COMEX – Record Commercials Long Jump!

News

|

Posted 30/05/2016

|

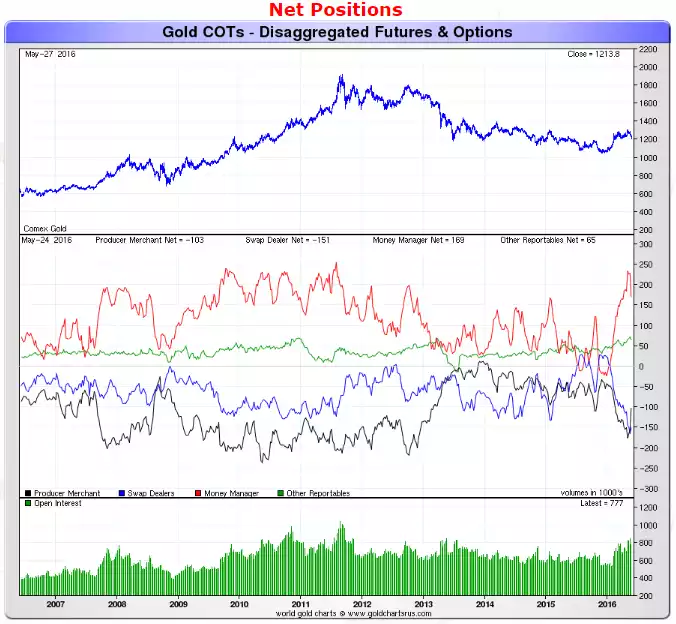

7372

Fresh off our posts on Friday on the London ‘Paper’ Gold Market and First Majestic’s very bullish view on silver going forward it was interesting to note the COT (Commitment of Traders Report) on Saturday. The COT report is issued each week by the CFTC (Commodity Futures Trading Commission) and provides a breakdown of the futures positions in gold and silver (and other commodities) for major traders. As we’ve reported before the 2 main categories are the “Managed Money” or so called speculators, and the Commercials, the big bullion banks and producers. The latter are often short as they essentially hedge their physical positions with paper. Of late the speculators have taken their long positions to historical highs riding the gold and silver bull markets this year. But the potentially very bullish action this week was the Commercials’ all time biggest weekly jump in long positions (check out the vertical blue line below). This indicates the category who are the biggest gold expert participants are making a significant move. The speculators coughed up these long positions amid talk of the June hike and rising USD. Those investors not convinced to date that we’ve seen the USD spot price bottom in gold and silver will no doubt be looking at this very carefully. For Aussie investors in AUD gold and silver, many believe the bottom has been and gone as any potential further weakness in USD spot gold price would likely be courtesy of a strengthening (for now…) USD, which in itself ordinarily sees the AUD fall and buffering out the difference in metal price in AUD.