Brigden says Buy Platinum and Silver now!

News

|

Posted 20/10/2021

|

11792

Whilst we will most certainly look back in abject wonder at this current economic setup, whether we do so with glee or regret largely depends on how you position yourself to either profit from it or watch your wealth evaporate before your eyes.

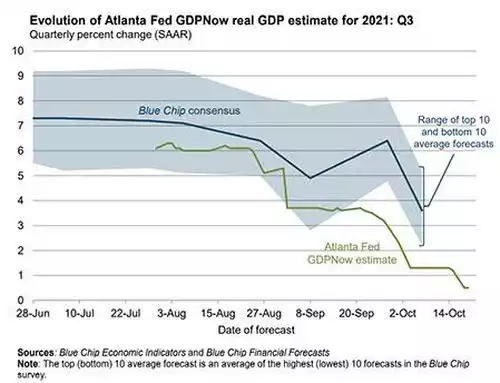

Last night saw the S&P500 post another night of gains as it heads toward retesting all time highs. It does this on the same night the Atlanta Fed revised its GDP Now forecast for the US to just 0.5%. It was only a week ago where we reported the Atlanta Fed, with a track record of getting it right more than most, bucked the bullish trend and estimated 1.2% GDP for this 3rd quarter. It was only a couple of months back that they had this with the rest of the crowd up around 6%! Quite clearly the Atlanta Fed sees trouble ahead…

It also does this as inflation prints, surveys and industry leaders at the coal face (pardon the pun) warn that this is NOT transitory and the spectre of stagflation is most definitely real.

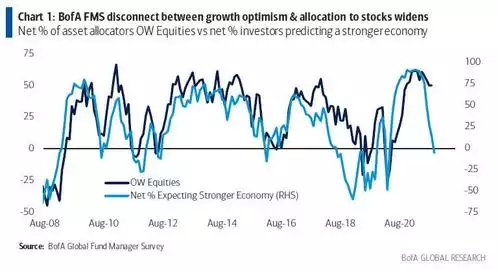

The ‘experts’ who are not only in that optimistic blue band above, are also completely at odds in terms of being overweight equities whilst being pessimistic about the economy. Yep you read that right, the latest Bank of America Fund Manager’s Survey has the biggest divergence between the two in its entire history:

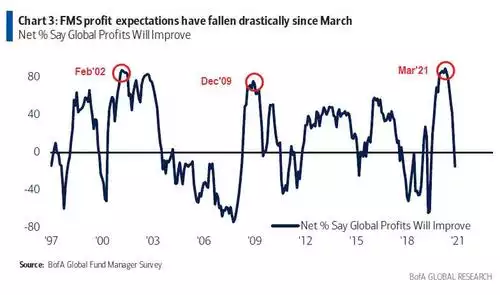

To be clear, they are “all in” (overweight) shares whilst at the same time expecting a weaker economy. But, but… don’t they know a weaker economy would likely mean weaker profits in the companies they are buying up? Yep…

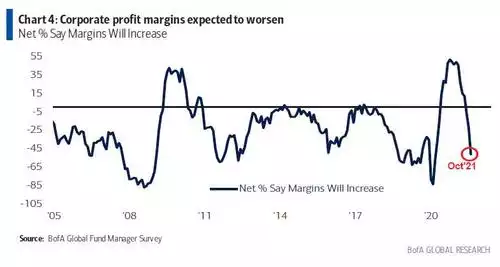

OK, and surely they know that with rising inflation in a poor economy, their profit margins will decrease? Yep, the lowest since the COVID recession…

As we started today’s piece, surely we will look back in wonder at this. But we also said you could profit from it. The brilliant Macro Insiders’ Julian Brigden posted an urgent Flash Update last night given recent developments in markets. Brigden trades a wide range of instruments and commodities and is a true ‘macro’ guy along with partner Raoul Pal. His update from his October In Focus paper is on the basis that the factors seeing weakness in the S&P500 has seemingly “miraculously lifted”. “Namely, that the current “transitory” inflation surge might be significantly less transient than policymakers and most investors would like.”

Here’s a bit of what he had to say:

“Equities have been assailed by rising short-term rates, a fairly strong USD, the uncertainties of China’s handling of the Evergrande debacle… and still failed to crack. Clearly, FOMO [fear of missing out] and TINA [there is no alternative] are still at play. USD strength may now be beginning to roll. If so, it is time to re-enter some combination of precious metal and mining plays.”

“Despite rising rate hike expectations, USD strength may have started to roll over. This may be partly attributed to the fact that other G10 front-end rates have risen just as fast or faster than the US. The UK is the standout where hawkish rhetoric from the Governor of the Bank of England caused a paroxysm in short rate futures on Monday.

Thus, it appears that just when investors were reconciling themselves to the countertrend rally in the USD persisting, the first signs of USD weakness have appeared, especially against the commodity currencies. A necessary pre-condition for us to get more positive in our approach to precious metals has thus been fulfilled.

Is it sufficient?

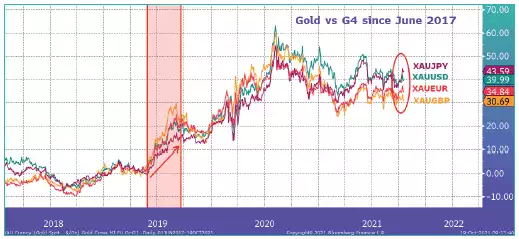

The chart below shows the breadth of Gold. It is now beginning to show some independent strength.

“Another tell is the Gold/Silver ratio, which tends to be correlated with bullish precious metals’ markets. The price relative to Gold has broken its uptrend line, which began just around the FOMC pivot to taper at their June meeting.”

“Whatever the catalyst, recent price action has turned very positive for all four precious metals (Gold, Silver, Platinum and Palladium).

Platinum has been a focus of mine for some time, and it now finally appears to have unambiguously broken out. I like platinum’s fundamentals and have been keeping an eye on it. Back in March 2021 (Deep Dive: The Hydrogen Revolution), I talked about how the push for clean energy could lead to significantly increased demand for various materials, including silver, platinum and uranium.

Platinum

I am keen to buy the current platinum breakout. Platinum: broke the downtrend line ~USD980 last Friday. After a few days of consolidation, it seems ready for a test of the May highs near USD1300.”

As an aside, we now again have plentiful supply of 1oz and 10oz minted platinum bars (now Credit Suisse instead of Baird) to compliment the 1oz Platinum Perth Mint Roos. See here. We will discuss more tomorrow about the great story now that is platinum.

Silver

We are trading back above the 50-day moving average. The downtrend line from May comes in just above USD23.00. Silver broke higher last week, pulled back, survived the threat of higher short-term rates and pushed on. This is a very good sign.

Buy here ~USD24 with a stop loss below USD22.00. The initial target is a test of the 2021 highs at 30.00. Ultimately, my original target of ~USD35 is entirely plausible.”

What about gold you say? Brigden is waiting for it to clear USD1825 before re-entering his trade. That is only $55 away at the time of writing…