Bitcoin - has 2022 changed everything?

News

|

Posted 07/12/2021

|

10074

Bitcoin has taken a sizeable hit this last week, down 20% at its worst from the USD57,000 it held through late November, early December to USD47,000 and currently rallying and back to USD50,800 at the time of writing.

Zooming out a little to that high of USDS68,600 in mid November and the correction looks all the more sizeable but notably not atypical at the magic 30%...

And why ‘magic’ 30%? Because as we saw in the 2017 bull run, it was littered with 30%+ corrections along the way:

So what has caused this latest pullback? It looks like, yet again, people got a bit carried away with leverage again and it just took one decent pullback to then trigger stop losses on a heap of leveraged longs, and then the capitulating downward spiral that triggers. Yet another reminder of the dangers of greed and over leverage…

The reasons for the initial pullback could simply be the same as what has seen such volatility on Wall Street – ala concerns around the Fed tightening (and too late) and of course Omicron. The other possibility is closing out of trades at year end, particularly in the US and EU where the financial year is also the calendar year. This could include some of that big hedge fund money that piled in this year. Such funds often earn fees based on profits. At the $57K before this sell off, Bitcoin was up 94% this year. Quite the incentive if it’s ‘other people’s money’ to take the profit and those juicy fees and then pile back in early January (at your now lower price thanks to all the wiped out leveraged players) for another year. Ethereum takes that to a whole new level, up 520% before the correction…. That’s a lot of fees…

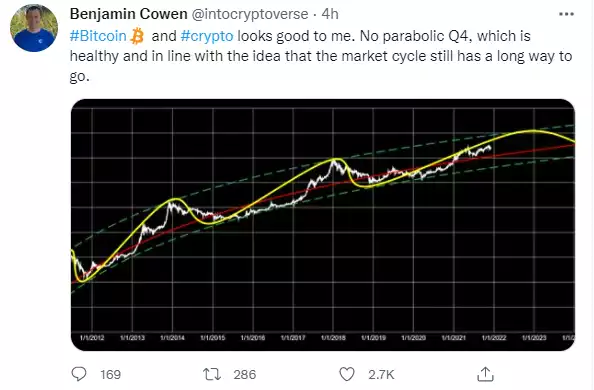

There is also growing commentary around structural changes to the classic 4 year cycle which is based on the halvening events and the ‘usual’ parabolic blow-off top that many were expecting at the end of this year. 2021 has been notable for the amount of institutional money entering the space, the growth of futures and hence both long and short positions with leverage, and of course the emergence of ETF’s, again seeing large ‘traditional’ money coming in. Such forces could well see a ‘smoothing’ of the curve. Another respected analyst is Benjamin Cowen and he is one such party questioning the 4 year cycle. He tweeted this a few hours ago:

This chart, if correct, tells us a couple of things. Firstly cycles might be getting longer. Second, the next big top could be both smoother and not until Q3 of 2022. If that in any way sounds ‘disappointing’ can I draw your attention to the fact that the left hand scale is logarithmic. i.e. at a market cap now of $2.4 trillion, that top is in the order of $15-20 trillion…

Our usual writer who gives those amazing insights into on chain metrics is sick today but will be back next week. It should be fascinating to see what’s happening on chain during this big flush out. Here’s a titbit from one of his sources, Glassnode, for last week:

“Short-Term Holder SOPR printed its lowest value since late July, which shows the hallmark signature of a capitulation by newer investors. For Short-Term Holders to be realizing losses here means they had to buy their coins at the recent tops, and are already spending them to new hands. This group appears to be the only cohort reacting significantly to the events of last week. More mature HODLers remain unmoved.

Through our observations of the data, last week's sell-off was driven by liquidations in the futures market, and the various on-chain cohorts that make up Bitcoin's supply remain largely unfazed. Those who are spending coins appear to be predominantly those who bought the top, and they are realizing losses and capitulating.

High levels of leverage followed by price volatility is a classic recipe for a correction, and capitulative moments like Bitcoin just experienced are unfortunately needed for markets to return to a healthy equilibrium.”