COMEX Flags a Bottom in Gold and Silver

News

|

Posted 29/04/2019

|

8041

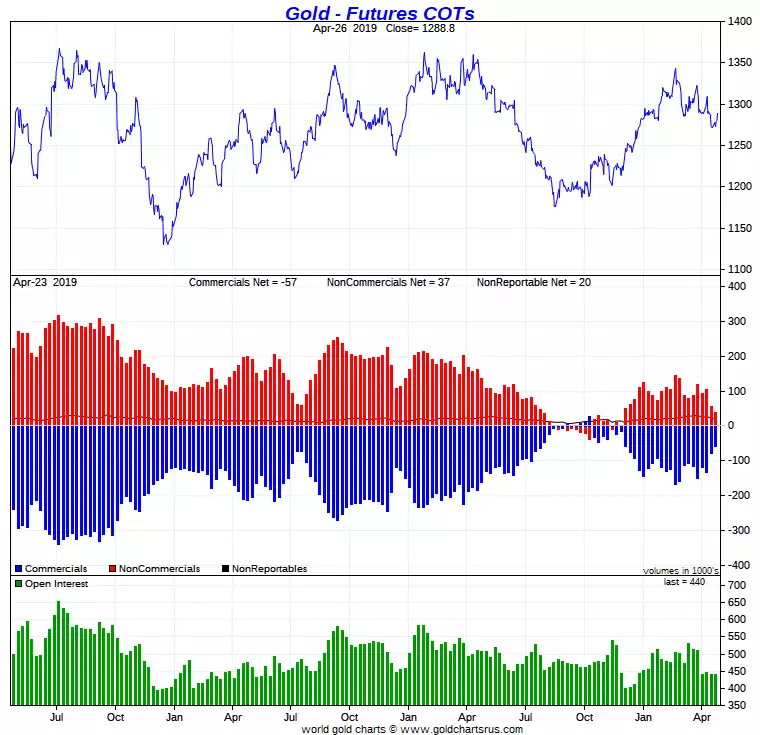

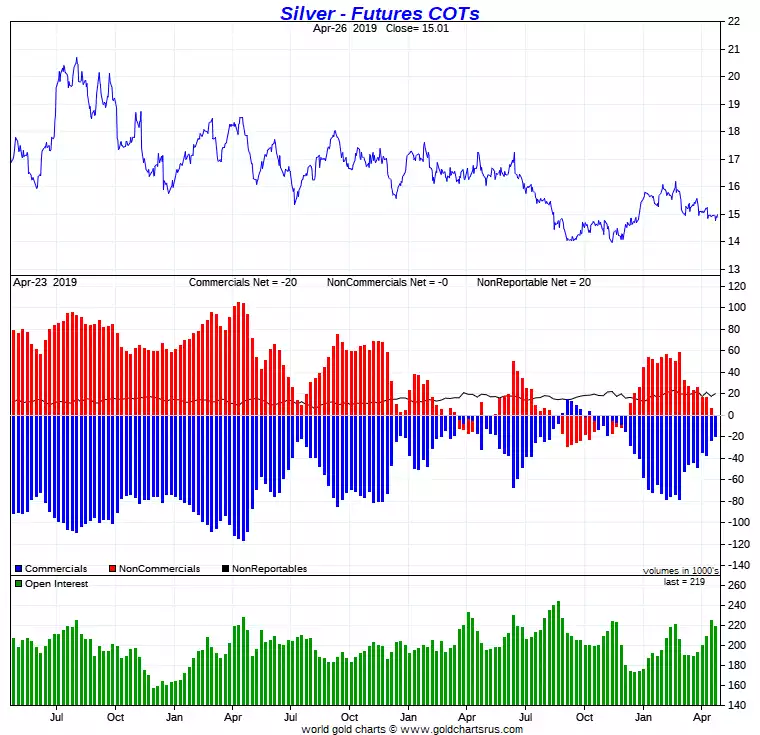

For those looking for short-mid term cues on price bottoming action in gold and silver there are few better indicators than the respective net position of the so called ‘Commercials’ (dominated by the big bullion banks) and the speculative ‘Managed Money’ on the COMEX future exchange. These positions are reported weekly in the CoT (Commitment of Traders) report issued by COMEX. Followers of this report have seen instances of the Managed Money long positions turning to or near short (or at least ‘bottoming’) and the Commercials short positions nearing nil or even long (or at least ‘bottoming’) preceding substantial market rallies. Looking at previous instances of this set up in the charts below you can see the predicable price action thereafter.

Indeed Greg Canavan called this a couple of weeks ago for gold:

“Gold is back where it was at the start of the year. Overnight, it fell to the bottom of the range that I previously suggested it will likely trade within for the next few months (see chart below).

Could it drop below the range? Sure.

But gold is still in an upward trend. I believe it is building a foundation for an eventual move higher later this year. By that I mean a break above US$1,360 an ounce, represented by the dark green line in the chart.

In short, I believe gold is just correcting and consolidating its big move made in the second half of 2018. The latest pullback is flushing short-term speculative money out of the market.”

Last week we wrote about reports of JP Morgan’s silver position and after this week’s report that same analyst, Ted Butler, estimates J P Morgan are now net long 3000 contracts (15m oz, 467 tonne) silver.

As we started, this COMEX setup, for now, is a short term indicator of price action but with substantial upside in each instance. The bigger question of the ‘breakout’ timing is more likely one tied to a broader action in the financial markets. i.e. until ‘the crash’ happens we will likely see these short term gyrations dominating, albeit in an upward trend since the end of 2015 (and late 2014 for AUD gold). That of course makes complete sense if we take impatience out of the equation. Most investors buy precious metals as their ‘uncorrelated’ asset trade (Shares are near all time highs so precious metals should be low). Be that their cash alternative (avoiding bank deposits), their ‘short’ of the financials market using a hard asset instead of a futures derivative, or their belief in outsized gains in precious metals in that environment, precious metals have proven their negative correlation to financial markets over history. History tells us another thing. Better a year too early than a day too late….