Debt Crisis 2015

News

|

Posted 27/11/2014

|

6787

As the headline US National Debt figure is about to surpass $18 trillion their National Inflation Association has called 2015 as the year the debt crisis hits the US and by default the world. They have just released an eye opening report that outlines some scary facts.

- The $18t headline equates to 102% of US GDP, the first time over 100% since end of WW2 1947.

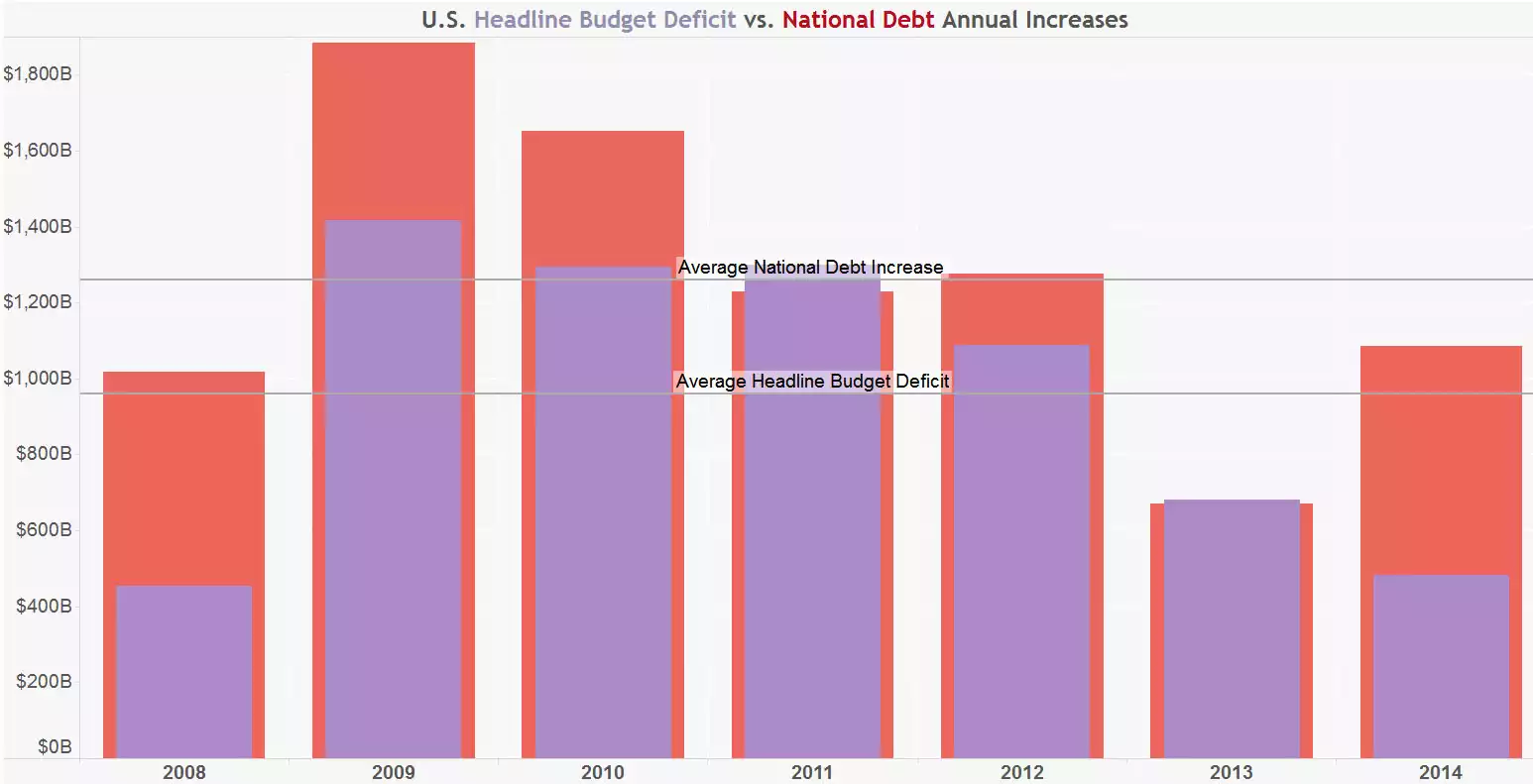

- Debt growth has incredibly exceeded official budget deficits with a 7 year average $960b deficit yet $1.26t average debt growth (depicted below)

- US debt growth has exceeded GDP growth for the last 13 consecutive years.

