BofA – “Transitory” Hyper Inflation

News

|

Posted 06/05/2021

|

6639

This last week has seen a surge in inflation concerns throughout Wall Street. Treasury Secretary Janet Yellen (and ex Fed Chair) sent markets in to a spin when she said [ex Reuters] “U.S. interest rates may need to rise to prevent the economy from overheating as more of U.S. President Joe Biden's economic investment programs come on line and boost growth,”

She very quickly had to walk back those comments later in the day as the market panicked, reassuring that inflation wasn’t going to be a problem and that she was not predicting rate hikes. She also belatedly fell into Fed Chair Powell’s line that if there were inflation that it would just be ‘transitory’. The market and her reaction highlight the dilemma before the Fed. This bubble-like market is completely built on ultra low interest rates that rely on QE, amassing more and more debt on the Fed’s balance sheet, as it fights the natural forces of the bond market that can see what’s coming.

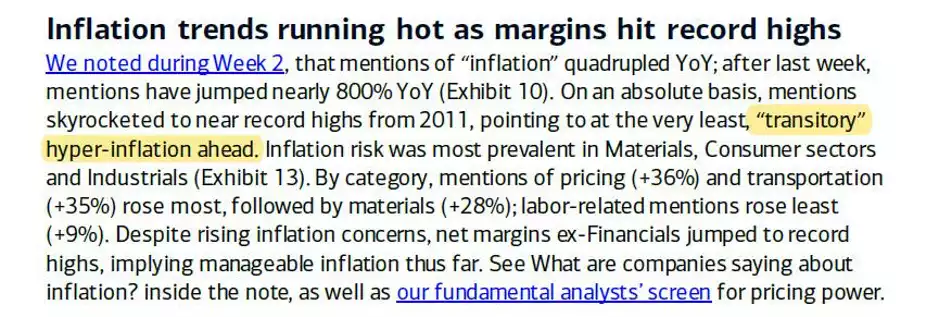

This acknowledgment was never clearer than in the most recent earnings reporting season for US companies. Bank of America (BofA) just reported an all time high and 800% jump in the mention of “inflation” in earning reports, a clear sign of what’s to come from the grass roots level. The chart below highlights the unprecedented level seen.

What was more incredible was the bank using the term ‘hyper inflation’ in its commentary, albeit, and somewhat contradictorily, calling it “transitory” in inverted commas per below:

The use of such language from such a large investment house can’t be understated.

Where rubber hits the road, we have also seen billionaire US real estate magnate Sam Zell turn from gold sceptic to gold buyer amid these increasingly clear signs. In an interview on Bloomberg Zell said:

"Obviously one of the natural reactions is to buy gold...It feels very funny because I’ve spent my career talking about why would you want to own gold? It has no income, it costs to store. And yet, when you see the debasement of the currency, you say, what am I going to hold on to?"

Whilst the Fed can continue to roll out its inflation measures based on questionable and conveniently weighted baskets of goods, Zell is at the coal face and notes:

"Oh boy, we’re seeing it all over the place…….You read about lumber prices, but we’re seeing it in all of our businesses. The obvious bottlenecks in the supply chain arena are pushing up prices. It’s very reminiscent of the ‘70s."

This is clearly not just a US thing either, the pressures here in Australia are clear for all to see and the implications just the same.

Whilst gold has languished since last August, bottoming in March of this year, the current slow increase may well accelerate as more people catch on as Zell has done and forget about the small loss of yield and storage costs against the relative capital appreciation of the world’s oldest inflation hedge. Silver, being commodity as well as precious metal, could benefit even more as the reflation trade takes commodities with it.