Chicken Little

News

|

Posted 05/11/2014

|

3746

We’ve all heard the story of Chicken Little running around saying “the sky is falling down!”. Sometimes in reporting the things we do, we too feel a little like that young chicken. We don’t do it to be sensationalist, we don’t do it to unnecessarily scare, and we certainly don’t do it for fun. We do it because very few do and someone needs to. Everyone WANTS to believe ‘everything is awesome’ but that is ultimately an incredibly dangerous investment strategy. Let’s just take a snapshot of late last week as a small example. Stocks soared to new records and gold plunged predominately because of a strong US GDP figure (that was largely based on debt fuelled Government defence spending) and news of Japan expanding its stimulus program (because its economy is so very bad)! Awesome? Sustainable? Clearly not.

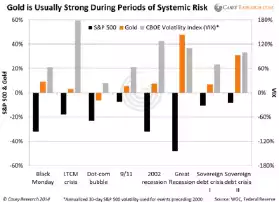

Now we don’t say it’s going to happen tomorrow and we don’t say sell everything and buy gold and silver. We don’t do either of those things because, quite frankly, we don’t know. With all due respect, neither do you. That’s why we espouse balance. Gold and silver are a well proven hedge or insurance against the crash that WILL happen. How can we say WILL? Simple math. You cannot keep accumulating record amounts of debt through central bank stimulus programs and continual deficits without a day of reckoning. That central banks have ‘bought’ their way out of the GFC (borne itself of too much debt) with printed money and more debt can only end one way. The graph below illustrates this quite clearly. So forgive us for sometimes looking a little ‘doomsday’ish but we are supremely confident you will one day thank us if you’ve balanced your wealth with some physical gold and silver. We are also supremely confident that when such a day comes and you haven’t already got yours, it will be much harder to get hold of. Broken record and all, but we are big believers in “Better a year too early than a day too late”.

Today we post an article on how the ex, and arguably most famous, US Fed chairman Alan Greenspan is saying exactly this. That the Fed balance sheet is a tinder box and people should be buying gold as protection. When asked in a separate interview where the gold price will be in the coming years he replied “measurably higher”.