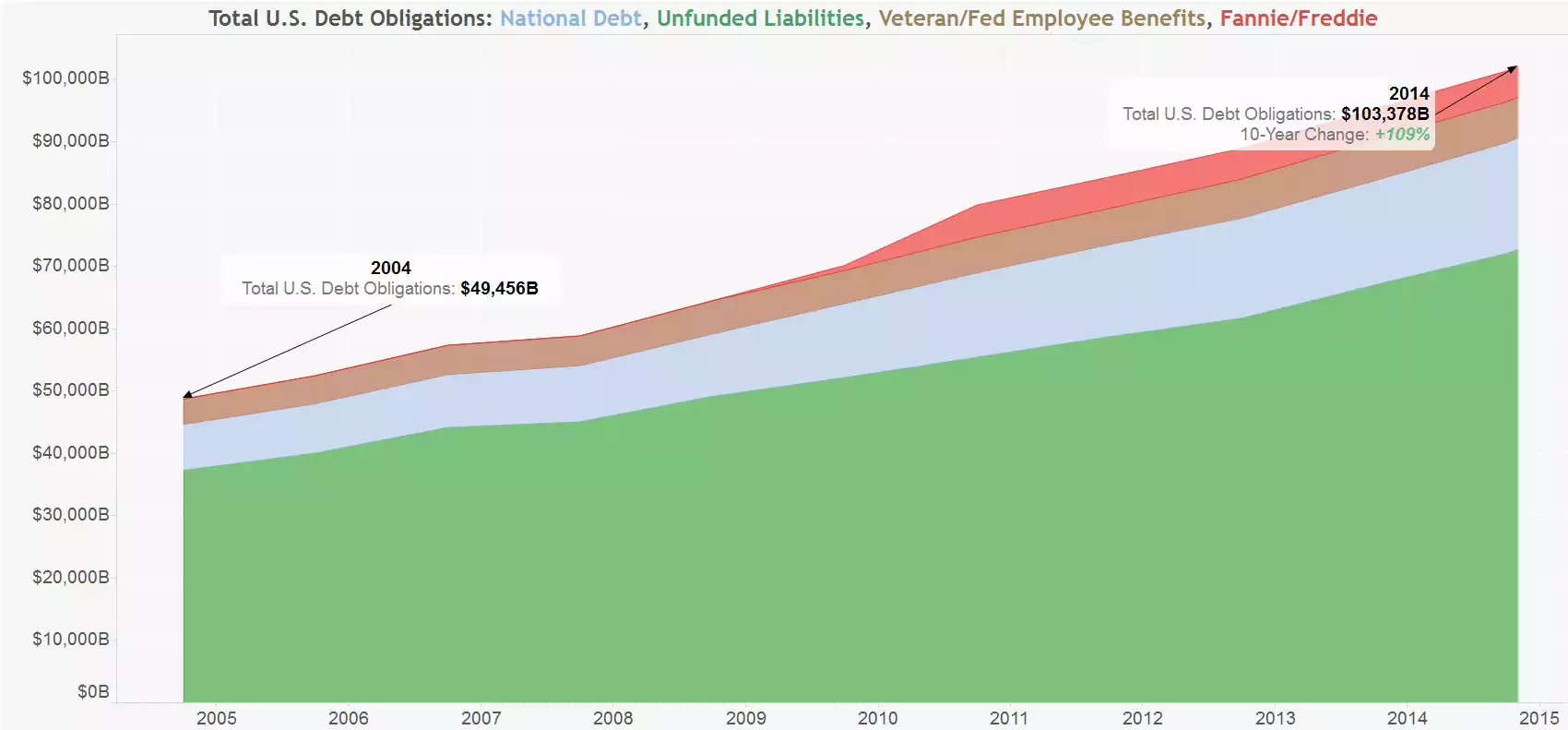

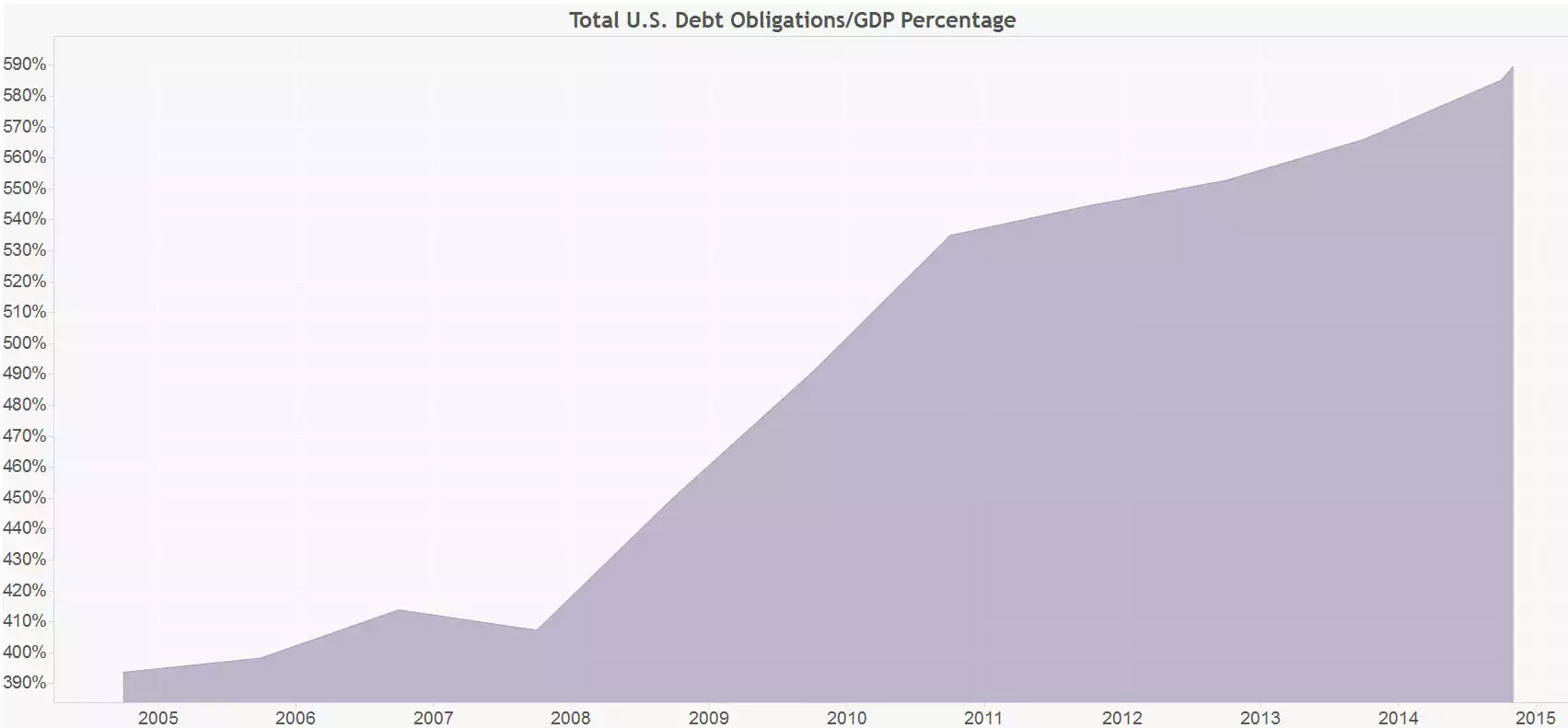

- The headline $18t conveniently omits REAL committed present value unfunded liabilities (future commits in excess of future revenues). The graph below shows these accounted for with an eye watering total of $103 trillion or 590% of GDP.

- Part of the problem is ‘entitlement’ spending (social welfare, medicare, etc) which since 2000 has risen from $724b to $1.67t (131% increase) or from 36% of Government income to 56%! (Try unwinding that and get re-elected….)

- This is all real, it all can’t magically disappear, and can only end badly. NIA is calling that next year. 2014 might be the time you balance your wealth with the world’s oldest and most proven hedge against such insanity, Gold and Silver. You can read the full report here.