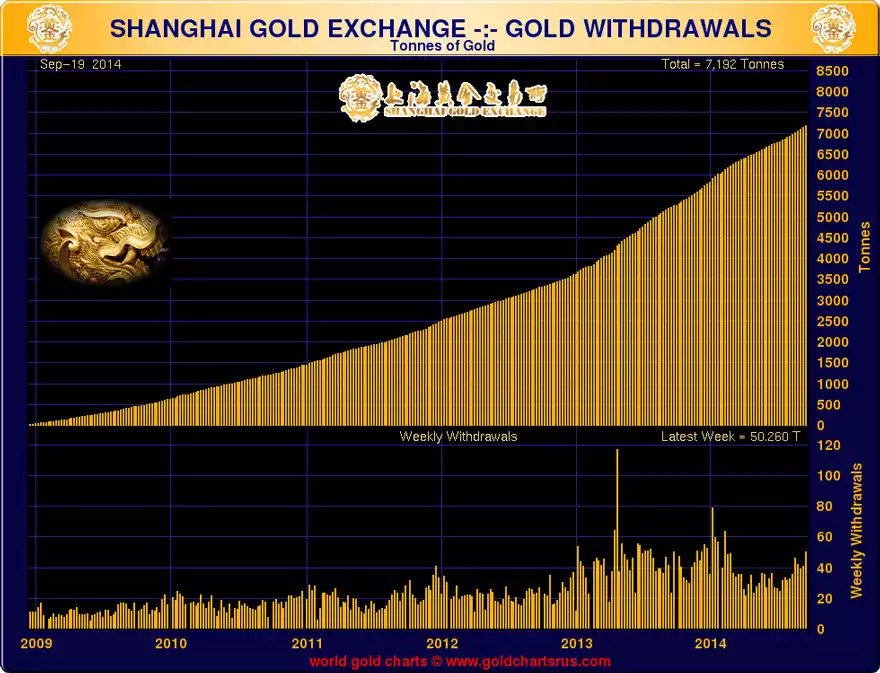

There is evidence from around the world that investor demand is on the rise. This could be bargain hunting or it could be the structural shift that people believe the bottom is either in now or close enough that they don’t want to get caught out with limited supply when the rush inevitably happens. It could of course also be the realisation that shares are starting to show signs of a big crash being close (and the historic ‘crash month’ of October* upon us) plus the growing geopolitical situation getting quite ‘real’. The old saying “better a year too early than a day too late” has never been more true. We’ve posted recently about the resurgent Indian and Chinese buying (see the chart below for China with last week’s 51 tonne purchases) and now the US Mint saw September purchases of Silver, Gold and Platinum Eagles all jump over 100% on August and Gold Buffaloes up over 80%, and our US suppliers are reporting a sudden jump in orders too.

* As ZeroHedge cleverly tweeted this morning “Since 1928 how many Octobers have seen the Fed hold $4.5trillion in assets [bonds] and stop buying [printing money]?”