Big Trouble in ‘Little’ China

News

|

Posted 17/02/2016

|

6328

Just 7 years after China was the world’s (and in particular Australia’s) saviour after the GFC it has become one of the biggest economic threats to the world. The sad irony is that this is in large part due to the sheer amount of debt they threw at generating growth post GFC, quadrupling to $28 trillion by mid 2014. Yes they were certainly not alone in doing this but not even the US matched the sheer scale of it.

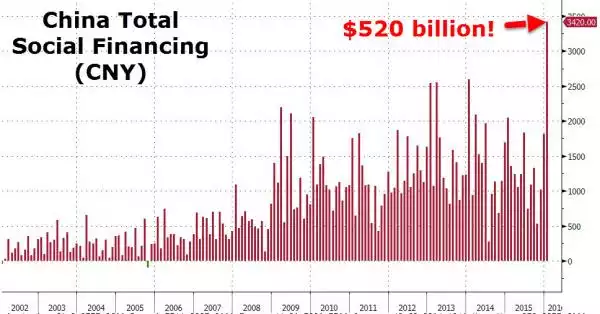

Whilst some eternal optimists say ‘but their GDP is still relatively strong in the high 6%’s’, they are missing the dual points that those numbers still represent a massive value drop in an already globally weak economy and importantly too has been ‘bought’ with 15.2% growth in debt in the last year. So to be clear – they are seeing 6.9% GDP growth but 15.2% total debt growth year on year. A grade 1’er can do that math.

We learned yesterday that in January alone they added a simply eye watering and record breaking $520 billion of debt.

A lot of the drag on global growth right now is that of the massive debt burden accumulated. That burden features strongly in most of the themes illustrated in the charts below.

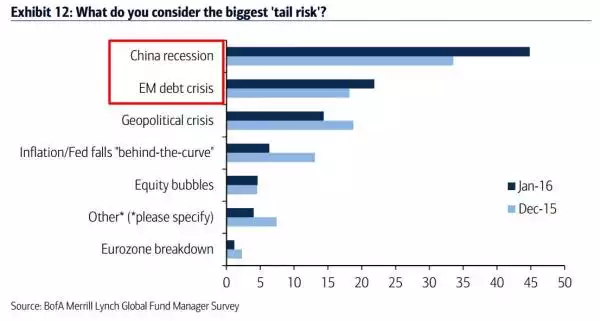

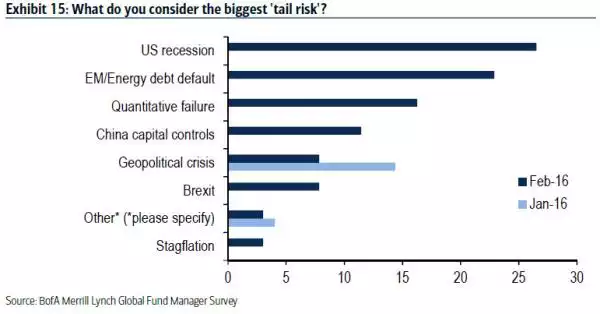

The 2 charts below are Bank Of America Merrill Lynch’s global fund manager survey on the question of what represents the biggest tail risks to the economy. You will note the marked changes just from January (1st) to February (2nd) but China features strongly in each.