China to Drop Gold v USD Bomb?

News

|

Posted 29/09/2017

|

10029

Public Holiday, Monday 2nd October.

China is the world’s most populous country, second biggest economy in simple terms, biggest economy in PPP (level playing field) terms, and growing 2 to 3 times faster than the world’s biggest economy, the US. It matters… a lot.

We saw recently the impact on crypto currencies with their clamp down on ICO’s and some exchanges delivering a 30% drop. Bitcoin is back up above its pre China / Jamie Dimon hit but China could well be setting gold up for its biggest support for a rally yet.

First some context for newcomers… China is the world’s biggest gold producer by far (450 tonne/yr) but exports none. China is also the world’s biggest importer of gold. In 2016 they reportedly net imported another 1300 tonne. Since wanting to join the IMF’s SDR (Special Drawing Rights global currency) they had to have a minimum gold holding to get a seat at that table along with the US, Euro, Japan and UK. They did that and now disclose having around 1840 tonne in official reserves, but most analysts believe ‘the rest’ is held by SAFE (State Administration of Foreign Exchange) and undisclosed for strategic reasons. Estimates range from 5,000 to 20,000 tonnes but no one knows. Simple math supports in the order of 10,000 but makes assumptions you can’t bank on. What is clear is China has a plan and it involves gold. Followers of Jim Rickards know he believes the world is heading to the SDR being the new reserve currency on the back of a loss of faith in the US dollar. Gold will essentially back that SDR given you need it to have your local currency in that basket of currencies. It’s set up, it’s global, and is already being used. It’s ready to go. Finally for context, a very large and historically significant reason for the USD being the world’s reserve currency is it’s so called ‘petro dollar’ role in essentially all global oil trade. China is the world’s biggest importer of oil. Remove the petro dollar status and you see a massive blow to the US’s reserve currency status, especially after the Fed’s $4.5 trillion printing spree post GFC and US government’s $20 trillion debt.

The big news we alluded to earlier is reports that China might be firing the first salvo on the USD in launching a yuan based, gold backed, crude oil futures contract. The story broke in the Nikkei Asian Review:

“Crude oil is usually priced in relation to Brent or West Texas Intermediate futures, both denominated in U.S. dollars.

China's move will allow exporters such as Russia and Iran to circumvent U.S. sanctions by trading in yuan. To further entice trade, China says the yuan will be fully convertible into gold on exchanges in Shanghai and Hong Kong.”

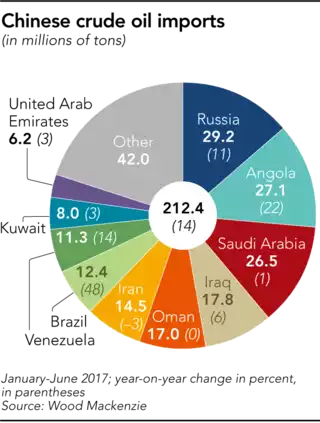

That latter point on gold conversion is critical as the Yuan is not yet a fully liquid currency for global trade despite it’s relatively meteoric rise. The backing by, let alone conversion to, gold could see massive increases in gold demand. Why massive? Consider that China imported approximately 7.6 million barrels a day in 2016 which, at say $50/barrel is around $138b per year. That equates to around 3500 tonne of gold (total global demand was around 4300 tonne in 2016) or 4 times the total market cap of the world’s biggest ETF, GLD, of around $35b.

So if only a quarter of the imports depicted below traded through these contracts it would equal the entire holdings of GLD and equate to 20% of global gold demand.

If that ‘quarter’ scenario seems fanciful you will note below that Russia, Brazil and Venezuela equal almost exactly 25% of Chinese imports and all 3 are on record as supporting a move to the SDR. These are not fans of the USD. Throw in Iran (not a big fan either….) and you are over 30%.

It remains to be seen if these reports are accurate but it is one you need to keep an eye on.