Crypto - No Short-Lived Tech Gimmick

News

|

Posted 22/02/2018

|

6933

Despite what seems like the continual production of FUD (fear, uncertainty and doubt) surrounding the emerging cryptocurrency market, the cryptocurrencies are proving themselves and the concept they represent to be more than a short-lived tech gimmick.

Bitcoin rose from the ashes of the GFC and out of the desire for protection from bank bailouts. In fact embedded in the genesis block (first block of bitcoins) was the following text:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” – Wikipedia.

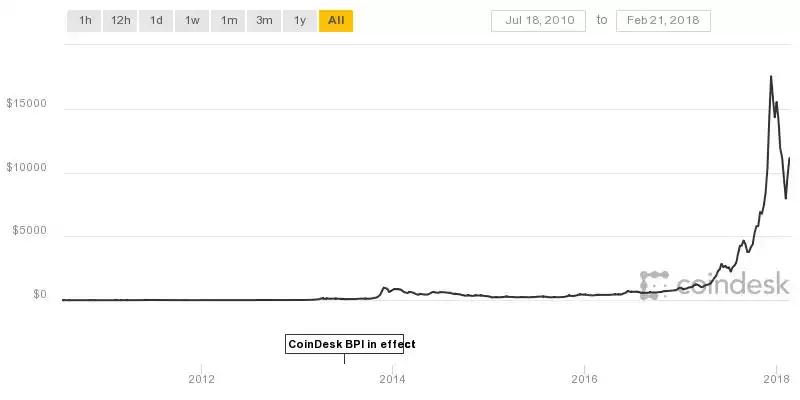

Time and time again over the last 9 years we have heard Bitcoin is dead, it’s dying, Bitcoin will never work or scale, it’s slow and so on, and granted many thought Bitcoin’s days were over, especially with the static sideways movement of the currency during most of 2013. However, no matter what seems to be thrown at this King of the Cryptos, Bitcoin bounces back.

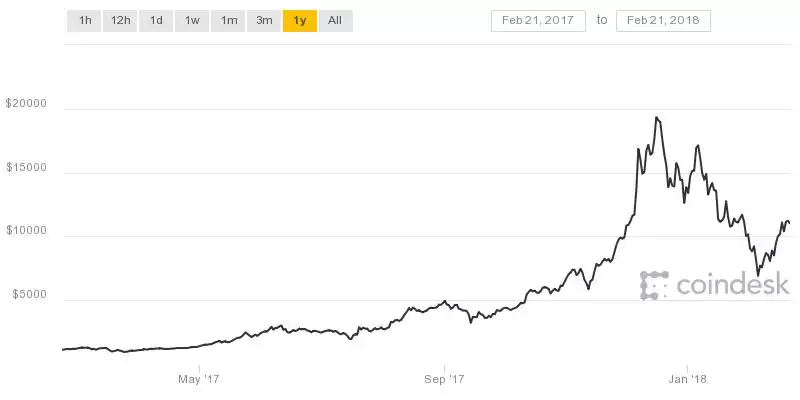

Since Bitcoin reached the heady heights of US$19,500 in mid December 2017 it dropped to ‘just’ US$6,200 early in February 2018, a 68% drop. We say ‘just’ because if you had bought Bitcoin just 12 months prior to that low of US$6,200, you’d still have made 505%. At the time of writing (and after a 10% drop last night) it had already rebounded to $10,500, or 924%, and appears to be on its next extended bull leg up.

The point is, whilst it certainly still might seem an extreme drop, particularly if you bought at the top, this drop was preceded by an even more extreme bull run as can be seen in the graph below. We are definitely not disputing the extreme volatility of the cryptocurrency markets (note how we just shrugged off a 10% drop last night…), however, it is very important to take a big picture perspective and remember that it was only in November 2017 that Bitcoin was around the US$6,000 mark, three months before that in September 2017, US$3,500 and in April 2017 just over US$1,000 would have bought you 1 Bitcoin. It is hard to dispute that it appears overall there is an upward trend for Bitcoin as mainstream adoption and awareness continues to flourish.

So far this week we have discussed the risks associated with deposits in our centralised, fractional banking system and the seemingly limitless supply of ‘money’ generated through newly created debt. Is it really any wonder then that an alternative form of money, a decentralised, peer-to-peer digital currency of limited supply is proving so popular in these historically unprecedented economic times. This is no gimmick.