Crypto’s Fundamental Market Strength Increasing

News

|

Posted 05/10/2021

|

5954

The Bitcoin market has rallied strongly this week, breaking out of the recent consolidation range low of $40,931 US, and peaking at $49,044 over the weekend. After a fairly brutal September, this rally has brought with it renewed optimism for the last quarter of 2021.

Similar to our observation during the rally in late July, a non-trivial volume of BTC changed hands during the recent consolidation trading range. We can see this via inspection of the coin volume which has now returned to holding an unrealised profit. This week we will analyse this return to profitability and how the fractals compare to previous market cycles. We will also look into the mining market which continues to recover after the Great Migration commenced in May.

Now, speculation is swirling among Bitcoin, Ethereum and cryptocurrency bulls that a long-awaited U.S. bitcoin exchange-traded fund (ETF) could be approved in October—with verdicts expected on a clutch of ETF applications.

"Following the August 3 quotes from [U.S. Securities and Exchange Commission chairman Gary] Gensler, a futures-based ETF seems most likely to get approved as of now, so the ETF response bonanza in October could be an exciting period to follow," Arcane Research analyst Vetle Lunde wrote this week. There are five ETF application responses from the SEC expected in October, with a few more due in November and December.

In early August, Gensler said that a bitcoin futures ETF that complies with the SEC’s strict rules for mutual funds could be a route toward approval. Since 2013, the SEC has rejected several attempts to create a bitcoin ETF, citing the potential for price manipulation.

"The bitcoin market could be heating up shortly, caused by anticipations leading into the ETF verdicts," added Lunde, predicting bitcoin and crypto traders "might seek to front-run in case of approvals."

As the market rallies higher, it is valuable to observe the various cohorts who are transacting on-chain to establish a case for both capital inflows, outflows, and aggregate market sentiment.

This week saw a marked decline in investors spending coins that were held at a loss. Realised losses fell to a multi-week low of around $175M per day. On the other hand, realised profits rose sharply to $996M/day. These observations are likely a function of:

- More coins returning to profit overall

- Profits taken by traders who bought the recent lows

- Investors who may have bought the March-May top 'getting their money back' closer to, or just above their cost basis.

Given the market continued to hold most of the week's gains, this also indicates that around $1.75B worth of capital is flowing into the market as buy-side demand per day.

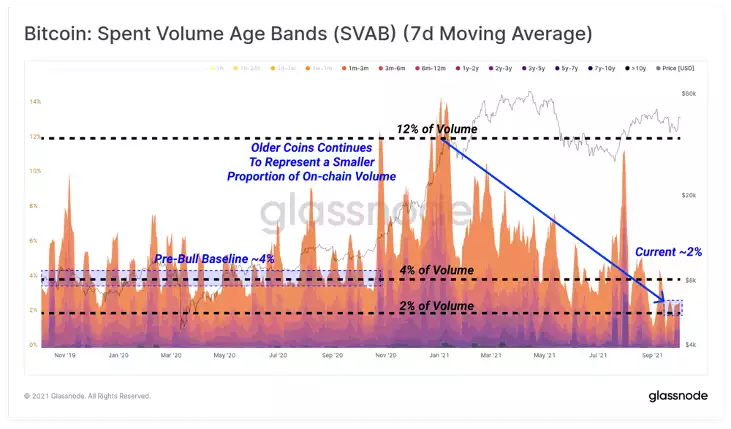

The structural downtrend on old coin volume dominance continues this week, reaching a multi-year low of around 2%. In the pre-bull phase of 2019-20, old coin volume represented around 4% of all volume moved on-chain as a baseline. This spiked in late 2020 and early 2021 as long term investors took profits in the bull market.

With old coin dominance at multi-year lows, it suggests two dynamics are at play:

- Old Hands have a strong conviction and are not spending at current prices.

- Young coin dominance is at multi-year highs which indicates the same liquid supply is transacting and likely being absorbed by new buyers

Now, with the fundamental strength in the market more apparent than ever, which proved itself over the long weekend, the sky is the limit for crypto. There are a few critical points to stop off at on the way towards all-time highs. However, if the market dynamics remain the same, crypto should certainly have a good crack at breaching and gaining into new territory.