BTC and ETH Hit New All-Time Highs

News

|

Posted 26/10/2021

|

6817

Bitcoin has rallied to new all-time highs (ATH) this week, following the launch of the ProShares Bitcoin Strategy ETF (Ticker $BITO). The market pushed above April’s previous ATH ($64,717 US) to reach a new peak of $66,928 US. The market has since corrected, putting in a weekly low of $59,722.

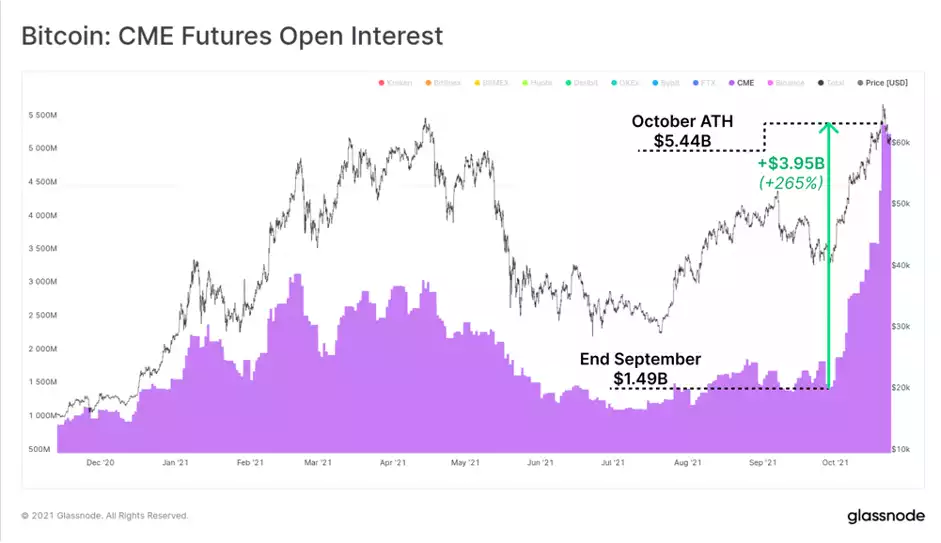

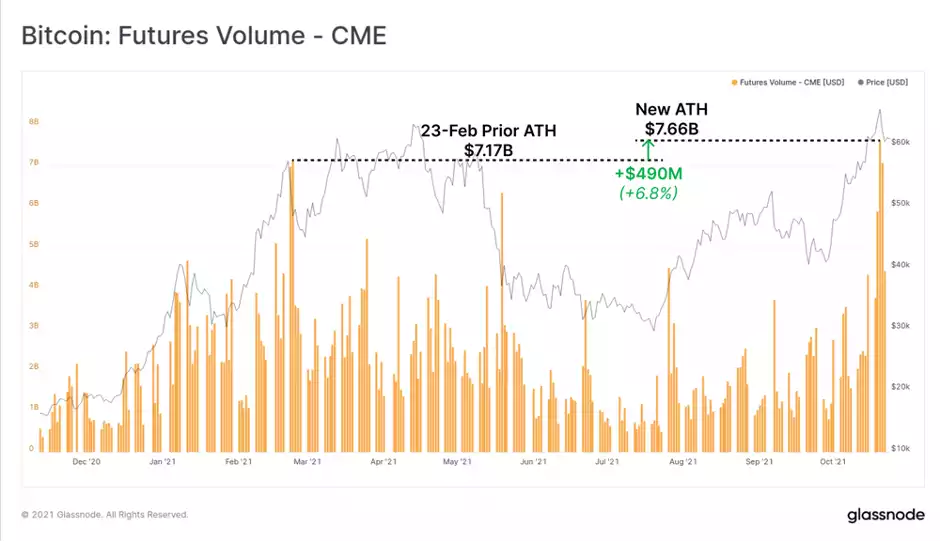

The BITO ETF surpassed $1.1B in assets under management in the first two days of trading, outpacing an 18-yr record set by the $GLD Gold ETF. As the underlying of the BITO ETF are Bitcoin futures trading on the CME exchange, explosive growth in open interest and volume in CME markets has occurred.

The ETF doesn’t invest directly in Bitcoin. It instead invests in the futures market tied to Bitcoin. Someone with an old-school brokerage account can buy the ETF, for example, without having to open a trading account for crypto.

Open interest in CME contracts has exploded higher through October, rising by $3.95 Billion (265%). This set a new all-time high of $5.44B for futures open interest on the CME exchange.

Trading volume also peaked at a new high of $7.66B on 20 October, the day of the current price ATH. Traders moved an additional $490M worth of volume on CME futures relative to the previous peak set in Feb 2021.

Funding rates in perpetual swap futures markets also reached a new local high on the same day prices reached $66k. This signalled that many traders were opening leveraged long positions amidst the excitement of the rally and ETF launch. As often happens during periods of enthusiasm and high leverage, prices quickly corrected, flushing out excess leverage, hitting stop-losses and returning funding rates to lower levels. Another salient lesson in holding the real asset and not leveraging it and risking it.

