"biggest dovish shock since 2008" – Why RBA shocked the world

News

|

Posted 05/10/2022

|

9038

That was how Bloomberg described yesterday’s surprise (80% expecting 0.5%), milder than expected, 0.25% rate hike by our own RBA. In an article titled “Australia Supercharges Market Debate That Peak Rates Are Near” Bloomberg said:

“Global stock and bond bulls are hoping the market impact of Australia’s dovish rate surprise will stick as it offers their best chance at arguing the worldwide wave of disruptive hikes is closer to the end than the beginning.

Yields on rate-sensitive three-year Australian government bonds plunged by the most since 2008 after the central bank raised interest-rates by a less-than-expected 25 basis points. The unexpected move ricocheted around global financial markets, giving a fresh boost to the rally in Treasuries, pushing New Zealand yields lower and helping turbocharge a rally in Japanese equities.

The Reserve Bank of Australia’s dovish surprise will be interpreted by some as a sign that the end is in sight to the wave of aggressive monetary tightening that has steamrolled global bonds and equities this year. Australia has acted as a lead indicator for at least the bond market since late 2021, when the RBA’s sudden abandonment of curve control sent local yields spiking.”

RBA Governor Philip Lowe explained:

"We are conscious that there are lags in the operation of monetary policy and that interest rates have increased very quickly," ……. "all else equal, the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises."

i.e. the full effects of their aggressive (catch up) hiking hasn’t fully played out into the average consumer’s pocket yet. Or in other words, the impact of how all those extra mortgage payments against that basket of much dearer goods has a lag yet to be fully felt.

Arguably though, this gun shyness may still bight as other central banks around the world maintain a narrative at least of aggressively continuing to hike. Tarric Booker summarises nicely as usual:

However the international market was on dove alert afterwards and got dished up a few juicy confirmation biases last night. First we saw abysmal jobs data out of the US as summarised by Crescat’s Tavi Costa:

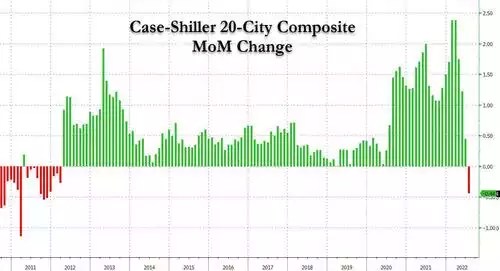

We also saw the US Case Shiller 20 City Composite house price print crash the most since the GFC (a housing crisis in the US you may remember):

The final straw was the ISM Manufacturing index in the US fell to 50.9 against expectations of 52 showing growing weakness in the US economy. The breakdown of the print saw new orders, employment, and prices all falling in September, with employment the biggest drop since the COVID lockdowns making it the second biggest drop in a decade.

And so, right on cue, the USD dropped like a school case and equities ripped higher as the market read this as ‘surely’ signs of a pivot needed by the Fed sooner than later… surely…

And so just 4 days into October, after September seeing the worst monthly fall on the S&P500 since COVID’s March 2020 collapse, shares surged on bad economic news. Sniffing this contradiction beautifully were precious metals which also rallied strongly in lockstep. If you missed it, Monday night saw silver rocket 8.8% overnight. That was its 7th biggest daily gain in history. For context, the largest ever daily surge for silver was 13.3% on 18 March 2009… during the GFC when shares were tumbling. Surging silver off a high GSR (gold:silver ratio) is often a precursor to both metals rallying strongly, albeit with silver outperforming as the GSR (still sitting at an historically very high 81.8 at the time of writing) mean reverts to around that 30 level.

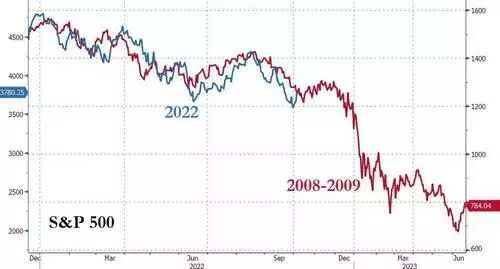

Speaking of comparing the GFC to now….

As a reminder, over the period of the GFC shares essentially halved and gold essentially doubled. Gold and silver both fell going into the GFC as they are beautifully liquid assets that had performed well going into it. That makes them perfect to sell for margin calls on those tumbling shares. Once that clean out took place they rocketed higher as the safest place to be as the sharemarket legged lower. We have seen a similar playbook this year.

History doesn’t always repeat, but it often rhymes…

************************************************************************************

GOT A QUESTION about today's news?

This afternoon, the Gold & Silver Standard Insights team will be breaking down the news and answering YOUR questions.

Submit your question to [email protected] and SUBSCRIBE to the YouTube Channel to be notified when the GSS Insights video is live.

**********************************************************************************