Crypto Gains to Continue

News

|

Posted 11/08/2020

|

9981

Many digital currency enthusiasts have been focused on crypto markets, as prices started rising again during the latter half of the weekend. Overnight BTC had jumped a hair above the $12k US zone, cracking through long-standing and established resistances.

However, BTC/USD prices slid 4% after reaching the $12k zone to the $11,500 region. BTC quickly moved back to the $11,700 position and again bitcoin bulls are pressing toward the $12k range.

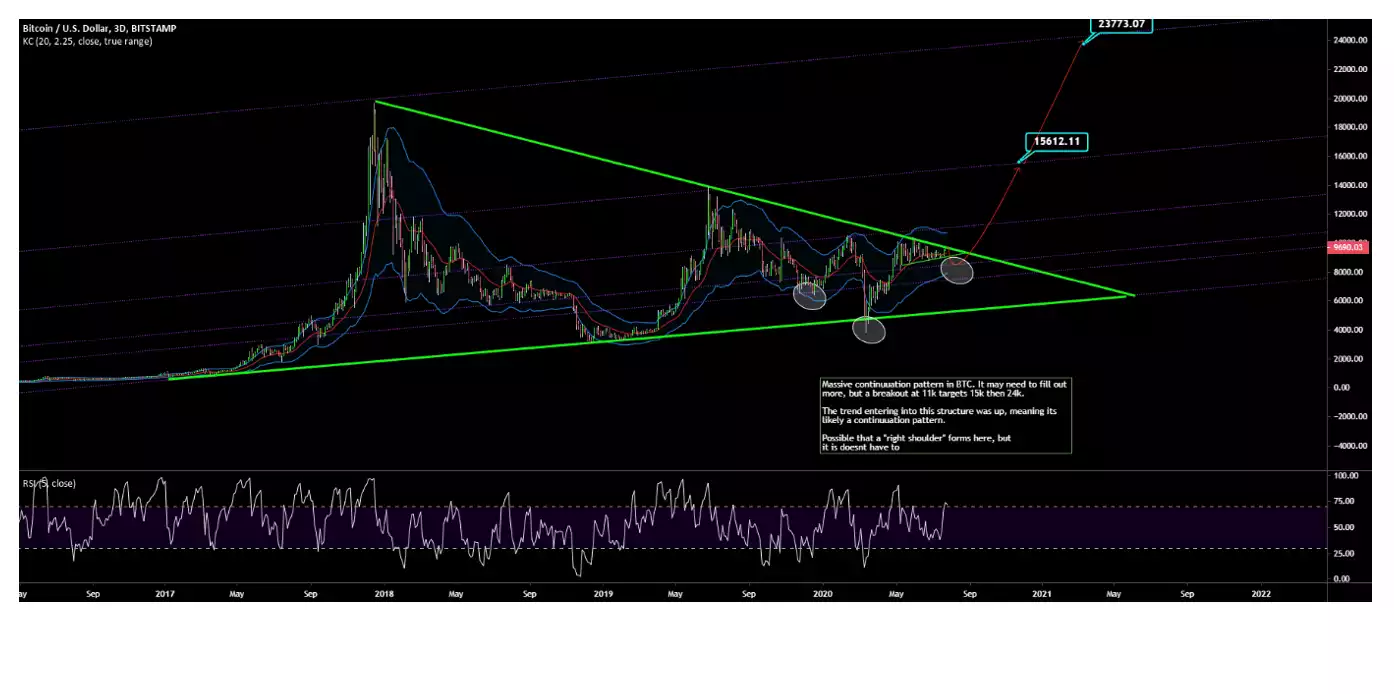

Full-time trader Adam Mancini told his 53,000 Twitter followers on Sunday that he’s seeing an “excellent rally in bitcoin.” Mancini thinks that the next big stop will be around $15,000 after the crypto asset recently busted through a bullish triangular pattern.

“[BTC] broke out of a multi-year bullish triangle with force,” Mancini tweeted on Sunday. “Bitcoin may be the new kid on the block but the same old classic patterns that apply to all financial assets still apply. [The] trend is up with $15k next target.”

The CEO of Real Vision, Raoul Pal, is short on the U.S. dollar and “irresponsibly long” toward bitcoin, according to a new interview published this week. Pal is extremely bullish toward BTC and he thinks it’s a better investment than precious metals, bonds, and traditional stocks.

“In fact, only one asset has offset the growth of the G4 balance sheet. It’s not stocks, not bonds, not commodities, not credit, not precious metals, not miners,” Pal said during the daily briefing. “Only one asset massively outperformed over almost any time horizon: Bitcoin. My conviction levels in bitcoin rise every day. I’m already irresponsibly long. I am now thinking it may not be even worth owning any other asset as a long-term asset allocation, but that’s a story for another day.”

Raoul Pal applies the economic cycle theory to predict a major disruption of the global financial system. He believes this will drive Bitcoin to new highs.

“I think that the stock market is trading hope and the bond markets trading reality and the bond market will show us where the stock market will go.”

According to Pal’s interpretation of the economic cycle theory – a sequence of boom and bust periods in the world economy – we are at the bottom of the downcycle, which means there is a high probability of major disruption in the global financial system.

“The probability is high that we have to move to a new financial system. And that will probably involve digital currencies in multiple formats.”

Still, Pal predicts that the devaluation of currencies all around the world will pave the way for the Bitcoin price to rise 50x to 100x in the next five years. In this scenario, Bitcoin has a high chance to become a widely adopted reserve currency.

“Think of it as your own sovereign currency that you can always go to if your governments are acting bad.”

Stock-to-flow model on track

The author of the bitcoin stock-to-flow (S2F) price model said that at current prices the S2F model is “perfectly on track.” S2F shows the price could hit around $30,000 by the year’s end and by August 2021 prices could be $100,000 per bitcoin.

The crypto asset bitcoin (BTC) is up over 24% over the last 30 days and up more than 16% during the last 90 days. BTC touched a 2020 high of just above $12,000 per coin before tumbling 10.9% last Sunday.

With the price giving traders optimism many speculators wonder if crypto assets are about to witness another massive bull run. On August 1, the author of the contested S2F price model told his 121,000 Twitter followers that the model is on track.

“I can’t make a chart for you now (at sea), but [the] S2F model [is] perfectly on track,” Plan B wrote on Saturday.

“We’re going parabolic,” an individual tweeted in response to Plan B’s tweet.

Plan B’s popular editorial called “Modeling Bitcoin’s Value with Scarcity” has caught the attention of the community for quite some time.

“Bitcoin is almost back at the line that’s supposed to bring us to 100K ~1 year from now,” Tweeted Bit Harrington, an analyst. “Remember, the idea/model states we will move around this line. Both below and above the line.”

Plan B also recently changed their model to measured “phase transitions” of assets like the U.S. dollar removing its gold backing. The new price model is dubbed “S2FX” and it suggests BTC could hit $288,000 by the end of 2023.

Bitcoins next target

The BTC/USD pair has formed a pennant, which usually acts as a continuation pattern. A breakout and close (UTC) above the pennant will be the first sign that bulls have gained the upper hand. The target objective of such a breakout is $14,756. However, as the overhead resistance of $12,304.37 is close by, traders can wait for the price to sustain above this level before turning positive.

Now that the price has rallied through the $12K mark, bulls will need to provide enough volume to push to a new high above the August 2 high at $12,122.

From a fundamental, technical and quant perspective, Bitcoins strength remains intact. The respected traders and analysts in the space remain as bullish as they ever have been. Time will only tell where the price of bitcoin goes but at the moment all the signs point the one way.