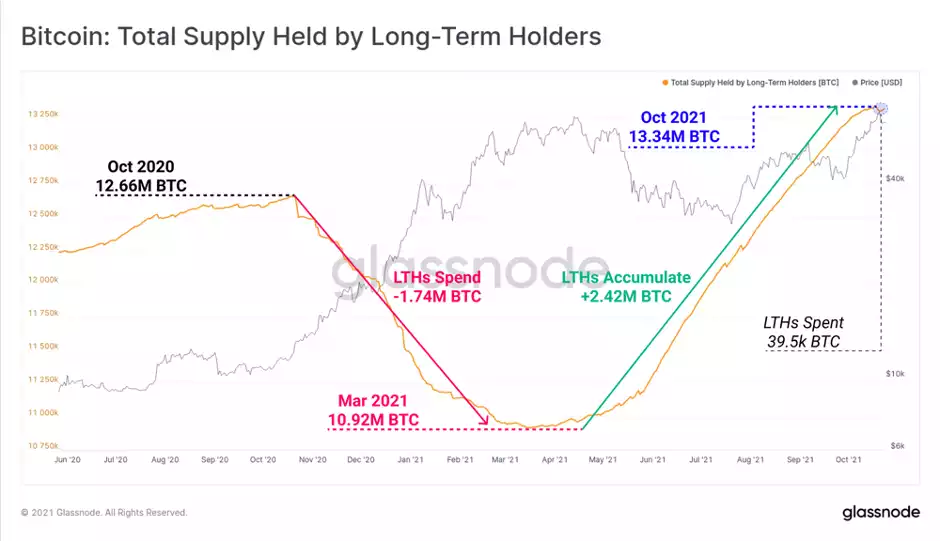

Long-term holder spending behaviour appears to be slowing down as conviction returns during this pullback. Last week there was very early signs of older coins, reflecting more experienced long-term holders (LTHs), being spent and taking profits. This is typical behaviour around new price ATHs.

Long-Term Holder supply declined by around 39.5k BTC over the last two weeks. However, when we look at this in context, it follows a period of incredible accumulation and HODLing, where LTH held supply increased by 2.42M BTC since the lows in March.

The current LTH supply is 680k BTC higher than it was this time last year, and even after the weeks spending, is starting to reverse back to the upside. This observation suggests perhaps LTH distribution has so far been more of an 'event', than a trend.

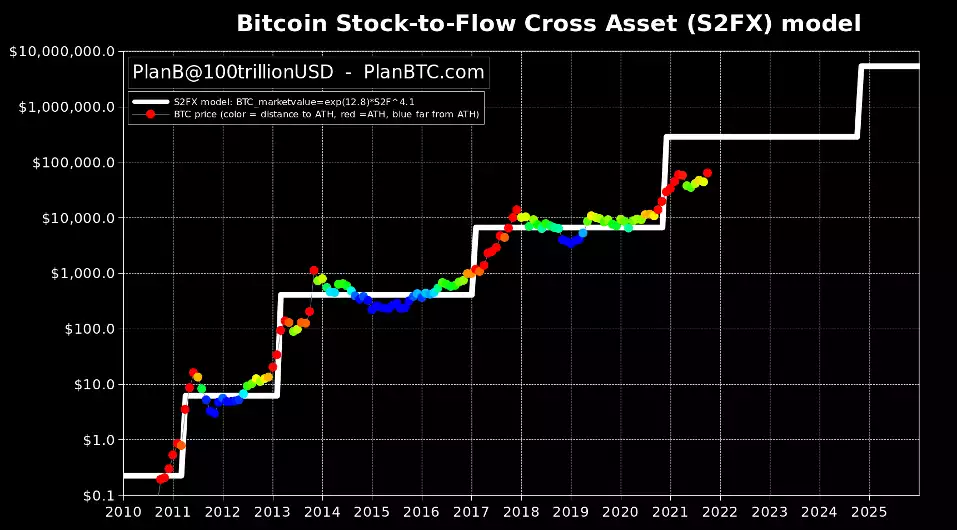

The Stock-to-Flow is continuing to prove its reliability as a model for the BTC price. The recent red dot indicates that the price has hit a new all-time high. The model predicts that there's a lot of room for the upside for this bull run… Make sure you project across to that left axis and understand it is logarithmic scale…

The second most valuable cryptocurrency, Ether, has been touching all-time highs in price ahead of a major upgrade of its underlying platform, Ethereum. Ether's market cap is just shy of $500 billion US. That's still slightly less than half that of the biggest cryptocurrency, Bitcoin.

But could this upgrade, ETH 2.0, be a vital step towards a much greener and faster version of the current system, put Ethereum on the path to becoming the dominant platform on the internet and make ETH number one?

The forthcoming upgrade is essentially a warm-up for more upgrades. Known as Altair, it introduces numerous technical changes that are designed to keep validators honest and make the system more decentralised.

Certainly, the price of Ether has been strong ahead of the Altair upgrade. The recent surge in bitcoin to all-time highs has been helping to lift the entire crypto market. But some of the price movement in ether probably reflects people betting that the upgrade will succeed, while the rest is from speculators switching from bitcoin, and new money moving into the space.